Tesco 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

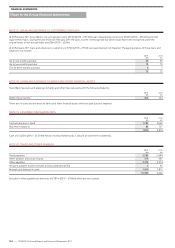

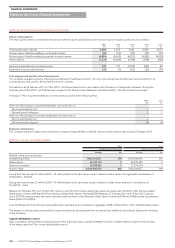

NOTE 23 FINANCIAL RISK FACTORS CONTINUED

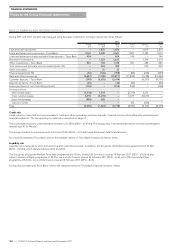

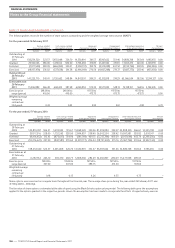

During 2011 and 2010, net debt was managed using derivative instruments to hedge interest rate risk as follows:

2011 2010

Fixed

£m

Floating

£m

Total

£m

Fixed

£m

Floating

£m

Total

£m

Cash and cash equivalents – 1,870 1,870 – 2,819 2,819

Loans and advances to customers – Tesco Bank 2,161 2,480 4,641 1,827 2,285 4,112

Loans and advances to banks and other financial assets – Tesco Bank 404 – 404 144 – 144

Short-term investments – 1,022 1,022 – 1,314 1,314

Other investments – Tesco Bank 925 183 1,108 581 282 863

Joint venture and associate, loan receivables (note 30) – 503 503 – 309 309

Other receivables – 25 25 – – –

Finance leases (note 36) (92) (106) (198) (83) (126) (209)

Bank and other borrowings (9,697) (1,180) (10,877) (11,806) (1,258) (13,064)

Customer deposits – Tesco Bank (398) (4,676) (5,074) – (4,357) (4,357)

Deposits by banks – Tesco Bank (36) – (36) (30) – (30)

Future purchases of non-controlling interests (106) – (106) (146) – (146)

Derivative effect:

Interest rate swaps (1,218) 1,218 – (2,215) 2,215 –

Cross currency swaps 3,459 (3,459) – 6,677 (6,677) –

Index-linked swaps (498) 498 – – – –

Caps and collars – – – 120 (120) –

Total (5,096) (1,622) (6,718) (4,931) (3,314) (8,245)

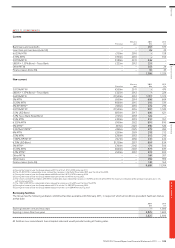

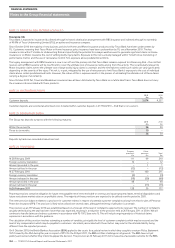

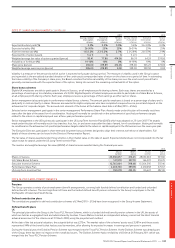

Credit risk

Credit risk arises from cash and cash equivalents, trade and other receivables, customer deposits, financial instruments and deposits with banks and

financial institutions. The Group policy on credit risk is described on page 57.

The counterparty exposure under derivative contracts is £1,287m (2010 – £1,474m). The Group policy is to transact derivatives only with counterparties

rated at least A1 by Moody’s.

The Group considers its maximum credit risk to be £10.9bn (2010 – £11.0bn), being the Group’s total financial assets.

For credit risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors below.

Liquidity risk

Liquidity risk is managed by short-term and long-term cash flow forecasts. In addition, the Group has committed facility agreements for £2.8bn

(2010 – £2.6bn), which mature between 2014 and 2015.

The Group has a European Medium Term Note programme of £15.0bn, of which £8.5bn was in issue at 26 February 2011 (2010 – £10.6bn), plus

a Euro Commercial Paper programme of £2.0bn, none of which was in issue at 26 February 2011 (2010 – £nil), and a US Commercial Paper

programme of $4.0bn, none of which was in issue at 26 February 2011 (2010 – $nil).

For liquidity risk relating to Tesco Bank, refer to the separate section on Tesco Bank financial risk factors below.

FINANCIAL STATEMENTS

130

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements