Tesco 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

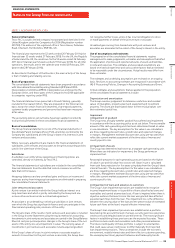

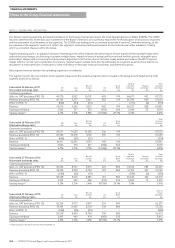

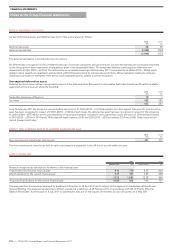

NOTE 2 SEGMENTAL REPORTING CONTINUED

Other segment information

Year ended 26 February 2011 UK

£m

Asia

£m

Rest of

Europe

£m

US

£m

Tesco

Bank

£m

Total

at actual

exchange

£m

Capital expenditure (including acquisitions through

business combinations):

Property, plant and equipment 1,486 977 603 192 62 3,320

Investment property – 17 7 – – 24

Goodwill and other intangible assets 159 28 23 82 163 455

Depreciation:

Property, plant and equipment (607) (273) (263) (40) (11) (1,194)

Investment property – (17) (14) – – (31)

Amortisation of intangible assets (109) (17) (22) – (47) (195)

Goodwill impairment losses recognised in the

Group Income Statement – (55) – – – (55)

Impairment losses recognised in the Group Income Statement (14) – (3) (8) – (25)

Reversal of prior year impairment losses through the

Group Income Statement 14 13 11 – – 38

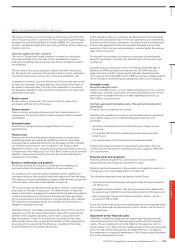

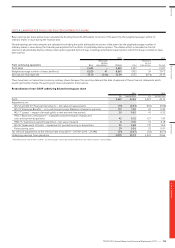

Year ended 27 February 2010 UK

£m

Asia

£m

Rest of

Europe

£m

US

£m

Tesco

Bank

£m

Total

at actual

exchange

£m

Capital expenditure (including acquisitions through

business combinations):

Property, plant and equipment 1,485 736 518 141 44 2,924

Investment property – 8 8 – – 16

Goodwill and other intangible assets 124 91 21 – 25 261

Depreciation:

Property, plant and equipment (570) (226) (260) (29) (6) (1,091)

Investment property – (8) (8) – – (16)

Amortisation of intangible assets (116) (14) (20) – (127) (277)

Goodwill impairment losses recognised in the

Group Income Statement – (131) – – – (131)

Impairment losses recognised in the Group Income Statement (27) (6) (18) – – (51)

Reversal of prior year impairment losses through the

Group Income Statement 27 10 40 – – 77

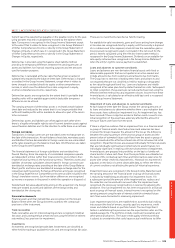

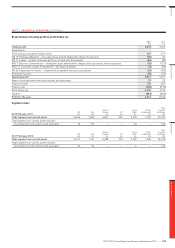

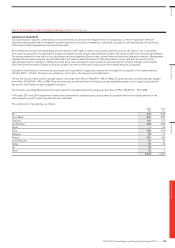

NOTE 3 INCOME AND EXPENSES

From continuing operations 2011

£m

2010

£m

Profit before tax is stated after charging/(crediting) the following:

Profit arising on property-related items (427) (377)

Rental income, of which £417m (2010 – £351m) relates to investment properties (541) (461)

Direct operating expenses arising on rental earning investment properties 122 103

Costs of inventories recognised as an expense 45,942 42,504

Stock losses 1,025 1,000

Depreciation of property, plant and equipment and investment property 1,225 1,107

Impairment of property, plant and equipment and impairment of investment property 25 51

Reversal of prior year impairment losses through the Group Income Statement (38) (77)

Amortisation of internally-generated development intangible assets 100 103

Amortisation of other intangibles 95 174

Operating lease expenses*1,064 927

* Operating lease expenses include £53m (2010 – £83m) for hire of plant and machinery.

FINANCIAL STATEMENTS

108

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements