Virgin Media 2011 Annual Report Download - page 203

Download and view the complete annual report

Please find page 203 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

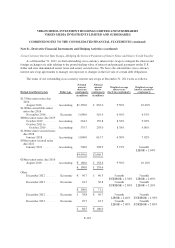

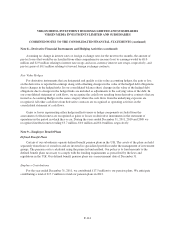

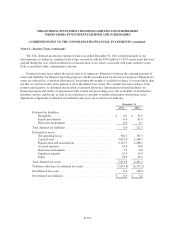

Note 8—Derivative Financial Instruments and Hedging Activities (continued)

Assuming no change in interest rates or foreign exchange rates for the next twelve months, the amount of

pre-tax losses that would be reclassified from other comprehensive income (loss) to earnings would be £0.0

million and £2.9 million relating to interest rate swaps and cross-currency interest rate swaps, respectively, and

pre-tax gains of £0.1 million relating to forward foreign exchange contracts.

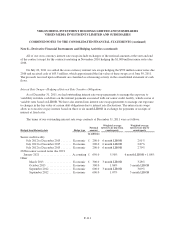

Fair Value Hedges

For derivative instruments that are designated and qualify as fair value accounting hedges, the gain or loss

on the derivative is reported in earnings along with offsetting changes in the value of the hedged debt obligations

due to changes in the hedged risks. In our consolidated balance sheet, changes in the value of the hedged debt

obligations due to changes in the hedged risks are included as adjustments to the carrying value of the debt. In

our consolidated statement of cash flows, we recognize the cash flows resulting from derivative contracts that are

treated as Accounting Hedges in the same category where the cash flows from the underlying exposure are

recognized. All other cash flows from derivative contracts are recognized as operating activities in the

consolidated statement of cash flows.

Gains or losses representing either hedge ineffectiveness or hedge components excluded from the

assessment of effectiveness are recognized as gains or losses on derivative instruments in the statement of

operations in the period in which they occur. During the years ended December 31, 2011, 2010 and 2009 we

recognized ineffectiveness totaling £3.7 million, £0.0 million and £0.0 million, respectively.

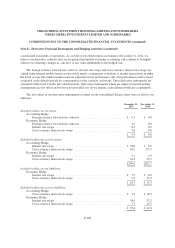

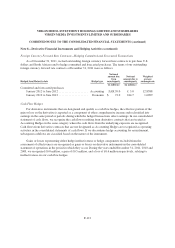

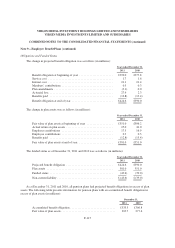

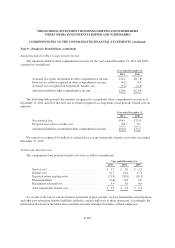

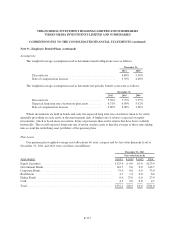

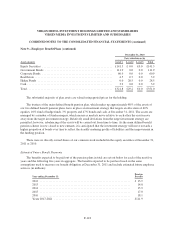

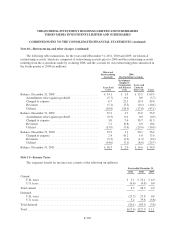

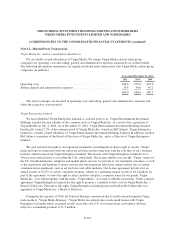

Note 9—Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the plans are held

separately from those of ourselves and are invested in specialized portfolios under the management of investment

groups. The pension cost is calculated using the projected unit method. Our policy is to fund amounts to the

defined benefit plans necessary to comply with the funding requirements as prescribed by the laws and

regulations in the U.K. Our defined benefit pension plans use a measurement date of December 31.

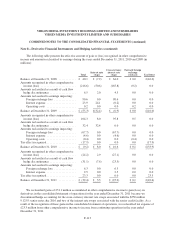

Employer Contributions

For the year ended December 31, 2011, we contributed £17.5 million to our pension plans. We anticipate

contributing a total of £17.7 million to fund our pension plans in 2012.

F-114