Virgin Media 2011 Annual Report Download - page 202

Download and view the complete annual report

Please find page 202 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

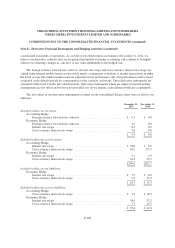

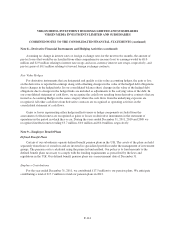

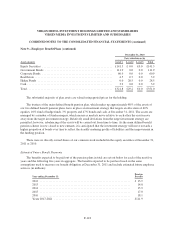

Note 8—Derivative Financial Instruments and Hedging Activities (continued)

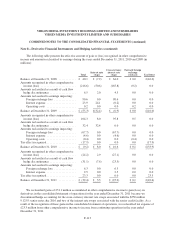

The following table presents the effective amount of gain or (loss) recognized in other comprehensive

income and amounts reclassified to earnings during the years ended December 31, 2011, 2010 and 2009 (in

millions):

Total

Interest rate

swaps

Cross-currency

interest rate

swaps

Forward foreign

exchange

contracts Tax Effect

Balance at December 31, 2008 ............ £ 40.1 £ (7.9) £ 64.0 £ 0.0 £(16.0)

Amounts recognized in other comprehensive

income (loss) ........................ (216.6) (50.6) (165.8) (0.2) 0.0

Amounts reclassified as a result of cash flow

hedge discontinuance .................. 6.5 2.0 4.5 0.0 0.0

Amounts reclassified to earnings impacting:

Foreign exchange loss ............... 90.6 0.0 90.6 0.0 0.0

Interest expense .................... 23.9 24.1 (0.2) 0.0 0.0

Operating costs .................... 0.2 0.0 0.0 0.2 0.0

Balance at December 31, 2009 ............ £ (55.3) £(32.4) £ (6.9) £ 0.0 £(16.0)

Amounts recognized in other comprehensive

income (loss) ........................ 104.3 8.0 95.8 0.5 0.0

Amounts reclassified as a result of cash flow

hedge discontinuance .................. 32.4 32.4 0.0 0.0 0.0

Amounts reclassified to earnings impacting:

Foreign exchange loss ............... (67.7) 0.0 (67.7) 0.0 0.0

Interest expense .................... (4.6) 0.0 (4.6) 0.0 0.0

Operating costs .................... (0.4) 0.0 0.0 (0.4) 0.0

Tax effect recognized .................... (17.9) 0.0 0.0 0.0 (17.9)

Balance at December 31, 2010 ............ £ (9.2) £ 8.0 £ 16.6 £ 0.1 £(33.9)

Amounts recognized in other comprehensive

income (loss) ........................ (24.2) 2.9 (27.1) 0.0 0.0

Amounts reclassified as a result of cash flow

hedge discontinuance .................. (31.1) (7.6) (23.5) 0.0 0.0

Amounts reclassified to earnings impacting:

Foreign exchange loss ............... 6.3 0.0 6.3 0.0 0.0

Interest expense .................... 2.5 0.0 2.5 0.0 0.0

Tax effect recognized .................... 23.3 0.0 0.0 0.0 23.3

Balance at December 31, 2011 ............ £ (32.4) £ 3.3 £ (25.2) £ 0.1 £(10.6)

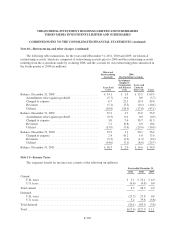

We reclassified gains of £31.1 million accumulated in other comprehensive income to gain (loss) on

derivatives in the consolidated statement of operations for the year ended December 31, 2011 because we

discontinued hedge accounting for the cross-currency interest rate swaps associated with the $550 million

9.125% senior notes due 2016 and two of the interest rate swaps associated with the senior credit facility. As a

result of the recognition of these gains in the consolidated statement of operations, we reclassified tax expense of

£23.3 million from other comprehensive income to income from continuing operations in the year ended

December 31, 2011.

F-113