Virgin Media 2011 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

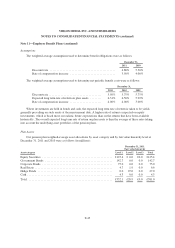

Note 13—Income Taxes (continued)

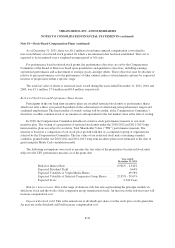

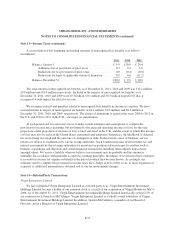

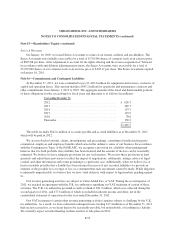

A reconciliation of the beginning and ending amounts of unrecognized tax benefits is as follows

(in millions):

2011 2010 2009

Balance, January 1 .................................... £ 9.9 £10.0 £ 20.4

Additions for tax provisions of prior years .............. 0.3 0.3 1.6

Reductions for tax provisions of prior years ............. 0.0 (0.4) (0.8)

Reductions for lapse of applicable statute of limitation .... 0.0 0.0 (11.2)

Balance, December 31 ................................. £10.2 £ 9.9 £ 10.0

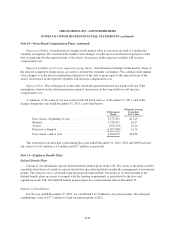

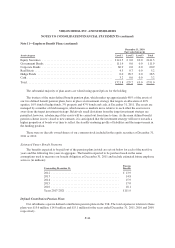

The total amount of unrecognized tax benefits as of December 31, 2011, 2010 and 2009 was £10.2 million,

£9.9 million and £10.0 million respectively. Included in the balance of unrecognized tax benefits as of

December 31, 2011, 2010 and 2009 were £0.3 million, £0.1 million and £0.5 million respectively that, if

recognized, would impact the effective tax rate.

We recognize interest and penalties related to unrecognized tax benefits in income tax expense. We have

accrued interest in respect of unrecognized tax benefits of £0.1 million, £0.0 million, and £0.2 million at

December 31, 2011, 2010 and 2009, respectively. The statute of limitations is open for the years 2008 to 2011 in

the U.S. and 2010 to 2011 in the U.K., our major tax jurisdictions.

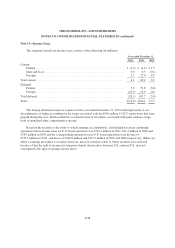

At each period end, it is necessary for us to make certain estimates and assumptions to compute the

provision for income taxes including, but not limited to the expected operating income (or loss) for the year,

projections of the proportion of income (or loss) earned and taxed in the U.K. and the extent to which this income

(or loss) may also be taxed in the United States, permanent and temporary differences, the likelihood of deferred

tax assets being recovered and the outcome of contingent tax risks. In the normal course of business, our tax

returns are subject to examination by various taxing authorities. Such examinations may result in future tax and

interest assessments by these taxing authorities for uncertain tax positions taken in respect to matters such as

business acquisitions and disposals and certain financing transactions including intercompany transactions,

amongst others. We accrue a liability when we believe an assessment may be probable and the amount is

estimable. In accordance with generally accepted accounting principles, the impact of revisions to these estimates

is recorded as income tax expense or benefit in the period in which they become known. Accordingly, the

estimates used to compute the provision for income taxes may change as new events occur, as more experience is

acquired, as additional information is obtained and as our tax environment changes.

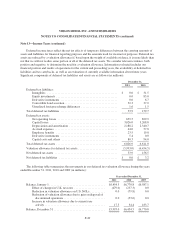

Note 14—Related Party Transactions

Virgin Enterprises Limited

We have identified Virgin Enterprises Limited as a related party to us. Virgin Entertainment Investment

Holdings Limited became a holder of our common stock as a result of our acquisition of Virgin Mobile on July 4,

2006. As of December 31, 2011, Virgin Entertainment Investment Holdings Limited beneficially owned 2.3% of

our common stock (based on SEC filings). Virgin Enterprises Limited is a wholly owned subsidiary of Virgin

Entertainment Investment Holdings Limited. In addition, Gordon McCallum is a member of our Board of

Directors and is a Director of Virgin Enterprises Limited.

F-51