Tesco 2011 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

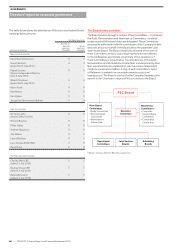

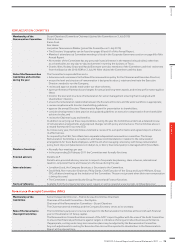

The key features of the revised arrangements are:

• Common remuneration arrangements with a Group focus –

There will be a return to a common set of incentive arrangements

with a focus on Group performance for short-term and long-term

reward. All executives, including the CEO and the US CEO, will

participate in the same plans going forward.

• Retain focus on performance related reward and delivery in

shares – The Remuneration Committee continues to believe that

the majority of total remuneration should be performance related

and delivered largely in shares, to closely align the interests of

shareholders and Executive Directors. This remains a feature

of the revised arrangements. To further enhance alignment with

shareholder interests, the Committee has decided to increase the

executive shareholding guideline from one times base salary to

four times base salary for the CEO and three times base salary

for the other executives.

• Removal of share options – Executive share options will no longer

be granted and will be replaced by a performance share award of

comparable expected value.

• Reduction in measures – The number of performance measures

will be reduced going forward, with a focus on delivery of ongoing

earnings growth and sustainable return on capital for long-term

elements of reward.

• Rebalancing of the CEO package – The CEO’s package has

been rebalanced compared to his previous package as an Executive

Director, to focus it more on performance-related rather than fixed

elements of reward.

• Introduction of ‘clawback’ – To reflect best practice, we have also

introduced ‘clawback’ for deferred share awards under the annual

bonus plan and long-term incentive (PSP) awards to allow the

Committee to scale back awards in the event that results are

materially misstated.

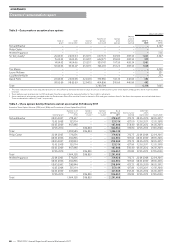

The following chart shows the make-up of remuneration:

REMUNERATION STRATEGY AND POLICY FROM 2011/12

ONWARDS

Executive Directors’ remuneration strategy

Tesco has a long-standing strategy of rewarding talent and experience.

We seek to provide incentives for delivering strong, sustainable and

profitable growth, thereby creating substantial additional value for

shareholders. We operate in a keenly competitive and rapidly changing

retail environment. Business success depends on the talents of the key

team, but outstanding business performance comes from teamwork.

Tesco has a stable and successful management team, and motivating

and incentivising that team at senior levels to deliver yet higher levels of

performance is vital to our ongoing success. We believe our incentives

should support the continued growth and the strengthening of our

returns from across the Group, as well as the creation and development

of significant new businesses.

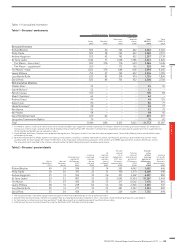

Total remuneration levels of Executive Directors are reviewed annually

by the Committee, taking into account their contribution in terms of

continuing strong performance, their potential and competitive market

practice. When setting the remuneration of Executive Directors, the

Committee considers the Group’s performance against a mixture of

corporate objectives and financial measures. Consideration is also given

to reward levels at the next tier of management below the Board and

across the Group in order to sustain a common sense of purpose and

sharing of success.

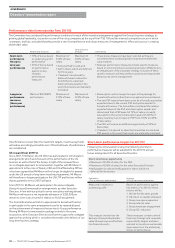

Remuneration policy for 2011/12

The Remuneration Committee has undertaken a detailed review

of executive remuneration arrangements in the past few months.

As outlined in the Chairman’s introduction, the objectives of this review

were to simplify arrangements and return to using measures relevant

to group performance for all Executive Directors. In addition, the review

focused on ensuring that executive arrangements are aligned with

strategy and shareholder value creation, while offering the right pay

for the right level of performance. In carrying out its review of Tesco’s

remuneration approach, the Committee considered total remuneration

levels and decided that there should be no overall increase in incentive

opportunity. The Committee believes that this package is appropriate

for the scope and responsibility of the Executive Director roles.

When reviewing remuneration and determining the revised level and

structure of reward, the Remuneration Committee has also been

conscious of the economic background and wider concerns around

executive pay and has sought to ensure reward outcomes are

proportionate to the performance outcome.

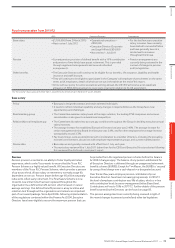

Base salary

Short-term performance Long-term performance

Performance share plan

Cash bonus Deferred

share bonus

Fixed element

Performance-related element

c14% – 40% depending on individual incentive arrangements and performance

c60% – 86% depending on individual incentive arrangements and performance

76

—

TESCO PLC Annual Report and Financial Statements 2011

GOVERNANCE

Directors’ remuneration report