Tesco 2011 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

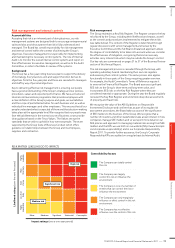

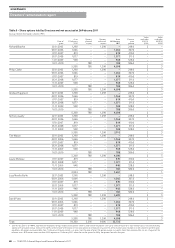

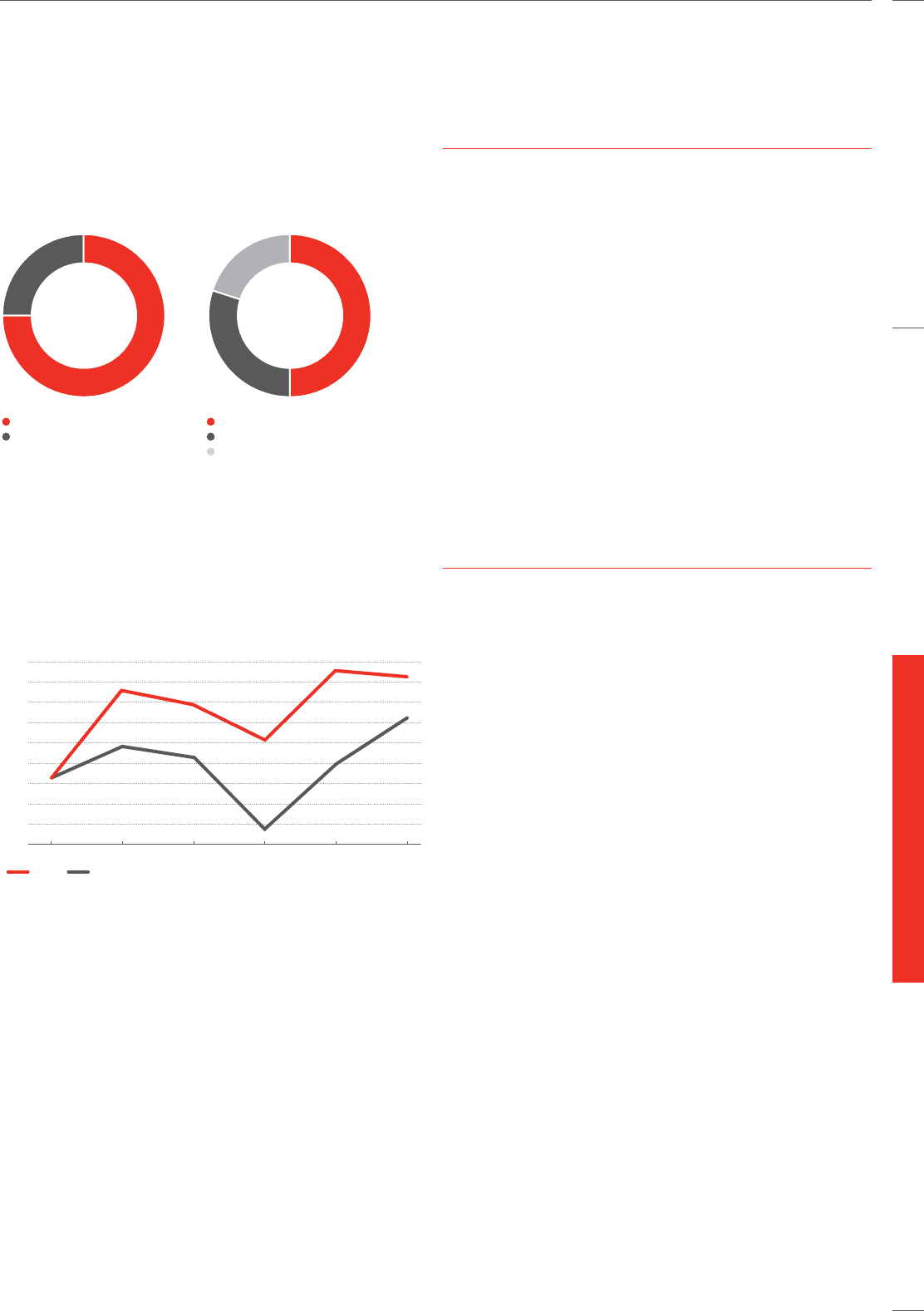

The balance of Group performance measures is illustrated in the

charts below:

