Virgin Media 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

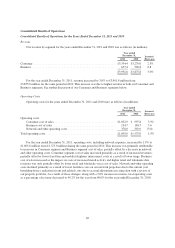

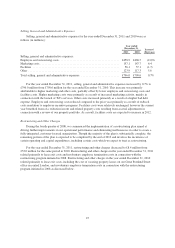

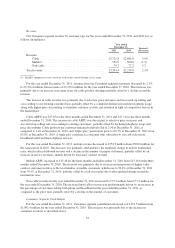

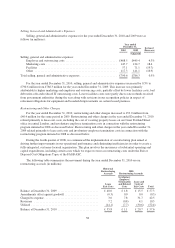

The following table summarizes the movement during the year ended December 31, 2011 on our

restructuring accruals (in millions):

Historical

Restructuring

Accruals

2008

Restructuring Accruals

Total

Lease

Exit Costs

Involuntary

Employee

Termination

and Related

Costs

Lease and

Contract

Exit Costs

Balance, December 31, 2010 ............................. £35.8 £ 1.1 £20.7 £ 57.6

Charged to expense ..................................... 2.4 10.2 5.0 17.6

Revisions ............................................ (5.1) (2.2) (1.9) (9.2)

Utilized .............................................. (14.8) (7.1) (9.2) (31.1)

Balance, December 31, 2011 ............................. £18.3 £ 2.0 £14.6 £ 34.9

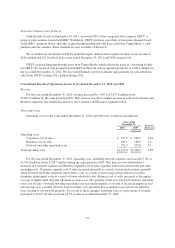

Depreciation Expense

For the year ended December 31, 2011, depreciation expense decreased to £923.2 million from £987.7 million

for the same period in 2010. This increase was primarily as a result of fixed assets becoming fully depreciated,

partially offset by depreciation in respect of new fixed assets.

Amortization Expense

For the year ended December 31, 2011, amortization expense decreased to £118.4 million from £147.6 million

for the same period in 2010. The decrease in amortization expense was primarily attributable to the cessation of

amortization of our intangible assets, all of which became fully amortized in 2011.

Interest Expense

For the year ended December 31, 2011, interest expense decreased to £440.8 million from £477.8 million

for the same period in 2010, primarily due to a reduction in the level of debt and lower borrowing costs on our

debt along with the effect of interest and cross currency rate swaps designated as accounting hedges.

We paid cash interest of £435.2 million for the year ended December 31, 2011 and £438.8 million for the

year ended December 31, 2010. The decrease in cash interest payments was primarily as a result of a lower level

of debt at lower average interest rates during the year ended December 31, 2011, along with differences in the

timing of interest payments on our senior credit facility and senior notes due to refinancing activity undertaken

during the years ended December 31, 2011 and 2010.

Loss on Extinguishment of Debt

For the year ended December 31, 2011, loss on extinguishment of debt was £47.2 million, which related to

the write off of deferred financing costs as a result of the repayments of our senior credit facility from the net

proceeds of the senior secured notes issued on March 3, 2011, the refinancing of our senior credit facility on

May 20, 2011 and the redemption of our senior notes on July 26, 2011. For the year ended December 31, 2010,

loss on extinguishment of debt was £70.0 million, which related to the write off of deferred financing costs as a

result of the partial repayments of our senior credit facility in 2010 and the call premium totaling £5.5 million on

the repayment of a portion of the senior notes due 2014.

48