Virgin Media 2011 Annual Report Download - page 100

Download and view the complete annual report

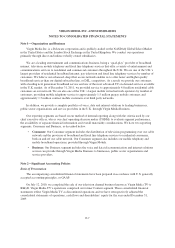

Please find page 100 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

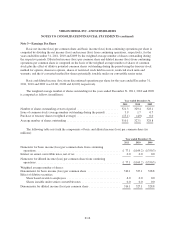

Note 2—Significant Accounting Policies (continued)

Impairment of Long-Lived Assets

In accordance with the Property, Plant, and Equipment Topic of the FASB ASC, long-lived assets, including

fixed assets and amortizable definite lived intangible assets, are reviewed for impairment whenever events or

changes in circumstances indicate that the carrying amount may not be recoverable. We assess the recoverability

of the carrying value of long-lived assets, by first grouping our long-lived assets with other assets and liabilities

at the lowest level for which identifiable cash flows are largely independent of the cash flows of other assets and

liabilities (the asset group) and, secondly, estimating the undiscounted future cash flows that are directly

associated with and expected to arise from the use of and eventual disposition of such asset group. We estimate

the undiscounted cash flows over the remaining useful life of the primary asset within the asset group. If the

carrying value of the asset group exceeds the estimated undiscounted cash flows, we record an impairment

charge to the extent the carrying value of the long-lived asset exceeds its fair value. We determine fair value

through quoted market prices in active markets or, if quoted market prices are unavailable, through the

performance of internal analysis of discounted cash flows or external appraisals. The undiscounted and

discounted cash flow analyses are based on a number of estimates and assumptions, including the expected

period over which the asset will be utilized, projected future operating results of the asset group, discount rate

and long term growth rate.

As of December 31, 2011 there were no indicators of impairment that suggest the carrying amounts of our

long-lived assets are not recoverable.

Deferred Financing Costs

Deferred financing costs are incurred in connection with the issuance of debt and are amortized over the

term of the related debt using the effective interest method. Deferred financing costs of £75.7 million and

£98.6 million as of December 31, 2011 and 2010, respectively, are included on the consolidated balance sheets.

Deferred financing costs associated with our convertible senior notes are amortized to the expected due date of

the notes which is currently November 2016. Should the holders of the convertible senior notes have the ability

to, and elect to, convert their notes prior to November 2016, we will expense the deferred financing costs

associated with the converted notes in the period of conversion.

Restructuring Costs

We account for our restructuring costs, which comprise of lease and contract exit costs as well as employee

termination costs, in accordance with the Exit or Disposal Cost Obligations Topic of the FASB ASC and

recognize a liability for costs associated with restructuring activities when the liability is incurred.

Revenue Recognition

Revenue is stated net of value added tax, or VAT, collected from customers on behalf of tax authorities.

On January 1, 2011 we adopted new accounting guidance issued by the FASB for revenue arrangements

with multiple-elements. We adopted this guidance on a prospective basis applicable for transactions originating

or materially modified after the date of adoption. This guidance changed the criteria for separating units of

accounting in multiple-element arrangements and the way in which an entity is required to allocate revenue to

these units of accounting.

F-11