Tesco 2011 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

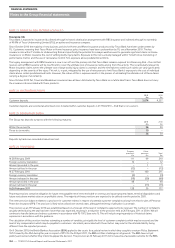

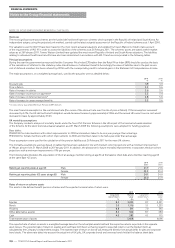

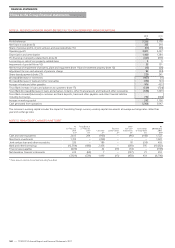

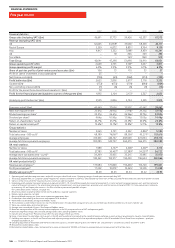

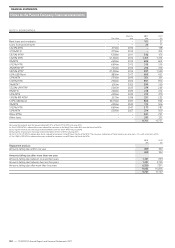

NOTE 35 CAPITAL RESOURCES

The following table shows the composition of regulatory capital resources of Tesco Personal Finance PLC (TPF), being the regulated entity, at the

balance sheet date:

2011

£m

2010

£m

Tier 1 capital:

Shareholders’ funds and non-controlling interests 761 576

Tier 2 capital:

Qualifying subordinated debt 235 235

Other interests 18 21

Supervisory deductions (365) (263)

Total regulatory capital 649 569

The movement of tier 1 capital during the financial year is analysed as follows:

2011

£m

2010

£m

At beginning of year 576 521

Share capital and share premium 446 230

Profit attributable to shareholders 57 37

Ordinary dividends (162) (153)

Increase in intangible assets (156) (59)

At end of year 761 576

It is Tesco Personal Finance PLC’s (TPF) policy to maintain a strong capital base, to expand it as appropriate and to utilise it efficiently throughout its

activities to optimise the return to shareholders while maintaining a prudent relationship between the capital base and the underlying risks of the

business. In carrying out this policy, TPF has regard to the supervisory requirements of the Financial Services Authority (FSA). TPF has carried

regulatory capital reserves in excess of its capital requirements during the financial year.

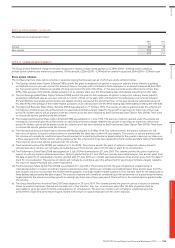

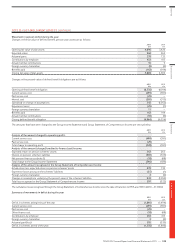

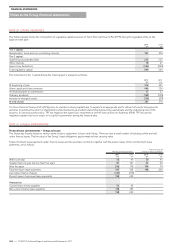

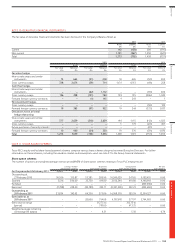

NOTE 36 LEASING COMMITMENTS

Finance lease commitments – Group as lessee

The Group has finance leases for various items of plant, equipment, fixtures and fittings. There are also a small number of buildings which are held

under finance leases. The fair value of the Group’s lease obligations approximate to their carrying value.

Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net minimum lease

payments, are as follows:

Minimum lease payments

Present value of

minimum lease payments

2011

£m

2010

£m

2011

£m

2010

£m

Within one year 56 49 50 45

Greater than one year but less than five years 81 101 44 90

After five years 206 178 104 74

Total minimum lease payments 343 328 198 209

Less future finance charges (145) (119)

Present value of minimum lease payments 198 209

Analysed as:

Current finance lease payables 50 45

Non-current finance lease payables 148 164

198 209

FINANCIAL STATEMENTS

144

—

TESCO PLC Annual Report and Financial Statements 2011

Notes to the Group financial statements