Tesco 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

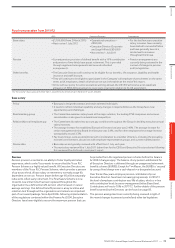

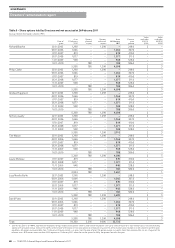

Short-term performance targets for 2011/12

Following the remuneration review, the following short-term

performance measures will be adopted for the 2011/12 annual

bonus arrangements for all Executive Directors:

Short-term bonus opportunity

• Maximum of 250% of salary for the CEO

• Maximum of 200% of salary for the other Executive Directors

• Half payable in cash and half payable in shares which are

deferred for three years

Profitability

(70% of short-term performance)

Strategic

(30% of short-term performance)

Measured in relation to

underlying profit

Based on performance against

key metrics. For 2011/12 these

metrics will be:

1. UK like-for-like sales growth

2. UK return on capital employed

3. Group new space expansion

4. Group internet sales

5. Group employee engagement

6. Group CO2 reduction

This measure incentivises the

delivery of annual shareholder

value through improved bottom-

line financial results.

These measures contain a mix of

financial, strategic and corporate

responsibility targets and were

selected to incentivise sustainable

improvements in the underlying

drivers of performance.

If performance is lower than the maximum targets, incentive payments

will reduce accordingly and will be zero if threshold levels of performance

are not attained.

US reward from 2011/12

Since 2007, Tim Mason, the US CEO, has participated in remuneration

arrangements which were focused on the performance of the US

business as well as that of the Group. In light of the renewed focus

on a collegiate approach to remuneration, together with Mr Mason’s

appointment to the roles of Deputy CEO and Chief Marketing Officer,

it has been agreed that Mr Mason will no longer be eligible for awards

under the US annual or long-term incentive programmes. Mr Mason

will therefore no longer participate in the US LTIP and the two million

shares granted to him in 2007 will lapse.

From 2011/12, Mr Mason will participate in the same collegiate

(Group-focused) remuneration arrangements as other Executive

Directors. In line with our policy for senior executives working abroad,

Mr Mason will receive a net expatriate allowance of £282,000 per

annum to cover costs incurred in relation to his US assignment.

The Committee believes that it is appropriate for Executive Directors

to participate in the same arrangements and to be rewarded based

on the achievement of measures that are key to Group performance.

Moving Mr Mason’s remuneration package entirely to the same

structure as other Executive Directors will further support the collegiate

approach to working which is considered essential to the delivery of our

long-term business strategy.

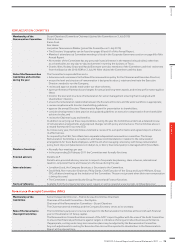

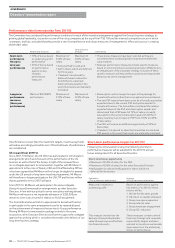

Performance related remuneration from 2011/12

The Committee has considered the performance conditions for each of the incentive arrangements against the Group’s business strategy, its

growing global leadership, its position as one of the rising companies at the top of the FTSE 100 and the intensely competitive sector in which

it operates, and has concluded that they provide a set of comprehensive and robust measures of management’s effort and success in creating

shareholder value.

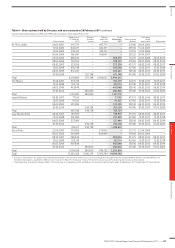

Performance measures

CEO

Other Executive

Directors

Commentary

Short-term

performance

measures

(one year

performance)

• 70% of bonus based

on underlying profit

performance

• 30% of bonus based

on performance

against six key

strategic

performance

measures

Maximum of

250% of base

salary

Maximum of

200% of base

salary

• These bonus measures have been selected as they are

considered to be closely aligned to long-term shareholder

value creation.

• Strategic performance measures include specific measures

based on environmental, social and governance (ESG) factors,

an integral part of the corporate strategy. Inclusion of these

specific measures will help reinforce positive and responsible

behaviour by senior management.

• Delivered half in cash; and

• half in shares which are deferred

for three years

• ‘Clawback’ introduced for

deferred shares to allow the

Committee to scale back

deferred share awards in the

event that results are materially

misstated

Long-term

performance

measures

(three year

performance)

Matrix of ROCE/EPS

performance

Maximum of

275% of base

salary

Maximum of

225% of base

salary

• Share options will no longer form part of the package for

Executive Directors (other than in exceptional circumstances).

• The new PSP awards have been set to be of broadly equivalent

expected value to the current PSP and option awards for

Executive Directors. The Committee considered the relative

expected values of the PSP and share option awards and

determined that a PSP award of 75% of salary is broadly

equivalent to the current share option award of 200% of

salary resulting in an increase in PSP from 150% to 225%

of base salary.

• The CEO will receive an additional opportunity of 50% of

base salary.

• ‘Clawback’ introduced to allow the Committee to scale back

PSP awards in the event that results are materially misstated.

78

—

TESCO PLC Annual Report and Financial Statements 2011

GOVERNANCE

Directors’ remuneration report