Tesco 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Pension

Pension provision is central to our ability to foster loyalty and retain

experience, which is why Tesco wants to ensure that the Tesco PLC

Pension Scheme is a highly valued benefit. All Executive Directors are

members of the Tesco PLC Pension Scheme, which provides a pension

of up to two-thirds of base salary on retirement, normally at age 60,

dependent on service. Pension drawn before age 60 will be actuarially

reduced to reflect early retirement. The Final Salary Scheme is now

closed to new entrants but has been replaced throughout the

organisation by a defined-benefit pension scheme based on career

average earnings. Our defined benefit pension is a key incentive and

retention tool throughout the organisation and remains an important

part of our reward package. Since April 2006, following implementation

of the regulations contained within the Finance Act 2004, Executive

Directors have been eligible to receive the maximum pension that can

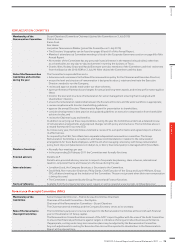

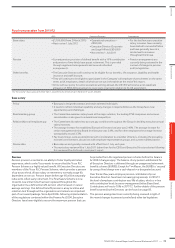

Fixed remuneration from 2011/12

CEO1Executive Directors Commentary

Base salary • £1,100,000 (from 2 March 2011)

• Next review 1 July 2012

• Operational executives –

£832,000

• Executive Director (Corporate

and Legal Affairs) £624,000

• Next review 1 July 2011

• For the last few years executive

salary increases have normally

been limited to around inflation

and have generally been at a

similar level to increases

throughout the Group.

Pension • Current pension provision of defined benefit with a 10% contribution

and pension of two-thirds base pay at retirement. This is provided

through registered arrangements and secured unfunded

arrangements.

• Pension arrangements are

currently being reviewed in the

context of changes in pension

and tax legislation.

Other benefits • The Executive Directors will continue to be eligible for car benefits, life assurance, disability and health

insurance and staff discount.

• They will continue to be eligible to participate in the Company’s all employee share schemes on the same

terms as UK employees, details of which are set out in the tables at the end of this report.

• In line with our policy for senior executives working abroad, the US CEO will receive a net expatriate

allowance of £282,000 per annum to cover costs incurred in relation to his US assignment.

1 Sir Terry Leahy’s base salary with effect from 1 July 2010 to his retirement on 1 March 2011 was £1,444,000.

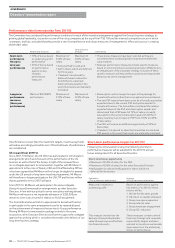

Base salary

Policy • Base pay is designed to attract and retain talented individuals.

• It needs to reflect individual capability and any changes in responsibilities as the Group faces new

opportunities and challenges.

Benchmarking group • The Committee examines salary levels at the major retailers, the leading FTSE companies and ensures

consideration is also given to international competitors.

Relationship to all employee pay • The Committee also takes into account pay conditions throughout the Group in deciding executive annual

salary increases.

• The average increase for established Executive Directors last year was 2.46%. The average increase for

senior management below Board level last year was 2.4%, and for other employees the average increase

was typically around 2.3%.

• Pay levels Group-wide are determined with consideration to a number of factors, including the prevailing

economic environment, discussions with employee representative groups, and current market practice.

Review date • Base salaries are typically reviewed with effect from 1 July each year.

• The next salary review will be 1 July 2011 (other than for the CEO) and Executive Director salaries following

this review will be disclosed in next year’s report.

be provided from the registered pension scheme before the Finance

Act 2004 changes apply. The balance of any pension entitlement for

all Executive Directors is delivered through an unapproved retirement

benefits scheme (SURBS). Except for Tim Mason, the SURBS is ‘secured’

by using a fixed charge over a cash deposit in a designated account.

Over the last few years employee pension contributions by our

Executive Directors have been increasing progressively. In 2010/11

the level of employee contribution was 9% of salary, which is in line

with contribution levels by senior management below Board level.

Contributions will rise to 10% in 2011/12. Further details of the pension

benefits earned by the Directors can be found on page 85.

The pension arrangements are currently being reviewed in light of

the recent changes to pension tax relief and other tax legislation.

TESCO PLC Annual Report and Financial Statements 2011

—

77

Overview Business review Governance Financial statements