Tesco 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

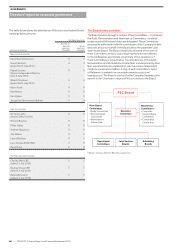

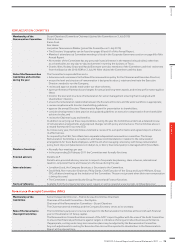

Risk management and internal controls

Accountabilities

Accepting that risk is an inherent part of doing business, our risk

management systems are designed both to encourage entrepreneurial

spirit and also provide assurance that risk is fully understood and

managed. The Board has overall responsibility for risk management

and internal control within the context of achieving the Group’s

objectives. Executive management is responsible for implementing

and maintaining the necessary control systems. The role of Internal

Audit is to monitor the overall internal control systems and report on

their effectiveness to executive management, as well as to the Audit

Committee, in order to facilitate its review of the systems.

Background

The Group has a five-year rolling business plan to support the delivery

of its strategy. Every business unit and support function derives its

objectives from the five-year plan and these are cascaded to managers

and staff by way of personal objectives.

Key to delivering effective risk management is ensuring our people

have a good understanding of the Group’s strategy and our policies,

procedures, values and expected performance. We have a structured

internal communications programme that provides employees with

a clear definition of the Group’s purpose and goals, accountabilities

and the scope of permitted activities for each business unit, as well as

individual line managers and other employees. This ensures that all our

people understand what is expected of them and that decision-making

takes place at the appropriate level. We recognise that our people may

face ethical dilemmas in the normal course of business so we provide

clear guidance based on the Tesco Values. The Values set out the

standards that we wish to uphold in how we treat people. These are

supported by the Group Code of Business Conduct which offers

guidance on relationships between the Group and its employees,

suppliers and contractors.

Risk management

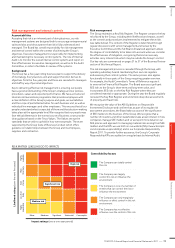

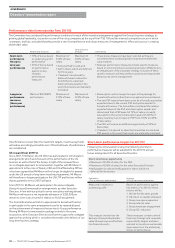

The Group maintains a Key Risk Register. The Register contains the key

risks faced by the Group, including their likelihood and impact, as well

as the controls and procedures implemented to mitigate these risks

(see table below). The content of the Register is determined through

regular discussions with senior management and review by the

Executive Committee and the full Board. A balanced approach allows

the degree of controllability to be taken into account when we consider

the effectiveness of mitigation, recognising that some necessary

activities carry inherent risk which may be outside the Group’s control.

Our key risks are summarised on pages 51 to 57 of the Business Review

section of this Annual Report.

The risk management process is cascaded through the Group, with

operating subsidiary boards maintaining their own risk registers

and assessing their control systems. The same process also applies

functionally in those parts of the Group requiring greater overview.

For example, the Audit Committee’s Terms of Reference require it

to oversee the Finance Risk Register. The Board assesses significant

SEE risks to the Group’s short-term and long-term value, and

incorporates SEE risks on the Key Risk Register where they are

considered material or appropriate. During the year the Board regularly

reviewed the Key Risk Register and undertook deep dive assessments

of property and fraud risks.

We recognise the value of the ABI Guidelines on Responsible

Investment Disclosure and confirm that, as part of its regular risk

assessment procedures, the Board takes account of the significance

of SEE matters to the business of the Group. We recognise that a

number of investors and other stakeholders take a keen interest in how

companies manage SEE matters and so we report more detail on our

SEE policies and approach to managing material risks arising from SEE

matters and the KPIs we use both on our website (http://www.tescoplc.

com/corporate-responsibility/) and in our Corporate Responsibility

Report 2011. To provide further assurance, the Group’s Corporate

Responsibility KPIs are audited on a regular basis by Internal Audit.

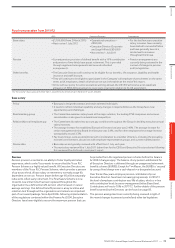

RISK MATRIX (LIKELIHOOD TO IMPACT)

Even

chance

Significant

Less than

likely

Moderate

Highly

probable

Catastrophic

Highly

improbable

Minor

More

than likely

Substantial

Likelihood ratings (over the next five years)

Impact ratings (over a one-year period)

High risk

Medium risk

Significant risk

The Company can totally control

this risk

The Company can largely

control this risk or influence the

environment

The Company is one of a number of

entities that can control the risk or

influence the environment

The Company can only marginally

influence or effect control in this risk

environment

The Company has no effective

influence over the control of this risk

Controllability factors

TESCO PLC Annual Report and Financial Statements 2011

—

71

Overview Business review Governance Financial statements