Tesco 2011 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

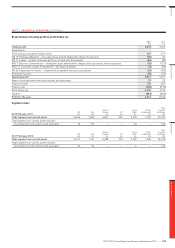

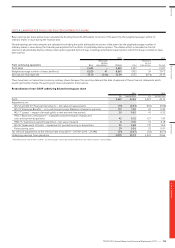

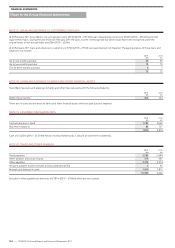

NOTE 11 PROPERTY, PLANT AND EQUIPMENT CONTINUED

Land and

buildings

£m

Other(a)

£m

Total

£m

Cost

At 28 February 2009 22,349 7,495 29,844

Foreign currency translation 793 234 1,027

Additions(b) 2,189 735 2,924

Reclassification (279) 71 (208)

Classified as held for sale 2 4 6

Disposals (1,669) (141) (1,810)

At 27 February 2010 23,385 8,398 31,783

Accumulated depreciation and impairment losses

At 28 February 2009 2,540 4,152 6,692

Foreign currency translation 80 121 201

Charge for the year 354 737 1,091

Impairment losses for the year 51 – 51

Reversal of impairment losses for the year (74) – (74)

Reclassification (34) (48) (82)

Classified as held for sale (39) 1 (38)

Disposals (178) (83) (261)

At 27 February 2010 2,700 4,880 7,580

Net carrying value(c)(d)(e)

At 27 February 2010 20,685 3,518 24,203

At 28 February 2009 19,809 3,343 23,152

Construction in progress included above(f )

At 27 February 2010 1,652 193 1,845

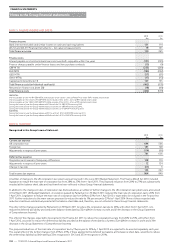

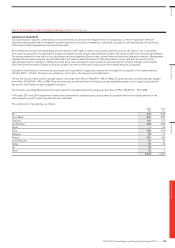

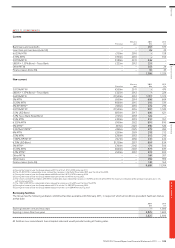

Impairment of property, plant and equipment

The Group has determined that for the purposes of impairment testing, each store is a cash-generating unit. Cash-generating units are tested for

impairment if there are indications of impairment at the balance sheet date.

Recoverable amounts for cash-generating units are mainly based on value in use, which is generally calculated from cash flow projections for five to

20 years using data from the Group’s latest internal forecasts, the results of which are reviewed by the Board. The key assumptions for the value in use

calculations are those regarding discount rates, growth rates and expected changes in margins. Management estimate discount rates using pre-tax rates

that reflect the current market assessment of the time value of money and the risks specific to the cash-generating units. Changes in selling prices and

direct costs are based on past experience and expectations of future changes in the market.

The forecasts are extrapolated beyond five years based on estimated long-term growth rates of 2% to 5% (2010 – 1% to 4%).

The pre-tax discount rates used to calculate value in use range from 6% to 14% (2010 – 6% to 14%) depending on the specific conditions in which

each store operates. These discount rates are derived from the Group’s post-tax weighted average cost of capital.

Overview Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011

—

117