Tesco 2011 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

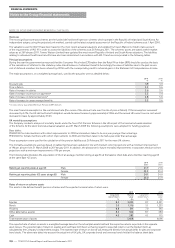

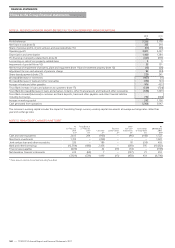

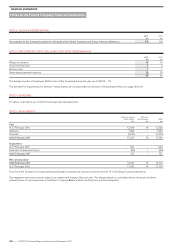

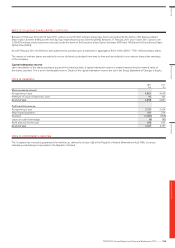

Basis of preparation

The Company financial statements have been prepared under UK GAAP

using the historical cost convention modified for the revaluation of

certain financial instruments, in accordance with applicable accounting

standards and the Companies Act 2006.

The financial year represents the 52 weeks ended 26 February 2011

(prior financial year 52 weeks ended 27 February 2010).

A summary of the Company’s significant accounting policies is set

out below.

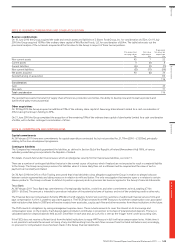

Exemptions

The Directors have taken advantage of the exemption available under

Section 408 of the Companies Act 2006 and not presented a Profit

and Loss Account for the Company alone.

The Company has taken advantage of the FRS 29 ‘Financial

Instruments: Disclosures’ exemption and not provided derivative

financial instrument disclosures of the Company alone.

The Company has also taken advantage of the exemption

from preparing a cash flow statement under the terms of FRS 1

‘Cash Flow Statement’. The cash flows of the Company are included

in the Tesco PLC Group financial statements.

The Company is also exempt under the terms of FRS 8 ‘Related Party

Disclosure’ from disclosing related party transactions with entities that

are part of the Tesco PLC Group.

Changes in accounting policy and disclosure

Standards, amendments and interpretations adopted, following new

amendments to FRS interpretations. These have not had a significant

impact on the results or net assets of the Company:

• Amendment to FRS 25 ‘Financial Instruments: Presentation’ on

‘Puttable Financial Instruments and Obligations Arising on Liquidation’,

effective for annual periods beginning on or after 1 January 2010.

• Amendment to FRS 25 ‘Financial Instruments: Presentation’ –

Presentation on Classification of Rights Issues, effective for annual

periods beginning on or after 1 February 2010.

• Amendment to FRS 26 ‘Financial Instruments: Recognition and

Measurement’ on Eligible Hedged Items, effective for annual periods

beginning on or after 1 July 2009.

• Amendment to FRS 20 ‘Share Based Payment’, effective for annual

periods beginning on or after 1 January 2010.

• UITF 48 Abstract ‘Accounting implications of the replacement of

RPI with CPI’, effective for annual periods beginning on or after

1 January 2010.

Standards, amendments and interpretations not yet effective, but not

expected to have a significant impact on the Company:

• UITF Abstract 47 ‘Extinguishing liabilities with equity instruments’,

effective for annual periods beginning on or after 1 July 2010.

• Improvements to FRSs, effective for annual periods beginning on or

after 1 January 2011.

• FRS 30 ‘Heritage Assets’, effective for annual periods beginning on or

after 1 April 2010.

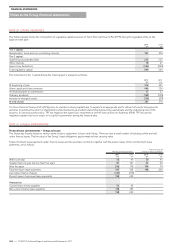

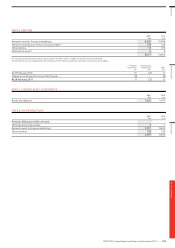

Current asset investments

Current asset investments relate to money market deposits which are

stated at cost. All income from these investments is included in the

Parent Company Profit and Loss Account as interest receivable and

similar income.

Investments in subsidiaries and joint ventures

Investments in subsidiaries and joint ventures are stated at cost less,

where appropriate, provisions for impairment.

Foreign currencies

Assets and liabilities that are denominated in foreign currencies are

translated into Pounds Sterling at the exchange rates prevailing at the

balance sheet date of the financial year.

Share-based payments

Employees of the Company receive part of their remuneration in the

form of share-based payment transactions, whereby employees render

services in exchange for shares, rights over shares (equity-settled

transactions) or in exchange for cash.

The fair value of employee share option plans is calculated at the

grant date using the Black-Scholes model. In accordance with FRS 20

‘Share-Based Payment’ the resulting cost is charged to the Parent

Company Profit and Loss Account over the vesting period. The value

of the charge is adjusted to reflect expected and actual levels of vesting.

Where the Company awards options to employees of subsidiary entities,

this is treated as a capital contribution.

Financial instruments

Financial assets and financial liabilities are recognised on the Parent

Company’s Balance Sheet when the Company becomes a party to the

contractual provisions of the instrument.

Debtors

Debtors are non interest-bearing and are recognised initially at fair

value and subsequently at amortised cost using the effective interest

rate method, less provision for impairment.

Financial liabilities and equity instruments

Financial liabilities and equity instruments are classified according to

the substance of the contractual arrangements entered into. An equity

instrument is any contract that gives a residual interest in the assets

of the Company after deducting all of its liabilities. Equity instruments

issued by the Company are recorded as the proceeds received, net of

direct issue costs.

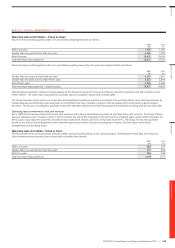

Interest-bearing borrowings

Interest-bearing bank loans and overdrafts are initially recognised at

the value of the amount received, net of attributable transaction costs.

Subsequent to initial recognition, interest-bearing borrowings are stated

at amortised cost with any differences between cost and redemption

value being recognised in the Parent Company Profit and Loss Account

over the period of the borrowings on an effective interest basis.

Other creditors

Other creditors, except for intercompany creditors, are non interest-

bearing and stated at amortised cost. Intercompany creditors are either

interest-bearing or non interest-bearing depending on the type and

duration of creditor relationship.

NOTE 1 ACCOUNTING POLICIES

FINANCIAL STATEMENTS

148

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Parent Company financial statements