Tesco 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

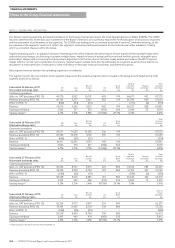

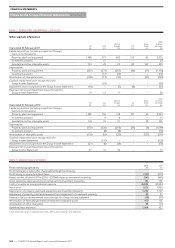

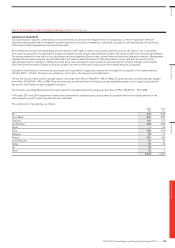

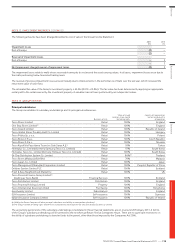

NOTE 6 TAXATION CONTINUED

Certain deferred tax assets and liabilities have been offset and analysed as follows:

2011

£m

2010

£m

Deferred tax assets 48 38

Deferred tax liabilities (1,094) (795)

(1,046) (757)

The deferred tax balance is considered to be non-current.

No deferred tax is recognised on the unremitted earnings of overseas subsidiaries and joint ventures, because the earnings are continually reinvested

by the Group and no tax is expected to be payable on them in the foreseeable future. The temporary difference unrecognised at the year end

amounted to £3.0bn (2010 – £2.7bn). The deferred tax on unremitted earnings at 26 February 2011 is estimated to be £90m (2010 – £50m) which

relates to taxes payable on repatriation and dividend withholding taxes levied by overseas tax jurisdictions. UK tax legislation relating to company

distributions provides for exemption from tax for most repatriated profits, subject to certain exceptions.

Unrecognised deferred tax assets

Deferred tax assets have not been recognised in respect of the following items (because it is not probable that future taxable profits will be available

against which the Group can utilise the benefits):

2011

£m

2010

£m

Deductible temporary differences 19 1

Tax losses 403 286

422 287

As at 26 February 2011 the Group has unused trading tax losses of £1,309m (2010 – £1,019m) available for offset against future profits. A deferred tax

asset has been recognised in respect of £109m (2010 – £142m) of such losses. No deferred tax asset has been recognised in respect of the remaining

£1,200m (2010 – £877m) due to the unpredictability of future profit streams. Included in unrecognised tax losses are losses of £390m that will expire

in 2015 (2010 – £297m in 2014) and £744m that will expire between 2016 and 2031 (2010 – £550m between 2015 and 2030). Other losses will be

carried forward indefinitely.

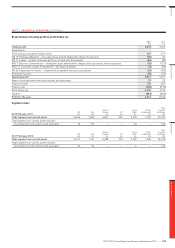

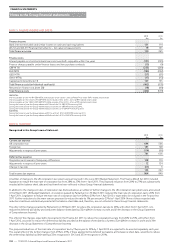

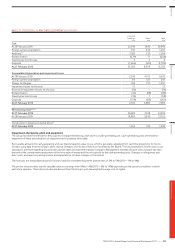

NOTE 7 NON-CURRENT ASSETS CLASSIFIED AS HELD FOR SALE

2011

£m

2010

£m

Non-current assets classified as held for sale 431 373

The non-current assets classified as held for sale consist mainly of properties in the UK due to be sold within one year.

NOTE 8 DIVIDENDS

2011 2010

pence/share £m pence/share £m

Amounts recognised as distributions to owners in the financial year:

Final dividend for the prior financial year 9.16 730 8.39 660

Interim dividend for the current financial year 4.37 351 3.89 308

13.53 1,081 12.28 968

Proposed final dividend for the current financial year 10.09 812 9.16 731

The proposed final dividend was approved by the Board of Directors on 18 April 2011 and is subject to the approval of shareholders at the Annual

General Meeting. The proposed dividend has not been included as a liability as at 26 February 2011, in accordance with IAS 10 ‘Events After the

Balance Sheet Date’. It will be paid on 8 July 2011 to shareholders who are on the register of members at close of business on 3 May 2011.

FINANCIAL STATEMENTS

112

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements