Tesco 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Group continues to receive insurance commission arising from the

sale of insurance policies sold under the Tesco brand through the legacy

arrangement with the Royal Bank of Scotland (RBS). This commission

income is variable and dependent upon the profitability of the underlying

insurance policies.

Clubcard, loyalty and other initiatives

The cost of Clubcard and loyalty initiatives is treated as a deduction

from sales and part of the fair value of the consideration received is

deferred and subsequently recognised over the period that the awards

are redeemed.

The fair value of the points awarded is determined with reference to

the fair value to the customer and considers factors such as redemption

via Clubcard deals versus money-off-in-store and redemption rate.

Computers for Schools, Sport for Schools and Club vouchers are issued

by Tesco for redemption by participating schools/clubs and are part of

our overall Community Plan. The cost of the redemption (i.e meeting

the obligation attached to the vouchers) is treated as a cost rather than

a deduction from sales.

Rental income

Rental income is recognised in the period in which it is earned, in

accordance with the terms of the lease.

Finance income

Finance income, excluding income arising from financial services, is

recognised in the period to which it relates using the effective interest

rate method.

Dividend income

Dividends are recognised when a legal entitlement to receive

payment arises.

Finance costs

Finance costs directly attributable to the acquisition or construction

of qualifying assets are capitalised. Qualifying assets are those that

necessarily take a substantial period of time to prepare for their intended

use. All other borrowing costs are recognised in the Group Income

Statement in finance costs, excluding those arising from financial services,

in the period in which they occur. For Tesco Bank, finance cost on financial

liabilities is determined using the effective interest rate method and is

recognised in cost of sales.

Business combinations and goodwill

The Group accounts for all business combinations by applying the

purchase method. All acquisition-related costs are expensed.

On acquisition, the assets (including intangible assets), liabilities and

contingent liabilities of an acquired entity are measured at their fair value.

The interest of minority shareholders is stated at the minority’s proportion

of the fair values of the assets and liabilities recognised.

The Group recognises intangible assets as part of business combinations

at fair value on the date of acquisition. The determination of these fair

values is based upon management’s judgement and includes assumptions

on the timing and amount of future incremental cash flows generated

by the assets acquired and the selection of an appropriate cost of capital.

The useful lives of intangible assets are estimated and amortisation is

charged on a straight-line basis.

Goodwill arising on consolidation represents the excess of the cost of an

acquisition over the fair value of the Group’s share of the net assets/net

liabilities of the acquired subsidiary, joint venture or associate at the

date of acquisition. If the cost of acquisition is less than the fair value

of the Group’s share of the net assets/net liabilities of the acquired entity

(i.e a discount on acquisition), the difference is credited to the Group

Income Statement in the period of acquisition.

At the acquisition date of a subsidiary, goodwill acquired is recognised as

an asset and is allocated to each of the cash-generating units expected to

benefit from the business combination’s synergies and to the lowest level

at which management monitors the goodwill. Goodwill arising on the

acquisition of joint ventures and associates is included within the carrying

value of the investment.

On disposal of a subsidiary, joint venture or associate, the attributable

amount of goodwill is included in the determination of the profit or loss

on disposal.

Goodwill arising on acquisitions before 29 February 2004 (the date of

transition to IFRS) was retained at the previous UK GAAP amounts

subject to being tested for impairment at that date. Goodwill written

off to reserves under UK GAAP prior to 1998 has not been restated and will

not be included in determining any subsequent profit or loss on disposal.

Intangible assets

Acquired intangible assets

Acquired intangible assets, such as software, pharmacy licences, customer

relationships, contracts and brands, are measured initially at cost and are

amortised on a straight-line basis over their estimated useful lives, at

2%-100% of cost per annum.

Internally-generated intangible assets – Research and development

expenditure

Research costs are expensed as incurred.

Development expenditure incurred on an individual project is capitalised

only if all the criteria set out in IAS 38 ‘Intangible Assets’ are met,

principally:

• an asset is created that can be identified (such as software or new

processes);

• it is probable that the asset created will generate future economic

benefits; and

• the development cost of the asset can be measured reliably.

Following the initial recognition of development expenditure, the cost

is amortised over the project’s estimated useful life, usually at 14%-25%

of cost per annum.

Property, plant and equipment

Property, plant and equipment is carried at cost less accumulated

depreciation and any recognised impairment in value.

Property, plant and equipment is depreciated on a straight-line basis to its

residual value over its anticipated useful economic life.

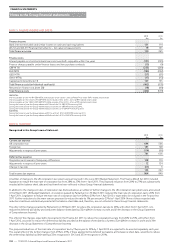

The following depreciation rates are applied for the Group:

• freehold and leasehold buildings with greater than 40 years unexpired –

at 2.5% of cost;

• leasehold properties with less than 40 years unexpired are depreciated

by equal annual instalments over the unexpired period of the lease; and

• plant, equipment, fixtures and fittings and motor vehicles – at rates

varying from 9% to 50%.

Assets held under finance leases are depreciated over their expected useful

lives on the same basis as owned assets or, when shorter, over the term of

the relevant lease.

Impairment of non-financial assets

Goodwill is reviewed for impairment at least annually by assessing the

recoverable amount of each cash-generating unit to which the goodwill

relates. The recoverable amount is the higher of fair value less costs to

sell, and value in use. When the recoverable amount of the cash-generating

unit is less than the carrying amount, an impairment loss is recognised.

Any impairment is recognised immediately in the Group Income Statement

and is not subsequently reversed.

NOTE 1 ACCOUNTING POLICIES CONTINUED

TESCO PLC Annual Report and Financial Statements 2011

—

101

Overview Business review Governance Financial statements