Tesco 2011 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For all other non-financial assets (including intangible assets and property,

plant and equipment) the Group performs impairment testing where there

are indicators of impairment. If such an indicator exists, the recoverable

amount of the asset is estimated in order to determine the extent of the

impairment loss (if any). Where the asset does not generate cash flows that

are independent from other assets, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

The recoverable amount is the higher of fair value less costs to sell and

value in use. If the recoverable amount of an asset (or cash-generating

unit) is estimated to be less than its carrying amount, the carrying amount

of the asset (or cash-generating unit) is reduced to its recoverable amount.

An impairment loss is recognised as an expense immediately.

Where an impairment loss subsequently reverses, the carrying amount of

the asset (or cash-generating unit) is increased to the revised estimate of

the recoverable amount, but so that the increased carrying amount does

not exceed the carrying amount that would have been determined if no

impairment loss had been recognised for the asset (or cash-generating

unit) in prior years. A reversal of an impairment loss is recognised

immediately as a credit to the Group Income Statement.

Investment property

Investment property is property held to earn rental income and/or for

capital appreciation rather than for the purpose of Group operating

activities. Investment property assets are carried at cost less accumulated

depreciation and any recognised impairment in value. The depreciation

policies for investment property are consistent with those described for

owner-occupied property.

Other investments

Other investments in the Group Balance Sheet comprise loan receivables

and available-for-sale financial assets.

Loan receivables are recognised at amortised cost and available-for-sale

financial assets are recognised at fair value.

Refer to the financial instruments accounting policy for further detail.

Inventories

Inventories comprise goods held for resale and properties held for,

or in the course of, development and are valued at the lower of cost

and fair value less costs to sell using the weighted average cost basis.

Short-term investments

Short-term investments in the Group Balance Sheet consist of deposits

with money market funds.

Cash and cash equivalents

Cash and cash equivalents in the Group Balance Sheet consist of cash at

bank, in hand and demand deposits with banks together with short-term

deposits with an original maturity of three months or less.

Non-current assets held for sale

Non-current assets and disposal groups are classified as held for sale

if their carrying amount will be recovered through sale rather than

continuing use. This condition is regarded as met only when the sale is

highly probable and the asset (or disposal group) is available for immediate

sale in its present condition. Management must be committed to the sale

and it should be expected to be completed within one year from the date

of classification.

Non-current assets (and disposal groups) classified as held for sale are

measured at the lower of carrying amount and fair value less costs to sell.

Leasing

Leases are classified as finance leases whenever the terms of the lease

transfer substantially all the risks and rewards of ownership to the lessee.

All other leases are classified as operating leases.

The Group as a lessor

Amounts due from lessees under finance leases are recorded as

receivables at the amount of the Group’s net investment in the leases.

Finance lease income is allocated to accounting periods so as to reflect a

constant periodic rate of return on the Group’s net investment in the lease.

Rental income from operating leases is recognised on a straight-line basis

over the term of the lease.

The Group as a lessee

Assets held under finance leases are recognised as assets of the Group

at their fair value or, if lower, at the present value of the minimum lease

payments, each determined at the inception of the lease. The corresponding

liability is included in the Group Balance Sheet as a finance lease obligation.

Lease payments are apportioned between finance charges and a

reduction of the lease obligations so as to achieve a constant rate of

interest on the remaining balance of the liability. Finance charges are

charged to the Group Income Statement.

Rentals payable under operating leases are charged to the Group Income

Statement on a straight-line basis over the term of the lease.

Sale and leaseback

A sale and leaseback transaction is one where the Group sells an asset and

immediately reacquires the use of that asset by entering into a lease with

the buyer. The accounting treatment of the sale and leaseback depends

upon the substance of the transaction (by applying the lease classification

principles described above) and whether or not the sale was made at the

asset’s fair value.

For sale and finance leasebacks, any profit from the sale is deferred

and amortised over the lease term. For sale and operating leasebacks,

generally the assets are sold at fair value, and accordingly the profit or loss

from the sale is recognised immediately in the Group Income Statement.

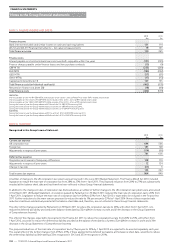

Post-employment and similar obligations

The Group accounts for pensions and other post-employment benefits

(principally private healthcare) under IAS 19 ‘Employee Benefits’.

For defined benefit plans, obligations are measured at discounted present

value (using the projected unit credit method) whilst plan assets are

recorded at fair value. The operating and financing costs of such plans are

recognised separately in the Group Income Statement; service costs are

spread systematically over the expected service lives of employees and

financing costs are recognised in the periods in which they arise. Actuarial

gains and losses are recognised immediately in the Group Statement of

Comprehensive Income.

Payments to defined contribution schemes are recognised as an expense

as they fall due.

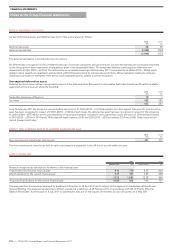

Share-based payments

Employees of the Group receive part of their remuneration in the form

of share-based payment transactions, whereby employees render services

in exchange for shares, rights over shares (equity-settled transactions) or

in exchange for cash.

The fair value of employee share option plans is calculated at the grant

date using the Black-Scholes model. The resulting cost is charged to the

Group Income Statement over the vesting period. The value of the charge

is adjusted to reflect expected and actual levels of vesting.

Taxation

The tax expense included in the Group Income Statement consists of

current and deferred tax.

NOTE 1 ACCOUNTING POLICIES CONTINUED

FINANCIAL STATEMENTS

102

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements