Virgin Media 2011 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

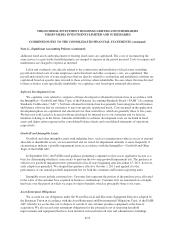

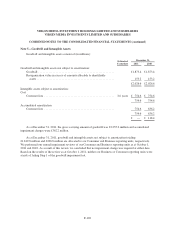

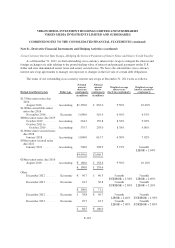

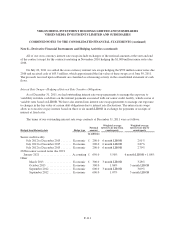

Note 6—Long Term Debt

Long term debt consists of (in millions):

December 31,

2011

December 31,

2010

VMIH VMIL VMIH VMIL

Amounts due to third parties

U.S. Dollar

6.50% senior secured notes due 2018 ..................... £ 635.4 £ 0.0 £ 632.3 £ 0.0

5.25% senior secured notes due 2021 ..................... 353.1 0.0 0.0 0.0

Sterling

7.00% senior secured notes due 2018 ..................... 864.5 0.0 863.1 0.0

5.50% senior secured notes due 2021 ..................... 722.4 0.0 0.0 0.0

Senior credit facility .................................. 750.0 81.6 1,675.0 179.1

Capital leases ........................................ 258.0 258.0 245.9 245.9

Other .............................................. 0.3 0.3 0.8 0.8

3,583.7 339.9 3,417.1 425.8

Less current portion ................................... (76.6) (76.6) (222.1) (72.1)

Long term debt due to third parties ........................... £3,507.1 £ 263.3 £3,195.0 £ 353.7

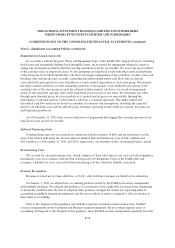

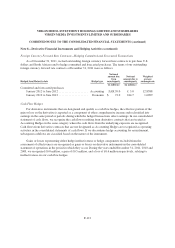

Amounts due to group companies

U.S. Dollar

9.125% senior notes due 2016 ........................... £ 0.0 £ 0.0 £ 352.6 £ 352.6

6.50% senior notes due 2016 ............................ 0.0 0.0 176.7 176.7

9.50% senior notes due 2016 ............................ 849.2 849.2 843.2 843.2

8.375% senior notes due 2019 ........................... 380.6 380.6 378.8 378.8

6.50% senior secured notes due 2018 ..................... 0.0 635.4 0.0 632.3

5.25% senior secured notes due 2021 ..................... 0.0 353.1 0.0 0.0

Floating rate senior loan notes due 2012 ................... 64.3 64.3 64.1 64.1

Euro

9.50% senior notes due 2016 ............................ 145.3 145.3 148.5 148.5

Sterling

8.875% senior notes due 2019 ........................... 345.2 345.2 344.8 344.8

7.00% senior secured notes due 2018 ..................... 0.0 864.5 0.0 863.1

5.50% senior secured notes due 2021 ..................... 0.0 722.4 0.0 0.0

Senior credit facility .................................. 0.0 668.4 0.0 1,495.9

Other amounts due to group companies

Other notes due to affiliates ............................ 435.0 435.0 437.7 437.7

2,219.6 5,463.4 2,746.4 5,737.7

Less current portion ................................... (64.3) (64.3) 0.0 (150.0)

Long term debt due to group companies ....................... £2,155.3 £5,399.1 £2,746.4 £5,587.7

The carrying values of our $500 million 5.25% and £650 million 5.50% senior secured notes due 2021

include adjustments of £45.7 million and £77.9 million, respectively, as a result of our application of fair value

hedge accounting to these instruments.

F-103