Cash Shares deferred for

three years

25% Corporate objectives

75% EPS

Tesco Bank

50% EPS

30% Corporate objectives

20% TSR

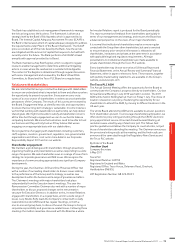

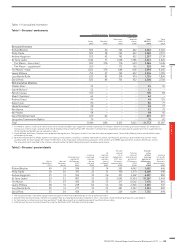

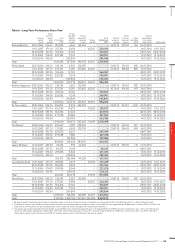

Total shareholder return (TSR) is the notional return from a share or

index based on share price movements and declared dividends.

The graph below highlights the Group’s TSR performance over the last

five financial years, relative to the FTSE 100 index of companies. This

index has been selected to provide an established and broad-based

comparator group of retail and non-retail companies of similar scale

to Tesco. As illustrated below, Tesco has outperformed the FTSE 100

throughout the period.

Value of £100 invested 1 March 06

Feb 08Feb 07 Feb 09 Feb 10 Feb 11Feb 06

140

150

130

110

100

120

90

80

70

FTSE 100 Tesco

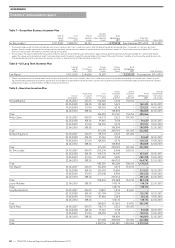

Payout levels

Following the Remuneration Committee’s consideration of the extent

to which the various performance measures in respect of the 2010/11

annual bonus award were achieved, the Executive Directors have been

awarded 92% of the potential maximum for the cash element and

76% of the potential maximum for the deferred shares element. The

Committee considers this level of reward appropriate.

EPS, on a like-for-like basis, achieved the maximum award level,

reflecting strong improvements in underlying profit growth as well as

sound financial management. In respect of corporate objectives,

performance against most measures was strong, resulting in delivery

at the upper end of the target range. Performance against financial

metrics was excellent with retail profit growth and UK new space

addition targets being exceeded. Performance against operational

targets, such as availability, was weakened by the severe weather

situation in Q4, but remained good. The business continues to make

strong progress in developing and deploying talent and targets in this

area have been achieved. Performance against corporate responsibility

metrics has also been excellent, with CO2 emissions reduced and with

the continued development of our community programmes. Long-term

TSR performance remains strong, but has been behind the market over

the past year.

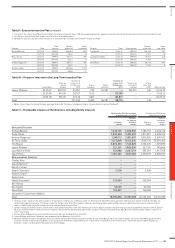

US short-term objectives

The US business continues to make solid progress, with strong

like-for-like sales growth and improved store operating ratios, as

well as steady improvements against a number of other key milestone

measures. Customer feedback remains excellent and our clear objective

now is to accelerate the strong growth in customer numbers we are

seeing. The overall business remains on track to break even towards

the end of the 2012/13 financial year.

Despite the good progress and the achievement of a number of

strategic goals, losses in the US business increased in the year, as a

consequence of the initial costs of integrating our acquisitions of two

dedicated fresh food suppliers and adverse exchange rate movements.

The Committee has therefore decided, having reviewed performance

against both financial and strategic targets, to award 40% of the

potential maximum opportunity to Tim Mason and Sir Terry Leahy

for that part of their respective annual bonuses which is measured

by reference to US-specific targets (compared with 65% in 2009/10).

This means that Tim Mason will receive an annual US bonus award

of 80% of base salary (compared with a possible maximum 200%

of salary) and Sir Terry will receive an award of 20% of base salary

(compared with a possible maximum 50% of salary).

TESCO PLC Annual Report and Financial Statements 2011

—

81

Overview Business review Governance Financial statements