Tesco 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

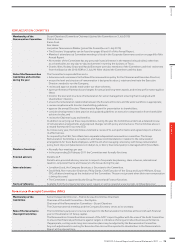

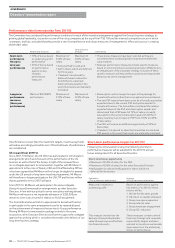

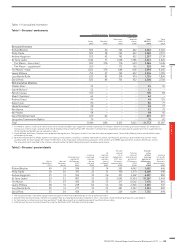

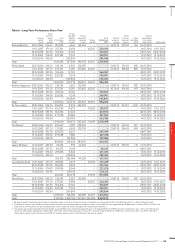

Long-term performance awards made in 2010

Performance measures Award size Performance conditions

Earnings per share • Options over shares with

a value of 200% of salary

• Exercise price equal to the

market value at the date

of grant

• Any gain is therefore

dependent on increasing

the share price between the

date of grant and exercise

• Vesting of the awards is subject to the achievement of EPS performance

conditions.

• The first 100% is subject to the achievement of underlying diluted EPS growth

of at least RPI plus 9% over three years.

• The balance vests for achieving growth of at least RPI plus 15%.

• Performance against this target will be measured at the end of 2012/13 to

determine the level of vesting.

Return on capital

employed – Group and

International

• Current plan maximum

of performance share award

of 150% of base salary

• In October 2010 awards

were made to all the

Executive Directors except

Tim Mason over Tesco PLC

shares equal to 150% of

salary

• An award was made to

Tim Mason over Tesco PLC

shares equal to 100%

of salary

• For all the Executive Directors, awards over 100% of salary will vest subject to

Group ROCE performance.

• The awards over a further 50% of salary (other than Tim Mason), will vest

subject to International ROCE performance. The rationale for this is to incentivise

and reward delivery of higher returns from invested capital outside the UK

(but excluding the US).

• Awards vest over a three-year performance period from 2010/11 to 2012/13.

• The first 75% of each element of the PSP award is subject to a target of 13.6%

for Group ROCE and 7.5% for International ROCE. 25% will vest for baseline

performance and the full 75% will vest for maximum performance against target.

• The remaining 25% of each element of the award will vest by reference to the

overall quality of ROCE performance.

• The purpose of this element of the ROCE award is to allow the Committee to

recognise the right behaviours by the Executive Directors – in particular, where

they have made substantial capital investments in the Group (especially in

developing markets) with the purpose of growing the long-term returns of the

Group but where those investments have led to a reduction in ROCE growth in

the short-term.

• The Remuneration Committee will take into account a number of factors,

including the level of ROCE achieved, the expected ROCE for additional and

existing capital investment, whether capital spend was in line with strategic

objectives and balanced short-term and long-term investment needs, the level

of sales and underlying profit growth and whether this reflected other developments

in the marketplace.

• If the Remuneration Committee exercises its judgement to allow some, or all,

of the remaining 25% of the PSP awards to vest, we will describe in the Directors’

Remuneration Report in the relevant year those factors taken into account in

determining the level of the award which would vest.

• There is no retesting of performance in respect of any targets.

• Participants are entitled to receive reinvested dividends on the value of the award

that vests.

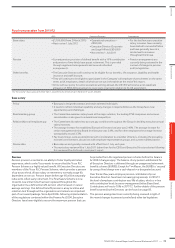

US long-term objectives

The first 25% of the awards made in 2007 under the US LTIP to the

US CEO and under the Group New Business Incentive Plan to the

former CEO was subject to testing against US ROCE and EBIT targets

in 2010/11. The performance targets for 2010/11 have not been met

and no portion of this first tranche will vest. The next assessment

of performance will be in respect of 2011/12. As mentioned above,

in order to refocus his reward on Group performance, the US CEO

will no longer participate in the US LTIP and his award will lapse.

No other Executive Directors participate in the US LTIP or Group

New Business Incentive Plan. Senior members of the US management

team will however continue to participate in the plan.

Long-term performance awards made in 2010

The long-term performance awards granted in 2010 were made under

the 2010/11 executive remuneration policy and were subject to the

performance measures described in the table below. The performance

period for these awards is 2010/11 to 2012/13 and the portion of the

award that vests will be disclosed in the 2012/13 Remuneration Report.

TESCO PLC Annual Report and Financial Statements 2011

—

83

Overview Business review Governance Financial statements