Tesco 2011 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

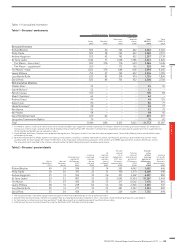

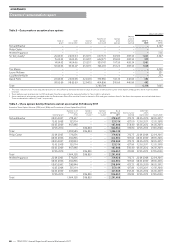

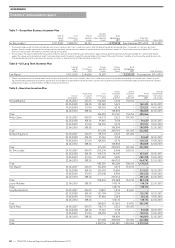

Table 1 – Directors’ emoluments

Fixed emoluments Performance-related emoluments

Salary

£000

Benefits3

£000

Short-term

cash

£000

Short-term

deferred

shares

£000

Total

2010/11

£000

Total

2009/10

£000

Executive Directors

Richard Brasher 825 40 765 632 2,262 2,402

Philip Clarke 825 38 765 632 2,260 2,701

Andrew Higginson 825 65 765 632 2,287 2,724

Sir Terry Leahy 1,432 77 1,328 1,386 4,223 5,220

Tim Mason – base salary1 825 376 716 649 2,566 3,616

Tim Mason – supplement1 200 – 172 156 528 649

Tim Mason – total 1,025 376 888 805 3,094 4,265

Laurie McIlwee 752 57 765 632 2,206 1,789

Lucy Neville-Rolfe 625 83 574 474 1,756 1,809

David Potts 825 86 765 632 2,308 2,708

Non-executive Directors

Charles Allen2 35 – – – 35 95

Gareth Bullock2 52 – – – 52 –

Patrick Cescau 109 – – – 109 89

Stuart Chambers2 64 – – – 64 –

Rodney Chase2 49 – – – 49 135

Karen Cook 80 – – – 80 77

Harald Einsmann2 28 – – – 28 77

Ken Hanna 92 – – – 92 79

Ken Hydon 98 – – – 98 95

David Reid (Chairman) 629 64 – – 693 677

Jacqueline Tammenoms Bakker 76 – – – 76 65

Total 8,446 886 6,615 5,825 21,772 25,007

1 Tim Mason’s salary is made up of a base salary and a non-pensionable salary supplement (shown separately). Tim Mason’s benefits are made up of travel, medical, tax-related costs

and services and free shares awarded under the all employee Share Incentive Plan (SIP). Payments in relation to tax equalisation on equity awards granted prior to his appointment as

US CEO totalling £768,000 are not included in table 1.

2 Gareth Bullock and Stuart Chambers were appointed during the year. The figures in table 1 are from their dates of appointment. Charles Allen, Rodney Chase and Harald Einsmann

retired during the year.

3 With the exception of Tim Mason, benefits are made up of car benefits, chauffeurs, disability and health insurance, staff discount, gym/leisure club membership and free shares

awarded under the all employee SIP. Under the SIP, shares in the Company are allocated to participants in the scheme up to HMRC approved limits (currently £3,000 per annum).

The amount of profit allocated to the scheme is determined by the Board taking into account Company performance.

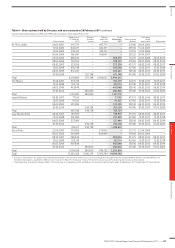

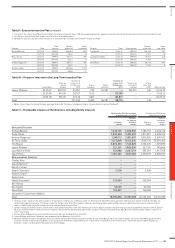

Table 2 – Directors’ pension details

Age at

26 February

2011

Years of

Company

service

Total accrued

pension at

26 February

20111,2

£000

Increase

in accrued

pension

during

the year

£000

(a)

Increase

in accrued

pension

(net of

inflation)4

£000

Transfer

value of

(a) at

26 February

2011 (less

Director’s

contributions)

£000

Transfer

value of

total accrued

pension at

27 February

2010

£000

Transfer

value

of total

accrued

pension at

26 February

2011

£000

Increase

in transfer

value (less

Director’s

contributions)

£000

Richard Brasher 49 24 384 25 14 202 4,842 5,482 640

Philip Clarke 50 36 415 25 13 190 5,579 6,269 690

Andrew Higginson 53 13 364 35 26 427 5,202 6,097 895

Sir Terry Leahy354 32 887 55 29 1,043 15,924 18,367 2,443

Tim Mason 53 29 450 26 13 217 6,662 7,478 816

Laurie McIlwee 48 10 238 60 54 740 2,306 3,253 947

Lucy Neville-Rolfe 58 14 277 33 25 481 4,452 5,334 882

David Potts 53 38 454 26 13 224 6,891 7,735 844

1 The accrued pension is that which would be paid annually on retirement at 60 based on service to 26 February 2011.

2 Some of the Executive Directors’ benefits are payable from an unapproved pension arrangement. This is secured by a fixed and floating charge on a cash deposit.

3 Sir Terry Leahy is entitled to retire at any age from 57 to 60 inclusive with an immediate pension of two-thirds of base salary.

4 Inflation over the year has been allowed for using the September 2010 statutory revaluation order.

Tables 1-11 are audited information

Overview Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011

—

85