Virgin Media 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Note 10—Stock-Based Compensation Plans (continued)

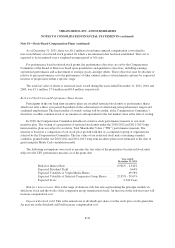

Expected volatility. Actual historical changes in the market value of our stock are used to calculate the

volatility assumption. We calculate daily market value changes over the most recent historical period as of the

date of grant equal to the expected term of the award. An increase in the expected volatility will increase

compensation cost.

Expected volatility of selected comparator group shares. Actual historical changes in the market values of

the selected comparator group stocks are used to calculate the volatility assumption. We calculate daily market

value changes over the most recent historical period as of the date of grant equal to the expected term of the

award. An increase in the expected volatility will decrease compensation cost.

Expected lives. This is the period of time after which the granted restricted stock units will vest. This

assumption is based on the stated performance period. An increase in the expected lives will increase

compensation cost.

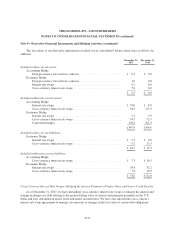

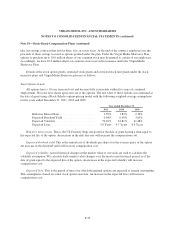

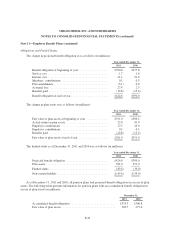

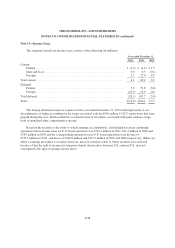

A summary of the status of our non-vested restricted stock units as of December 31, 2011, and of the

changes during the year ended December 31, 2011, is provided below:

Performance

Based

Weighted Average

Grant-date

Fair Value

Non-vested—beginning of year ...................... 5,179,451 $12.29

Granted ......................................... 1,570,471 20.27

Vested .......................................... (974,239) 12.16

Forfeited or Expired ............................... (1,697,008) 13.34

Non-vested—end of year ........................... 4,078,675 $14.96

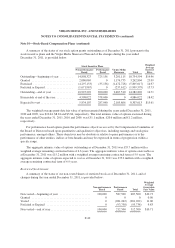

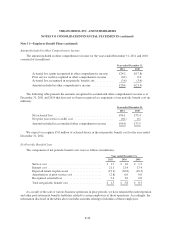

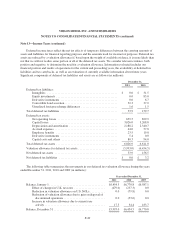

The restricted stock units that vested during the years ended December 31, 2011, 2010 and 2009 had total

fair values of £16.3 million, £1.8 million and £0.7 million, respectively.

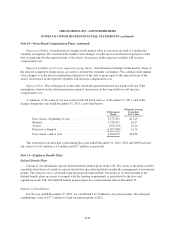

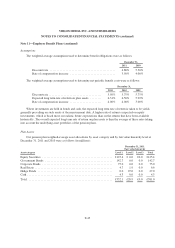

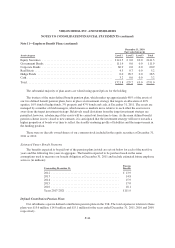

Note 11—Employee Benefit Plans

Defined Benefit Plans

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the plans are held

separately from those of ourselves and are invested in specialized portfolios under the management of investment

groups. The pension cost is calculated using the projected unit method. Our policy is to fund amounts to the

defined benefit plans necessary to comply with the funding requirements as prescribed by the laws and

regulations in the U.K. Our defined benefit pension plans use a measurement date of December 31.

Employer Contributions

For the year ended December 31, 2011, we contributed £17.5 million to our pension plans. We anticipate

contributing a total of £17.7 million to fund our pension plans in 2012.

F-42