Tesco 2011 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

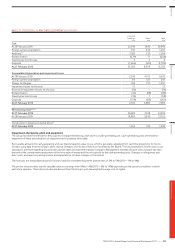

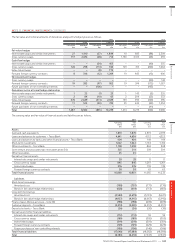

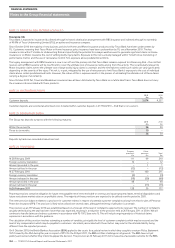

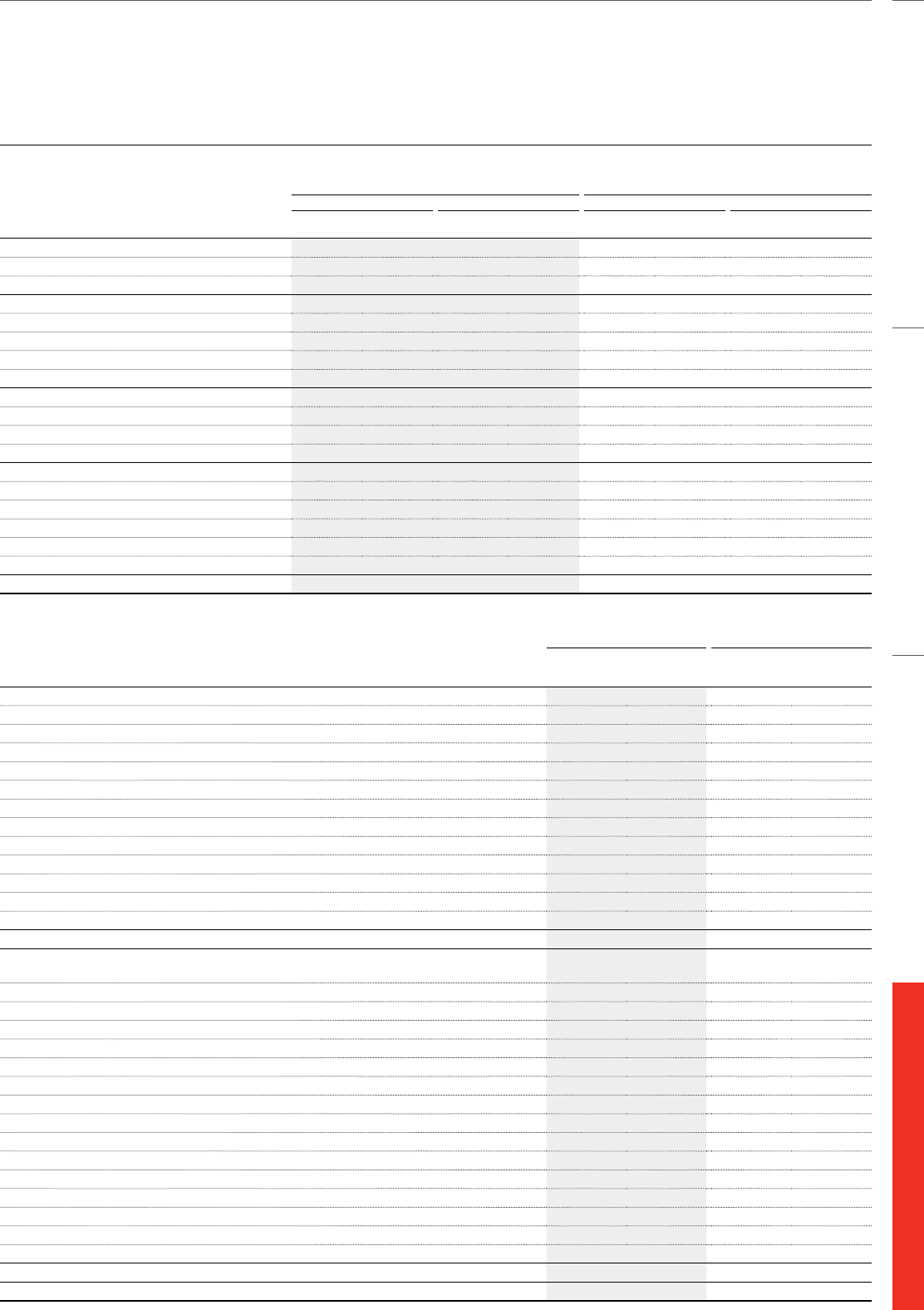

NOTE 22 FINANCIAL INSTRUMENTS CONTINUED

The fair value and notional amounts of derivatives analysed by hedge type are as follows:

