Tesco 2011 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and therefore paid in instalments to facilitate this. If the termination

occurs within one year of retirement, the termination payment will be

reduced accordingly.

New appointments of Executive Directors will normally provide for

termination on 12 months’ notice by the Executive. However, the

Committee reserves the right to vary this period to 24 months for the

initial period of appointment and for the notice period to then revert

to 12 months. The service agreements are available to shareholders

to view on request from the Company Secretary.

New CEO contract

The Committee has taken into account the feedback received from

shareholders and shareholder representative bodies regarding best

practice in relation to the inclusion of bonus in directors’ termination

arrangements. To ensure full alignment with best practice, the

Committee has agreed with Mr Clarke that under his new contract as

CEO any termination payment in lieu of notice will be based on salary

and benefits only. This will also be the policy going forward for new

executives joining the Board.

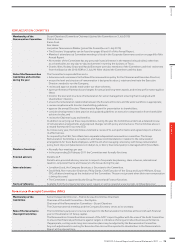

CURRENT REMUNERATION ARRANGEMENTS AND

PAYOUTS FOR 2010/11

Tesco’s core objective is to create value for customers to earn their

lifetime loyalty and through this to create value for our shareholders.

2010/11 has been another solid year despite ongoing challenging

market conditions. Returns have grown strongly over the past year

representing a significant step towards our long-term goals. Our core UK

business remains robust and the increasing scale and competitiveness

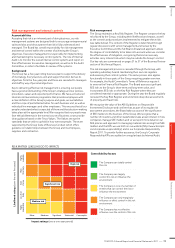

Group short-term objectives

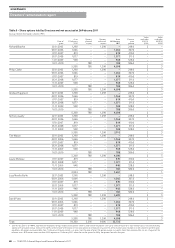

The table below is a summary of the actual performance delivered in 2010/2011:

of our international business is driving strong performance in these

markets. Against this performance background, the main aspects

of executive remuneration practice for the 2010/11 year are as follows:

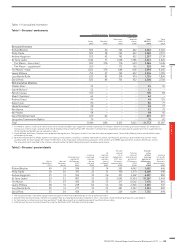

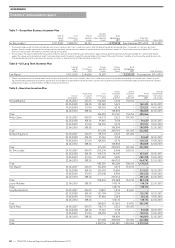

Salaries 2010/11

The base salaries of the Executive Directors following review in

July 2010 were:

Director

Basic salary 1 July 2010

£000

Richard Brasher 832

Philip Clarke 832

Andrew Higginson 832

Tim Mason 832

Laurie McIlwee* 832

Lucy Neville-Rolfe 624

David Potts 832

* Laurie Mcllwee was appointed to the role of CFO in January 2009. At this time, his base

salary was set behind that of the other Executive Directors to reflect the fact that he

was new to the role. The intention was to move his base salary to the level of the other

Directors over time. The Committee reviewed Mr Mcllwee’s performance and base salary

in July 2010 and concluded that Mr Mcllwee’s performance was that of an experienced

CFO and therefore it was appropriate to increase his base salary to £832,000, the same

level as the other Executives.

The average increase for established Executive Directors last year was

2.46%, which was broadly the same as the increase for other senior

executives and employees throughout the Group.

Performance measures Maximum award opportunity Performance against targets

Earnings per share 75% of cash element and 50%

of share element

The reported underlying diluted Group EPS for 2010/11 was 35.72p, an increase of

10.8% on last year.

Corporate objectives 25% of cash element and 30%

of share element

The corporate objectives are based on our balanced scorecard, known as the Steering

Wheel. Corporate objectives for the awards made in respect of the financial year

2010/11 were:

• increasing sales from new space; specific profit targets for international businesses

and for retailing services;

• like-for-like sales growth and the development of the non-food business;

• focus on productivity improvements and developing trading models internationally;

• enhancing talent management and capability;

• embedding the new international Community Plans and Community Promises; and

• reducing our environmental impact.

Two-thirds of targets were fully met at the stretch level and a solid performance was

delivered against the remainder.

Total shareholder

return

20% of share element The target to outperform against the FTSE 100 and a comparator group of international

retailers that includes Ahold, Carrefour, J Sainsbury, Metro, Wm Morrison, Safeway

Inc, Target and Walmart was not met over the short term although long-term TSR

performance remained strong.

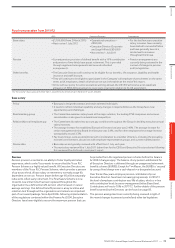

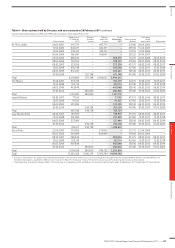

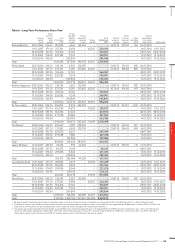

Former CEO

• Maximum of 250% of base salary

• 200% of salary based on Group

performance; 50% of salary based

on US performance

• 100% of salary in cash; 150% of salary

in shares

Executive Directors

• Maximum of 200% of salary

• All based on Group performance

• 100% of salary in cash; 100% of

salary in shares

US CEO

• Maximum of 300% of base salary

• 100% of salary based on Group

performance; 200% of salary based

on US performance

• 150% of salary in cash; 150% of salary

in shares

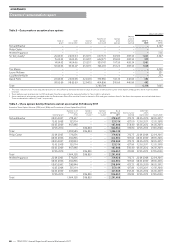

Short-term performance 2010/11

The table below sets out a summary of the maximum opportunity under the short-term remuneration arrangements for 2010/11:

80

—

TESCO PLC Annual Report and Financial Statements 2011

GOVERNANCE

Directors’ remuneration report