Tesco 2011 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

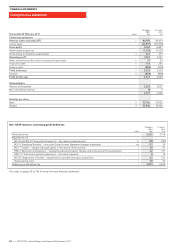

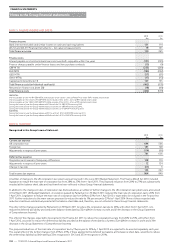

Provisions

Provisions have been made for onerous leases, dilapidations, restructuring,

pensions, customer redress and claims. These provisions are estimates and

the actual costs and timing of future cash flows are dependent on future

events. The difference between expectations and the actual future liability

will be accounted for in the period when such determination is made.

The Group has a provision for potential customer redress. During

the year, the FSA formally issued Policy Statement 10/12 (PS 10/12),

which introduces new guidance in respect of PPI customer redress

and evidential provisions to the FSA Handbook with an implementation

date of 1 December 2010. We will continue to handle complaints

and redress customers in accordance with PS 10/12. This will include

ongoing analysis of historical claims experience in accordance with

the guidance.

The calculation of this provision involves estimating a number of

variables, principally the level of customer complaints which may be

received and the level of any compensation which may be payable

to customers. Uncertainty associated with these factors may result

in the ultimate liability being different from the reported provision.

Insurance reserves

The Group recognises insurance commission arising from the sale

of general insurance policies sold under the Tesco brand. The level

of commission is dependent upon the profitability of the underlying

insurance policies, which is in turn dependent on the level of reserves

held by the insurance trading partner to underwrite the policies in

place. Calculation of the required level of insurance claims reserves

is dependent on a detailed actuarial review. Management also undertakes

an assessment of other risks which are outside the scope of this review

but that are inherent in assessing potential claims liabilities. A change

in the estimate of any of the key variables in this calculation could

have the potential to significantly impact the reserve balance recognised

which would therefore also impact the insurance commission revenue

recognised in the income statement.

Post-employment benefit obligations

The present value of the post-employment benefit obligations depends

on a number of factors that are determined on an actuarial basis using

a number of assumptions. The assumptions used in determining the

net cost (income) for pensions include the discount rate. Any changes in

these assumptions will impact the carrying amount of post-employment

benefit obligations.

The Group determines the appropriate discount rate at the end of

each year. This is the interest rate that should be used to determine

the present value of estimated future cash outflows expected to

be required to settle the post-employment benefit obligations. In

determining the appropriate discount rate, the Group considers the

interest rates of high-quality corporate bonds that are denominated

in the currency in which the benefits will be paid and that have terms

to maturity approximating the terms of the related post-employment

benefit obligation. Other key assumptions for post-employment benefit

obligations are based in part on current market conditions. Additional

information is disclosed in note 28.

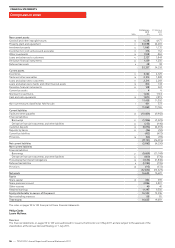

Changes in accounting policy and disclosure

The Group has adopted the following new and amended standards

and interpretations as of 28 February 2010:

• IFRS 3 (Revised) ‘Business Combinations’ is effective for periods

beginning on or after 1 July 2009. The revised standard continues

to apply the acquisition method to business combinations, but with

certain significant changes. All payments to purchase a business

will be recorded at fair value at the acquisition date, with some

contingent payments subsequently remeasured at fair value through

the Group Income Statement. Goodwill and non-controlling interests

may be calculated on a gross or net basis. All transaction costs will

be expensed.

• IAS 27 (Revised) ‘Consolidated and Separate Financial Statements’

is effective for periods beginning on or after 1 July 2009. The revised

standard requires the effects of all transactions with non-controlling

interests to be recorded in equity if there is no change in control. As

such, transactions with non-controlling interests with no change in

control will no longer result in recognition of goodwill in the Group

Balance Sheet or gains and losses recognised in the Group Income

Statement. The revised standard also specifies the accounting when

control is lost. Any remaining interest in the entity is remeasured to fair

value and a gain or loss is recognised in the Group Income Statement.

• IAS 39 (Amended) ‘Financial Instruments: Recognition and Measurement’

is effective for periods beginning on or after 1 July 2009. The

amendment requires that inflation may only be hedged if changes

in inflation are a contractually specified portion of cash flows of a

recognised financial instrument. The amendment also permits an

entity to designate purchased options as a hedging instrument in

a hedge of a financial or non-financial item.

The Group has adopted all amendments published in ‘Improvements

to IFRSs’ issued in April 2009. The adoption of these amendments has

not had any significant impact on the amounts reported in these financial

statements but may impact the accounting for future transactions

and arrangements.

Revenue

Revenue comprises the fair value of consideration received or receivable

for the sale of goods and services in the ordinary course of the

Group’s activities.

Sale of goods

Revenue is recognised when the significant risks and rewards of

ownership of the goods have transferred to the buyer and the amount

of revenue can be measured reliably.

Revenue is recorded net of returns, discounts/offers and value added

taxes. Offers include: money-off coupons, conditional spend vouchers

and offers such as buy one get one free (BOGOF) and 3 for 2.

Provision of services

Revenue from the provision of services is recognised when the service is

provided and the revenue can be measured reliably, based on the terms

of the contract.

Where the Group acts as an agent selling goods or services, only the

commission income is included within revenue.

Financial services

Revenue consists of interest, fees and income from the provision

of insurance.

Interest income on financial assets that are classified as loans and

receivables is determined using the effective interest rate method. This is

the method of calculating the amortised cost of a financial asset or for a

group of assets, and of allocating the interest income over the expected

life of the asset. The effective interest rate is the rate that discounts the

estimated future cash flows to the instrument’s initial carrying amount.

Calculation of the effective interest rate takes into account fees receivable,

that are an integral part of the instrument’s yield, premiums or discounts

on acquisition or issue, early redemption fees and transaction costs.

Fees in respect of services (such as credit card interchange, late payment

and balance transfer fees and ATM revenue) are recognised as the right

to consideration accrues through the provision of the service to the

customer. The arrangements are generally contractual and the cost of

providing the service is incurred as the service is rendered. The price is

usually fixed and always determinable.

The Group generates commission from the sale and service of Motor and

Home Insurance policies underwritten by Tesco Underwriting Limited.

This is based on pre-determined commission rates at the point of sale.

Similar commission income is also generated from the sale of white label

insurance products underwritten by other third party providers.

NOTE 1 ACCOUNTING POLICIES CONTINUED

FINANCIAL STATEMENTS

100

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements