Virgin Media 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

VIRGIN MEDIA INVESTMENTS LIMITED AND SUBSIDIARIES

COMBINED NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (continued)

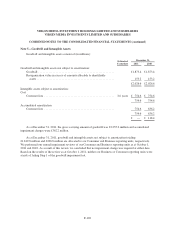

Note 2—Significant Accounting Policies (continued)

additional fixed assets and replacement of existing fixed assets are capitalized. The costs of reconnecting the

same service to a previously installed premise are charged to expense in the period incurred. Costs for repairs and

maintenance are charged to expense as incurred.

Labor and overhead costs directly related to the construction and installation of fixed assets, including

payroll and related costs of some employees and related rent and other occupancy costs, are capitalized. The

payroll and related costs of some employees that are directly related to construction and installation activities are

capitalized based on specific time devoted to these activities where identifiable. In cases where the time devoted

to these activities is not specifically identifiable, we capitalize costs based upon estimated allocations.

Software Development Costs

We capitalize costs related to computer software developed or obtained for internal use in accordance with

the Intangibles—Goodwill and Other Topic of the Financial Accounting Standards Board (“FASB”) Accounting

Standards Codification (“ASC”). Software obtained for internal use has generally been enterprise-level business

and finance software that we customize to meet our specific operational needs. Costs incurred in the application

development phase are capitalized and amortized over their useful lives, which are generally three to five years.

We have not sold, leased or licensed software developed for internal use to our customers and we have no

intention of doing so in the future. Amounts attributable to software development costs are included in fixed

assets and depreciation expense in the consolidated balance sheets and consolidated statements of operations

respectively.

Goodwill and Intangible Assets

Goodwill and other intangible assets with indefinite lives, such as reorganization value in excess of amount

allocable to identifiable assets, are not amortized and are tested for impairment annually or more frequently if

circumstances indicate a possible impairment exists in accordance with the Intangibles—Goodwill and Other

Topic of the FASB ASC.

In September 2011, the FASB issued guidance permitting companies to first assess qualitative factors as a

basis for determining whether it is necessary to perform the two-step goodwill impairment test. The guidance is

effective for goodwill impairment tests performed for fiscal years beginning after December 15, 2011; however,

early adoption is permitted. We adopted this guidance effective October 1, 2011 and applied it to the

performance of our annual goodwill impairment test for both the consumer and business reporting units.

Intangible assets include customer lists. Customer lists represent the portion of the purchase price allocated

to the value of the customer base acquired in business combinations. Customer lists are amortized on a straight-

line basis over the period in which we expect to derive benefits, which is principally three to six years.

Asset Retirement Obligations

We account for our obligations under the Waste Electrical and Electronic Equipment Directive adopted by

the European Union in accordance with the Asset Retirement and Environmental Obligations Topic of the FASB

ASC whereby we accrue the cost to dispose of certain of our customer premises equipment at the time of

acquisition. We also record asset retirement obligations for the estimated cost of removing leasehold

improvements and equipment that have been installed on leased network sites and administrative buildings.

F-93