Virgin Media 2011 Annual Report Download - page 71

Download and view the complete annual report

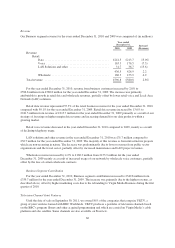

Please find page 71 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On March 3, 2011, our wholly owned subsidiary, Virgin Media Secured Finance PLC, issued $500 million

aggregate principal amount of 5.25% senior secured notes due 2021 and £650 million aggregate principal amount

of 5.50% senior secured notes due 2021. The senior secured notes due 2021 rank pari passu with our senior credit

facility and senior secured notes due 2018 and, subject to certain exceptions, share in the same guarantees and

security which have been granted in favor of our senior credit facility and senior secured notes due 2018. We

used the net proceeds from the senior secured notes due 2021 to make repayments totaling £900 million under

our then existing senior credit facility and for general corporate purposes. On September 8, 2011, we completed

an offer to exchange any and all of the then outstanding senior secured notes due 2021 which we originally

issued in a U.S. private placement, for an equivalent amount of new senior secured notes due 2021 which have

been registered under the U.S. Securities Act of 1933, as amended. In connection with this offer, we exchanged a

total of $499,870,000 aggregate principal amount, or 99.9% of the original U.S. dollar denominated outstanding

notes and £650,000,000 aggregate principal amount, or 100% of the original sterling denominated outstanding

notes, for an equivalent amount of newly issued senior secured notes due 2021. Holders of the original senior

secured notes due 2021 who did not tender their notes in compliance with the offer terms will remain subject to

restrictions on transfer of these notes. Completion of the exchange offer satisfied our obligations in full under a

registration rights agreement entered into in connection with the original notes issuance in March 2011. We did

not receive any additional proceeds from the exchange offer. For further details relating to the exchange offer,

please see the Registration Statement on Form S-4 of Virgin Media Inc., as filed with the SEC on July 20, 2011.

On July 26, 2011, we redeemed in full the outstanding balance of our $550 million 9.125% senior notes due

2016 using £355.8 million of cash from our balance sheet as part of our 2010 capital structure optimization

program. For more information, see “-Senior Unsecured Notes” below.

Our long term debt has been issued by Virgin Media Inc. and certain of its subsidiaries that have no

independent operations or significant assets other than investments in their respective subsidiaries and affiliates.

As a result, they will depend upon the receipt of sufficient funds from their respective subsidiaries to meet their

obligations. In addition, the terms of our existing and future indebtedness and the laws of the jurisdictions under

which our subsidiaries are organized limit the payment of dividends, loan repayments and other distributions

from them under many circumstances.

Our debt agreements contain restrictions on our ability to transfer cash between groups of our subsidiaries.

As a result of these restrictions, although our overall liquidity may be sufficient to satisfy our obligations, we

may be limited by covenants in some of our debt agreements from transferring cash to other subsidiaries that

might require funds. In addition, cross default provisions in our other indebtedness may be triggered if we default

on any of these debt agreements.

Senior Credit Facility

On March 16, 2010, we entered into a senior facilities agreement (as amended and restated on March 26,

2010, February 15, 2011 and May 27, 2011), or the Senior Facilities Agreement, under which Deutsche Bank

AG, London Branch, BNP Paribas London Branch, Bank of America, N.A., Crédit Agricole Corporate and

Investment Bank, GE Corporate Finance Bank SAS, Goldman Sachs Lending Partners LLC, J.P. Morgan Chase

Bank, N.A. London Branch, Lloyds TSB Bank plc, The Royal Bank of Scotland plc and UBS Limited agreed to

make available to certain subsidiaries of the Company a term loan A facility, or Tranche A, and a revolving

credit facility, or RCF. On April 12, 2010, a term loan B facility, or Tranche B was added to the Senior Facilities

Agreement by way of an accession deed between Virgin Media Investment Holdings Limited and Deutsche Bank

AG, London Branch. Tranche B was syndicated to a group of lenders.

On April 19, 2010, we drew down an aggregate principal amount of £1,675.0 million under the senior credit

facility and applied the proceeds towards the repayment in full of all amounts outstanding under our previous

senior credit facility dated March 3, 2006 (as amended and restated from time to time) as at the draw down date.

70