Tesco 2011 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

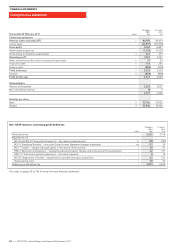

General information

Tesco PLC is a public limited company incorporated and domiciled in the

United Kingdom under the Companies Act 2006 (Registration number

445790). The address of the registered office is Tesco House, Delamare

Road, Cheshunt, Hertfordshire, EN8 9SL, UK.

The financial year represents the 52 weeks ended 26 February 2011 (prior

financial year 52 weeks ended 27 February 2010). For the UK, the Republic

of Ireland and the US, the results are for the 52 weeks ended 26 February

2011 (prior financial year 52 weeks ended 27 February 2010). For all other

operations, the results are for the calender year ended 28 February 2011

(year ended 28 February 2010).

As described in the Report of the Directors, the main activity of the Group

is that of retailing and retailing services.

Basis of preparation

The consolidated financial statements have been prepared in accordance

with International Financial Reporting Standards (IFRS) and IFRS

Interpretations Committee (IFRIC) interpretations as endorsed by the

European Union, and those parts of the Companies Act 2006 applicable

to companies reporting under IFRS.

The financial statements are presented in Pounds Sterling, generally

rounded to the nearest million. They are prepared on the historical cost

basis, except for certain financial instruments, share-based payments,

customer loyalty programmes and pensions that have been measured

at fair value.

The accounting policies set out below have been applied consistently

to all periods presented in these consolidated financial statements.

Basis of consolidation

The Group financial statements consist of the financial statements of

the ultimate Parent Company (Tesco PLC), all entities controlled by the

Company (its subsidiaries) and the Group’s share of its interests in joint

ventures and associates.

Where necessary, adjustments are made to the financial statements of

subsidiaries, joint ventures and associates to bring the accounting policies

used in line with those of the Group.

Subsidiaries

A subsidiary is an entity whose operating and financing policies are

controlled, directly or indirectly, by Tesco PLC.

The financial statements of subsidiaries are included in the consolidated

financial statements from the date that control commences until the

date that control ceases.

Intragroup balances and any unrealised gains and losses or income and

expenses arising from intragroup transactions are eliminated in preparing

the consolidated financial statements.

Joint ventures and associates

A joint venture is an entity in which the Group holds an interest on a

long-term basis and which is jointly controlled by the Group and one

or more other venturers under a contractual agreement.

An associate is an undertaking, not being a subsidiary or joint venture,

over which the Group has significant influence and can participate in the

financial and operating policy decisions of the entity.

The Group’s share of the results of joint ventures and associates is included

in the Group Income Statement using the equity method of accounting.

Investments in joint ventures and associates are carried in the Group Balance

Sheet at cost plus post-acquisition changes in the Group’s share of the net

assets of the entity, less any impairment in value. The carrying values of

investments in joint ventures and associates include acquired goodwill.

If the Group’s share of losses in a joint venture or associate equals or

exceeds its investment in the joint venture or associate, the Group does

not recognise further losses, unless it has incurred obligations to do so

or made payments on behalf of the joint venture or associate.

Unrealised gains arising from transactions with joint ventures and

associates are eliminated to the extent of the Group’s interest in the entity.

Use of assumptions and estimates

The preparation of the consolidated financial statements requires

management to make judgements, estimates and assumptions that affect

the application of policies and reported amounts of assets and liabilities,

income and expenses. The estimates and associated assumptions are

based on historical experience and various other factors that are believed

to be reasonable under the circumstances. Actual results may differ from

these estimates.

The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in accordance with

IAS 8 ‘Accounting Policies, Changes in Accounting Estimates and Errors’.

Critical estimates and assumptions that are applied in the preperation

of the consolidated financial statements include:

Depreciation and amortisation

The Group exercises judgement to determine useful lives and residual

values of intangibles, property, plant and equipment and investment

property. The assets are depreciated down to their residual values over

their estimated useful lives.

Impairment

i) Impairment of goodwill

The Group tests annually whether goodwill has suffered any impairment

in accordance with the accounting policy as set out below. The recoverable

amount of the cash-generating units has been determined based on value

in use calculations. The key assumptions for the value in use calculations

are those regarding discount rates, growth rates and expected changes

in margins. Management estimate discount rates using pre-tax rates that

reflect the current market assessment of the time value of money and

country specific risks.

ii) Impairment of assets

The Group has determined each store as a separate cash-generating unit.

Where there are indicators for impairment, the Group performs an

impairment test.

Recoverable amounts for cash-generating units are based on the higher

of value in use and fair value less costs to sell. Value in use is calculated

from cash flow projections for five years using data from the Group’s latest

internal forecasts. The key assumptions for the value in use calculations

are those regarding discount rates, growth rates and expected changes

in margins. Management estimate discount rates using pre-tax rates that

reflect the current market assessment of the time value of money and

country specific risks.

iii) Impairment of loans and advances to customers

The Group’s loan impairment provisions are established to recognise

incurred impairment losses in its portfolio of loans classified as loans and

receivables and carried at amortised cost. A loan is impaired when there is

objective evidence that events since the loan was granted have affected

expected cash flows from the loan. The impairment loss is the difference

between the carrying value of the loan and the present value of estimated

future cash flows at the loan’s original effective interest rate.

The Group’s loan impairment provisions are established on a portfolio

basis taking into account the level of arrears, security, past loss experience,

credit scores and defaults based on portfolio trends. The most significant

factors in establishing these provisions are the expected loss rates. These

portfolios include credit card receivables and other personal advances.

The future credit quality of these portfolios is subject to uncertainties

that could cause actual credit losses to differ materially from reported

loan impairment provisions. These uncertainties include the economic

environment, notably interest rates and their effect on customer spending,

the unemployment level, payment behaviour and bankruptcy trends.

NOTE 1 ACCOUNTING POLICIES

FINANCIAL STATEMENTS

TESCO PLC Annual Report and Financial Statements 2011

—

99

Overview Business review Governance Financial statements

Notes to the Group financial statements