2011 2010

Asset Liability Asset Liability

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value

£m

Notional

£m

Fair value hedges

Interest rate swaps and similar instruments 27 1,410 (57) 1,844 10 685 (88) 2,304

Cross currency swaps 717 2,674 (28) 714 1,130 4,513 (45) 259

Cash flow hedges

Interest rate swaps and similar instruments – – (54) 455 – – (40) 555

Cross currency swaps 126 298 (151) 784 129 315 (205) 1,064

Index-linked swaps – – (8) 772 – – – –

Forward foreign currency contracts 8 346 (12) 1,269 19 483 (15) 600

Net investment hedges

Cross currency swaps – – – – – – (30) 124

Forward foreign currency contracts 19 383 (97) 952 19 244 (172) 1,037

Future purchases of non-controlling interests – – (106) – – – (105) –

Derivatives not in a formal hedge relationship

Interest rate swaps and similar instruments 1 25 (1) 25 1 145 (5) 355

Cross currency swaps 2 84 (10) 65 2 204 (25) 533

Index-linked swaps 376 2,639 (311) 2,639 139 995 (109) 995

Forward foreign currency contracts 11 523 (20) 720 25 635 (42) 1,254

Future purchases of non-controlling interests – – – – – – (41) –

Total 1,287 8,382 (855) 10,239 1,474 8,219 (922) 9,080

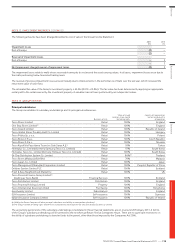

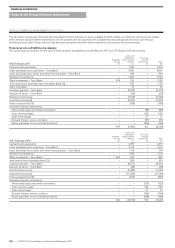

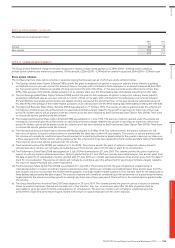

The carrying value and fair value of financial assets and liabilities are as follows:

2011 2010

Carrying

value

£m

Fair

value

£m

Carrying

value

£m

Fair

value

£m

Assets

Cash and cash equivalents 1,870 1,870 2,819 2,819

Loans and advances to customers – Tesco Bank 4,641 4,636 4,112 4,325

Loans and advances to banks and other financial assets – Tesco Bank 404 404 144 144

Short-term investments 1,022 1,022 1,314 1,314

Other investments – Tesco Bank 1,108 1,093 863 848

Joint venture and associates loan receivables (note 30) 503 514 309 309

Other receivables 25 25 – –

Derivative financial assets:

Interest rate swaps and similar instruments 28 28 11 11

Cross currency swaps 845 845 1,261 1,261

Index-linked swaps 376 376 139 139

Forward foreign currency contracts 38 38 63 63

Total financial assets 10,860 10,851 11,035 11,233

Liabilities

Short-term borrowings:

Amortised cost (708) (707) (771) (770)

Bonds in fair value hedge relationships (628) (614) (713) (683)

Long-term borrowings:

Amortised cost (4,584) (4,678) (5,513) (5,617)

Bonds in fair value hedge relationships (4,957) (4,915) (6,067) (5,992)

Finance leases (Group as lessee – note 36) (198) (198) (209) (209)

Customer deposits – Tesco Bank (5,074) (5,081) (4,357) (4,357)

Deposits by banks – Tesco Bank (36) (36) (30) (30)

Derivative and other financial liabilities:

Interest rate swaps and similar instruments (112) (112) 59 59

Cross currency swaps (189) (189) (305) (305)

Index-linked swaps (319) (319) (301) (301)

Forward foreign currency contracts (129) (129) (229) (229)

Future purchases of non-controlling interests (106) (106) (146) (146)

Total financial liabilities (17,040) (17,084) (18,582) (18,580)

Total (6,180) (6,233) (7,547) (7,347)

Overview Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011

—

127