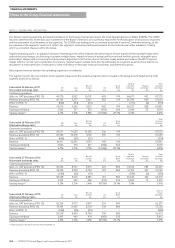

Tesco 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

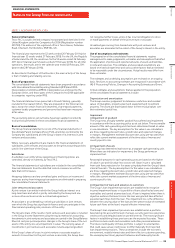

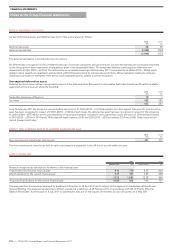

Current tax is the expected tax payable on the taxable income for the year,

using tax rates enacted or substantively enacted by the balance sheet

date. Tax expense is recognised in the Group Income Statement except

to the extent that it relates to items recognised in the Group Statement

of Other Comprehensive Income or directly in the Group Statement of

Changes in Equity, in which case it is recognised in the Group Statement

of Other Comprehensive Income or directly in the Group Statement of

Changes in Equity, respectively.

Deferred tax is provided using the balance sheet liability method,

providing for temporary differences between the carrying amounts of

assets and liabilities for financial reporting purposes and the amounts

used for taxation purposes.

Deferred tax is calculated at the tax rates that have been enacted or

substantively enacted by the balance sheet date. Deferred tax is charged

or credited in the Group Income Statement, except when it relates to

items charged or credited directly to equity or other comprehensive

income, in which case the deferred tax is also recognised in equity,

or other comprehensive income, respectively.

Deferred tax assets are recognised to the extent that it is probable that

taxable profits will be available against which deductible temporary

differences can be utilised.

The carrying amount of deferred tax assets is reviewed at each balance

sheet date and reduced to the extent that it is no longer probable that

sufficient taxable profits will be available to allow all or part of the assets

to be recovered.

Deferred tax assets and liabilities are offset against each other when

there is a legally enforceable right to set-off current taxation assets against

current taxation liabilities and it is the intention to settle these on a net basis.

Foreign currencies

Transactions in foreign currencies are translated at the exchange rate on

the date of the transaction. At each balance sheet date, monetary assets

and liabilities that are denominated in foreign currencies are retranslated

at the rates prevailing on the balance sheet date. All differences are taken

to the Group Income Statement.

The financial statements of foreign subsidiaries are translated into

Pounds Sterling. Since the majority of consolidated companies operate

as independent entities within their local economic environment, their

respective local currency is the functional currency. Therefore, assets and

liabilities of overseas subsidiaries denominated in foreign currencies are

translated at exchange rates prevailing at the date of the Group Balance

Sheet; profits and losses are translated at average exchange rates for the

relevant accounting periods. Exchange differences arising are recognised

in the Group Statement of Comprehensive Income and are included in the

Group’s translation reserve. Such translation differences are recognised

as income or expenses in the period in which the operation is disposed of.

Goodwill and fair value adjustments arising on the acquisition of a foreign

entity are treated as assets and liabilities of the foreign entity and

translated at the closing rate.

Financial instruments

Financial assets and financial liabilities are recognised on the Group’s

Balance Sheet when the Group becomes a party to the contractual

provisions of the instrument.

Trade receivables

Trade receivables are non interest-bearing and are recognised initially at

fair value, and subsequently at amortised cost using the effective interest

rate method, less provision for impairment.

Investments

Investments are recognised at trade date. Investments are classified as

either held for trading or available-for-sale, and are recognised at fair value.

There are no investments classified as held for trading.

For available-for-sale investments, gains and losses arising from changes

in fair value are recognised directly in equity, until the security is disposed

of or is determined to be impaired, at which time the cumulative gain or

loss previously recognised in equity is included in the net result for the

period. Interest calculated using the effective interest rate method is

recognised in the Group Income Statement. Dividends on an available-for-

sale equity instrument are recognised in the Group Income Statement

when the entity’s right to receive payment is established.

Loans and advances to customers and banks

Loans and advances are non-derivative financial assets with fixed or

determinable payments that are not quoted in an active market and

include amounts due from customers and amounts due from banks.

The Group has no intention of trading these loans and advances and

consequently they are not classified as held for trading or designated

as fair value through profit and loss. Loans and advances are initially

recognised at fair value plus directly related transaction costs. Subsequent

to initial recognition, these assets are carried at amortised cost using the

effective interest method less any impairment losses. Income from these

financial assets is calculated on an effective yield basis and is recognised

in the Group Income Statement.

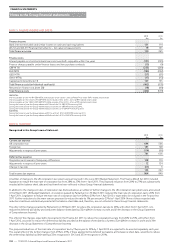

Impairment of loans and advances to customers and banks

At each balance sheet date the Group reviews the carrying amounts of

its loans and advances to determine whether there is any indication that

those assets have suffered an impairment loss. An impairment loss has

been incurred if there is objective evidence that an event or events since

initial recognition of the asset have adversely affected the amount or

timing of future cash flows from the asset.

If there is objective evidence that an impairment loss on a financial asset

or group of financial assets classified as loans and advances has been

incurred, the Group measures the amount of the loss as the difference

between the carrying amount of the asset or group of assets and the

present value of estimated future cash flows from the asset or group of

assets discounted at the effective interest rate of the instrument at initial

recognition. Impairment losses are assessed individually for financial assets

that are individually significant and collectively for assets that are not

individually significant. In making collective assessments of impairment,

financial assets are grouped into portfolios on the basis of similar risk

characteristics. Future cash flows from these portfolios are estimated on

the basis of the contractual cash flows and historical loss experience for

assets with similar credit risk characteristics. Historical loss experience is

adjusted, on the basis of current observable data, to reflect the effects

of current conditions not affecting the period of historical experience.

Impairment losses are recognised in the Group Income Statement and

the carrying amount of the financial asset or group of financial assets

is reduced by establishing an allowance for impairment losses. If in

a subsequent period the amount of the impairment loss reduces and

the reduction can be ascribed to an event after the impairment was

recognised, the previously recognised loss is reversed by adjusting the

allowance. Once an impairment loss has been recognised on a financial

asset or group of financial assets, interest income is recognised on the

carrying amount using the rate of interest at which estimated future

cash flows were discounted in measuring impairment.

Loan impairment provisions are established on a portfolio basis taking

into account the level of arrears, security, past loss experience, credit

scores and defaults based on portfolio trends. The most significant

factors in establishing the provisions are the expected loss rates and the

related average life. The portfolios include credit card receivables and

other personal advances. The future credit quality of these portfolios

is subject to uncertainties that could cause actual credit losses to differ

NOTE 1 ACCOUNTING POLICIES CONTINUED

TESCO PLC Annual Report and Financial Statements 2011

—

103

Overview Business review Governance Financial statements