Tesco 2011 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

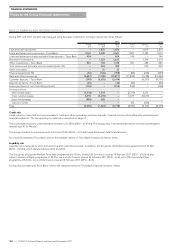

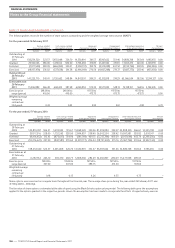

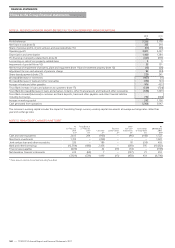

NOTE 23 FINANCIAL RISK FACTORS CONTINUED

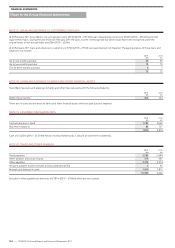

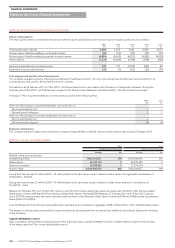

The impact on Group financial statements from foreign currency volatility is shown in the sensitivity analysis below.

Sensitivity analysis

The analysis excludes the impact of movements in market variables on the carrying value of pension and other post-employment obligations and on

the retranslation of overseas net assets as required by IAS 21 ‘The Effects of Changes in Foreign Exchange Rates’. However, it does include the foreign

exchange sensitivity resulting from all local entity non-functional currency financial instruments.

The sensitivity analysis has been prepared on the basis that the amount of net debt, the ratio of fixed to floating interest rates of the debt and

derivatives portfolio, and the proportion of financial instruments in foreign currencies are all constant and on the basis of the hedge designations

in place at 26February 2011. It should be noted that the sensitivity analysis reflects the impact on income and equity due to all financial instruments

held at the balance sheet date. It does not reflect any change in sales or costs that may result from changing interest or exchange rates.

The following assumptions were made in calculating the sensitivity analysis:

• the sensitivity of interest payable to movements in interest rates is calculated on net floating rate debt, deposits and derivative instruments with no

sensitivity assumed for RPI-linked debt;

• changes in the carrying value of derivative financial instruments designated as fair value hedges from movements in interest rates or foreign

exchange rates have an immaterial effect on the Group Income Statement and equity due to compensating adjustments in the carrying value of debt;

• changes in the carrying value of derivative financial instruments designated as net investment hedges from movements in foreign exchange rates

are recorded directly in the Group Statement of Comprehensive Income;

• changes in the carrying value of derivative financial instruments not designated as hedging instruments only affect the Group Income Statement;

• all other changes in the carrying value of derivative financial instruments designated as hedging instruments are fully effective with no impact

on the Group Income Statement; and

• the floating leg of any swap or any floating rate debt is treated as not having any interest rate already set, therefore a change in interest rates

affects a full 12-month period for the interest payable portion of the sensitivity calculations.

Using the above assumptions, the following table shows the illustrative effect on the Group Income Statement and the Group Statement of

Comprehensive Income that would result from changes in UK interest rates and in exchange rates:

2011 2010

Income

gain/(loss)

£m

Equity

gain/(loss)

£m

Income

gain/(loss)

£m

Equity

gain/(loss)

£m

1% increase in GBP interest rates (2010 – 1%) (14) – (38) –

5% appreciation of the Euro (2010 – 15%) 2 (46) (13) (43)

5% appreciation of the South Korean Won (2010 – 10%) (1) 1 – (82)

5% appreciation of the US Dollar (2010 – 25%) 8 35 (1) (8)

10% appreciation of the Thai Baht (2010 – 25%) – – – (1)

5% appreciation of the Czech Koruna (2010 – 10%) – (6) – (31)

A decrease in interest rates and a depreciation of foreign currencies would have the opposite effect to the impact in the table above.

The impact on the Group Statement of Comprehensive Income from changing exchange rates results principally from foreign currency deals used

as net investment hedges. The impact on the Group Statement of Comprehensive Income will largely be offset by the revaluation in equity of the

hedged assets. For changes in the USD/GBP exchange rate, the impact on the Group Statement of Comprehensive Income results principally from

forward purchases of US Dollars as cash flow hedges.

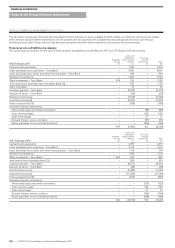

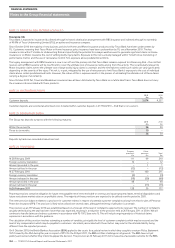

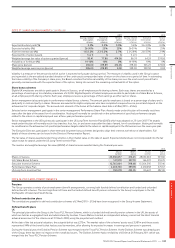

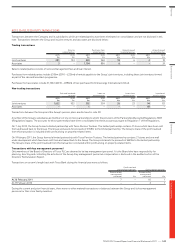

Capital risk

The Group’s objectives when managing capital (defined as net debt plus equity) are to safeguard the Group’s ability to continue as a going concern in

order to provide returns to shareholders and benefits for other stakeholders, while maintaining a strong credit rating and headroom whilst optimising

return to shareholders through an appropriate balance of debt and equity funding. The Group manages its capital structure and makes adjustments

to it, in light of changes to economic conditions and the strategic objectives of the Group.

To maintain or adjust the capital structure, the Group may adjust the dividend payment to shareholders, buy back shares and cancel them, or issue

new shares. In April 2006 the Group outlined its plan to release cash from its property assets, via a sequence of property joint ventures and other

transactions, and return significant value to shareholders, either through enhanced dividends or share buy-backs. The target for the value of share

buy-backs was increased from £1.5bn to £3.0bn over a five-year period from April 2007. Whilst the Group continued with the policy at the beginning

of 2009, it subsequently used the proceeds from property divestment to pay down debt, following the two major acquisitions in 2009 (Homever and

Tesco Bank). During 2009 the Group purchased and cancelled £100m ordinary shares. In the financial years 2010 and 2011 the Group continued to

use the proceeds from the sale of property to pay down debt.

The policy for debt is to ensure a smooth debt maturity profile with the objective of ensuring continuity of funding. This policy continued during the

current financial year with bonds redeemed of £1,861m (2010 – £390m) and new bonds issued totalling £125m (2010 – £nil). The Group borrows

centrally and locally, using a variety of capital market issues and borrowing facilities to meet the requirements of each local business.

FINANCIAL STATEMENTS

132

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements