Tesco 2011 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

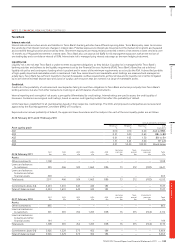

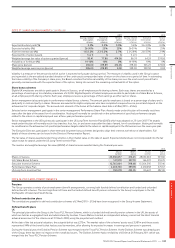

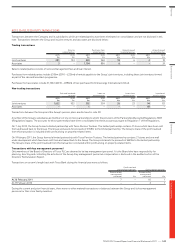

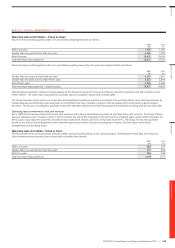

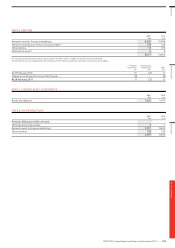

NOTE 31 RECONCILIATION OF PROFIT BEFORE TAX TO CASH GENERATED FROM OPERATIONS

2011

£m

2010

£m

Profit before tax 3,535 3,176

Net finance costs (note 5) 333 314

Share of post-tax profits of joint ventures and associates (note 13) (57) (33)

Operating profit 3,811 3,457

Depreciation and amortisation 1,420 1,384

Profit arising on property-related items (note 3) (427) (377)

Loss arising on sale of non property-related items 35

Impairment of goodwill (note 10) 55 131

Net reversal of impairment of property, plant and equipment (note 11) and investment property (note 12) (13) (26)

Adjustment for non-cash element of pensions charge 95 (24)

Share-based payments (note 27) 220 241

(Increase)/decrease in inventories (467) 34

(Increase)/decrease in trade and other receivables (152) 124

Increase in trade and other payables 976 453

Tesco Bank increase in loans and advances to customers (note 17) (529) (724)

Tesco Bank (increase)/decrease in loans and advances to banks, other financial assets and trade and other receivables (356) 1,369

Tesco Bank increase/(decrease) in customer and bank deposits, trade and other payables and other financial liabilities

including borrowings 730 (100)

Increase in working capital 202 1,156

Cash generated from operations 5,366 5,947

The increase in working capital includes the impact of translating foreign currency working capital movements at average exchange rates rather than

year end exchange rates.

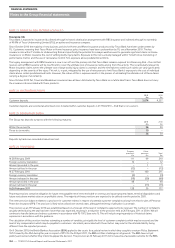

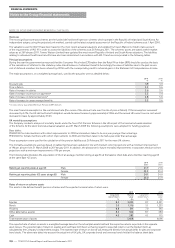

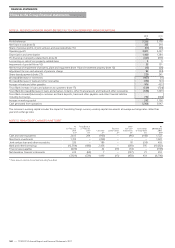

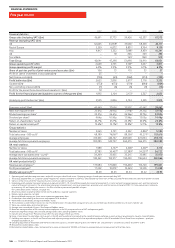

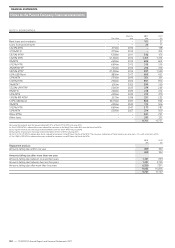

NOTE 32 ANALYSIS OF CHANGES IN NET DEBT

At

27 February

2010

£m*

Tesco Bank at

27 February

2010

£m

Cash flow

£m

Business

combinations

£m

Other

non-cash

movements

£m

Elimination

of Tesco Bank

£m

At

26 February

2011

£m*

Cash and cash equivalents 2,615 204 (903) – (46) (148) 1,722

Short-term investments 1,314 – (292) – – – 1,022

Joint venture loan and other receivables 320 – 189 – 18 (34) 493

Bank and other borrowings (12,584) (480) 2,456 – (269) 595 (10,282)

Finance lease payables (209) – 42 (17) (14) – (198)

Net derivative financial instruments 615 (63) 7 – (127) 21 453

(7,929) (339) 1,499 (17) (438) 434 (6,790)

* These amounts relate to the net debt excluding Tesco Bank.

FINANCIAL STATEMENTS

142

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements