Tesco 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

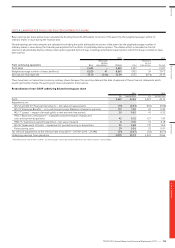

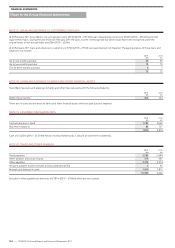

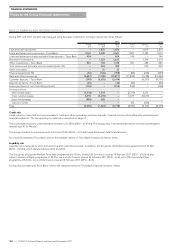

NOTE 16 TRADE AND OTHER RECEIVABLES CONTINUED

As at 26 February 2011 trade and other receivables of £37m (2010 – £49m) were past due and impaired. The amount of the provision was £44m

(2010 – £47m). The ageing analysis of these receivables is as follows:

2011

£m

2010

£m

Up to three months past due 48

Three to six months past due 34

Over six months past due 30 37

37 49

As at 26 February 2011 trade and other receivables of £144m (2010 – £115m) were past due but not impaired. The ageing analysis of these receivables

is as follows:

2011

£m

2010

£m

Up to three months past due 114 97

Three to six months past due 13 10

Over six months past due 17 8

144 115

No receivables have been renegotiated in the current or prior financial years.

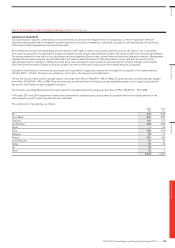

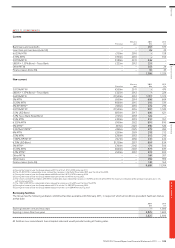

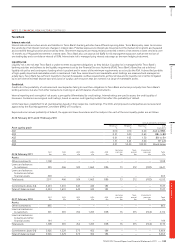

NOTE 17 LOANS AND ADVANCES TO CUSTOMERS

Tesco Bank has loans and advances to customers.

2011

£m

2010

£m

Current 2,514 2,268

Non-current 2,127 1,844

4,641 4,112

The maturity of these loans and advances is as follows:

2011

£m

2010

£m

Repayable on demand or at short notice 11

Within three months 2,572 2,370

Greater than three months but less than one year 47 70

Greater than one year but less than five years 1,700 1,504

After five years 503 481

4,823 4,426

Provision for impairment of loans and advances (182) (314)

4,641 4,112

Loans and advances include amounts subject to securitisation of £1,356m (2010 – £1,459m). During 2008 the Group entered into a securitisation

transaction and issued debt securities which the Group subsequently purchased. The purpose of the transaction was to allow the Group to enter into

the Special Liquidity Scheme whereby it would enter into a sale and repurchase agreement acquiring Treasury Bills issued by the UK Government and

using the debt securities as security. As at 26 February 2011 the Group held £296m (2010 – £500m) in respect of this transaction. The Treasury Bills

do not meet the recognition criteria of IAS 39 and are not recognised on the Group Balance Sheet.

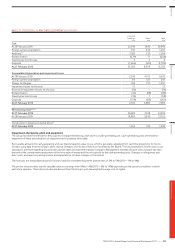

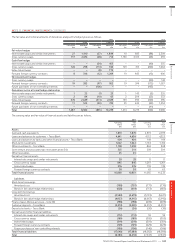

Provision for impairment of loans and advances

£m

At 28 February 2009 (250)

Charge for the year (177)

Uncollectible amounts written off 119

Recoveries of amounts previously written off (10)

Unwind of discount 4

At 27 February 2010 (314)

Charge for the year (131)

Uncollectible amounts written off 268

Recoveries of amounts previously written off (9)

Unwind of discount 4

At 26 February 2011 (182)

Overview Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011

—

123