Tesco 2011 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

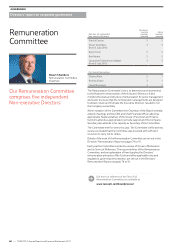

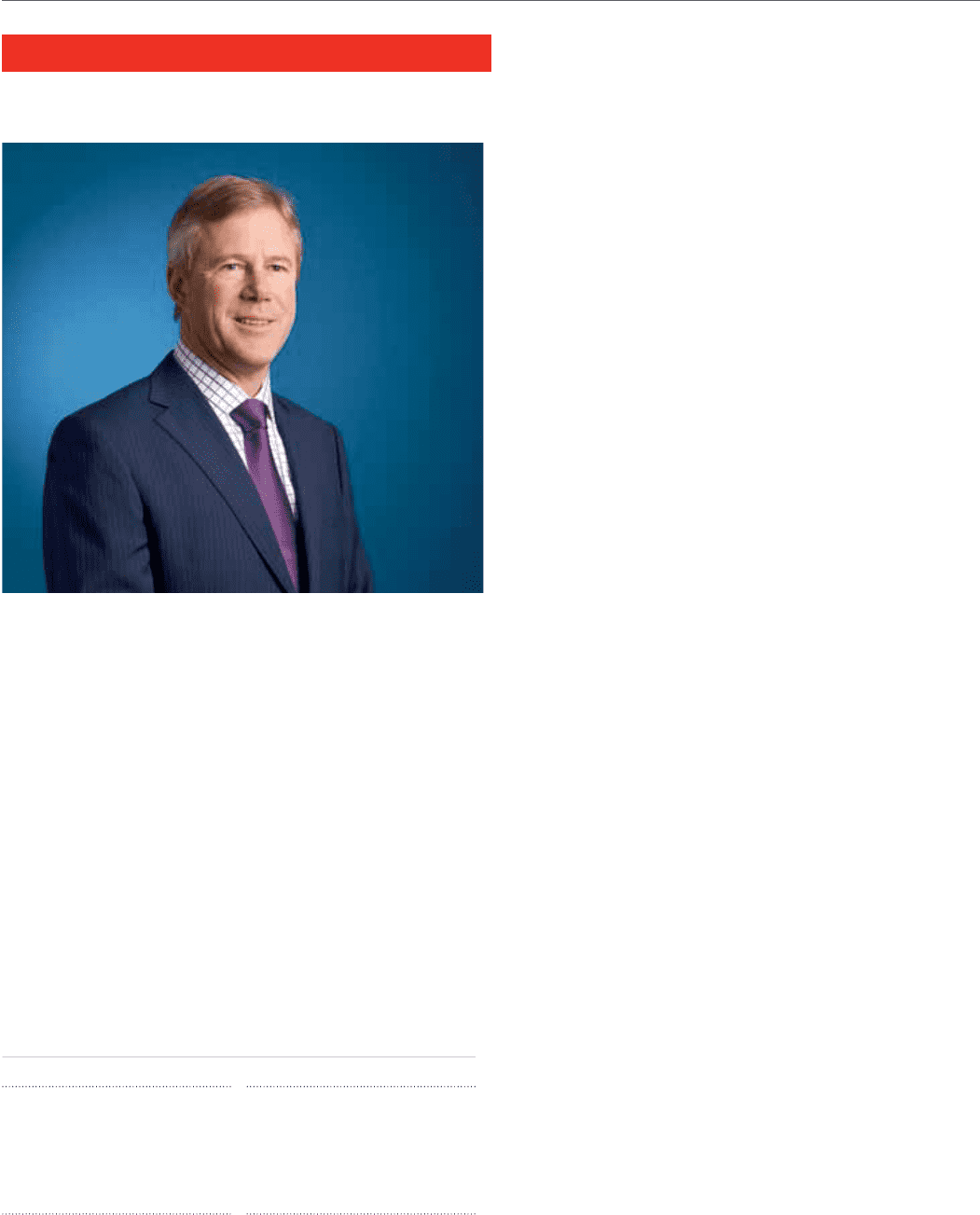

Following my appointment as Chairman of the Remuneration

Committee, I took the opportunity to meet with our largest

shareholders in November 2010 to understand their views and

concerns in relation to remuneration arrangements. The Remuneration

Committee has since reviewed all our executive remuneration

arrangements in the light of our strategy, our operational goals and the

feedback from shareholders. Whilst we believe that our remuneration

arrangements are broadly competitive and operate well, the Committee

has found opportunities to simplify, and rebalance where appropriate.

In carrying out this review, we have followed four guiding principles.

These principles as well as the key outcomes of the review are as follows:

1 Simplification – We will remove share options and operate only one

long-term incentive plan (currently four plans) with two performance

measures (currently five measures). We will also reduce the annual

bonus metrics to seven key measures (currently more than 20

individual measures are considered).

2 A collegiate approach – The focus for our long-term incentives will

be on Group results only for both the CEO and Executive Directors

and there will be no separate long-term incentives for Executive

Directors in relation to the US or other businesses. Going forward,

the US CEO will participate in the same incentive arrangements

as other executives and will no longer participate in the US LTIP.

3 Strategic alignment – We will emphasise earnings growth in the

long-term plan as well as delivering sustainable return on capital.

We are also increasing our executive shareholding guidelines to four

times base salary for the CEO and three times base salary for the

Executive Directors to enhance the alignment of interests between

executives and our shareholders.

4 Appropriate pay levels – The simplified remuneration

arrangements are of broadly the same expected value as the current

executive remuneration arrangements.

We are asking shareholders at this year’s AGM to approve the renewal of

the Performance Share Plan for a further ten years on broadly its existing

terms. In order to allow for the replacement of share options with a

performance share award and to allow for the Committee to structure

the reward of the CEO so that it is more focused on performance related

elements, our current intention is for the maximum award under the

long-term incentive plan (PSP) to be 225% of base salary for Executive

Directors and 275% of base salary for the CEO. To ensure that we have

sufficient headroom to grant awards in exceptional circumstances,

in line with usual practice, we are seeking shareholder approval to

increase the maximum award opportunity under the PSP to 350% of

base salary. In the event that this award policy changes we would expect

to consult our largest shareholders in advance.

Further details of the proposed remuneration arrangements are set out

on pages 76 to 79.

I believe that the remuneration arrangements we are proposing are

appropriate and will help incentivise executives to create future growth

in shareholder value. I very much hope that shareholders will support

our remuneration arrangements at our forthcoming AGM.

Last year’s remuneration

2010/11 was another strong performance year for Tesco in challenging

markets. Remuneration payouts for the year were based on the existing

reward framework and average payouts for the year were lower than

for 2009/10. Further details of this are provided on pages 80 to 83.

Stuart Chambers

Chairman of the Remuneration Committee

As the new Remuneration

Committee Chairman I am

pleased to present Tesco PLC’s

2010/11 Directors’ Remuneration

Report to you.

Stuart Chambers

Remuneration Committee Chairman

This report sets out the remuneration policy for the Executive and

Non-executive Directors of Tesco PLC and describes the individual

remuneration of the Directors for the year ended 26 February 2011.

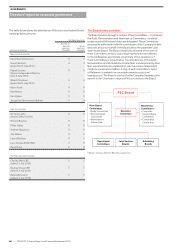

REMUNERATION COMMITTEE

75 Governance and risk

management, including the

role, membership and advisors

to the Committee

REMUNERATION STRATEGY

AND POLICY

76 Remuneration strategy and

policy from 2011/12

77 Fixed remuneration from

2011/12

78 Performance related

remuneration from 2011/12

79 Share ownership guidelines

79 Service agreements

REMUNERATION FOR 2010/11

80 Fixed remuneration for 2010/11

80 Performance related

remuneration for 2010/11

83 2010/11 long term performance

awards

OTHER INFORMATION

84 Outside appointments

84 Other remuneration matters

84 Non-executive Directors

84 Compliance

74

—

TESCO PLC Annual Report and Financial Statements 2011

GOVERNANCE

Directors’ remuneration report