Tesco 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

About 85% of annual bonus entitlement is based directly or indirectly

on financial metrics. These measures are considered to be important

for laying the foundations for future performance growth.

The balance of measures is illustrated in the pie chart below:

30% Strategic

70% Profitability

The targets will be clearly measurable and appropriately stretching.

The intention is that when payouts are made, the Committee will

include a description of the extent to which targets have been met,

as well as the rationale for why the Committee believes that the level of

payouts is appropriate. Naturally for reasons of commercial sensitivity

we will not be able to publish specific target figures in advance.

Long-term performance targets from 2011/12

Long-term plan opportunity

• Maximum of 275% of salary for the CEO

• Maximum of 225% of salary for the other Executive Directors

• Shares vest in three years’ time subject to performance targets

being met

Tesco believes that the best way to enhance shareholder value is to

grow earnings over the long term while maintaining a sustainable level

of return on capital – in other words to keep growing the size of the

business in an efficient way.

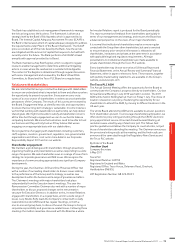

For awards granted from 2011 onwards, the Committee intends

that performance targets will be set as a matrix of stretching

earnings growth targets and sustainable return on capital employed

performance. The Committee believes that this combination of EPS

growth and ROCE performance is strongly aligned with our strategic

objectives and also reflects the drivers of long-term shareholder value.

In order for full vesting to occur, cumulative earnings have to grow by at

least 12% per annum over the next three years and ROCE for 2013/14

must have increased to at least 14.6%. No payout at all will be made

unless ROCE is increased from last year’s actual ROCE of 12.9% to

above 13.6% (a 70 basis point increase). For maximum vesting therefore

management is not only required to increase earnings significantly over

the three-year period but also to increase the efficiency of the use of

Group capital.

The Committee also believes that these targets are appropriately

stretching and if they are achieved will have generated significant value

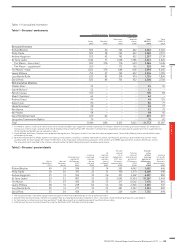

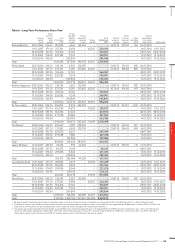

for our shareholders. The vesting matrix and targets are illustrated below:

% of initial award vesting

EPS

Targets Threshold Target EPS

7% 10% 12%

ROCE 14.6% 45% 75% 100%

13.6% 20% 60% 85%

In previous years, under the existing plan, ROCE performance outcomes

were adjusted to take into account acquisitions which were not

envisaged when the targets were set. The Remuneration Committee

reserves the right to make such adjustments under the new plan but

will only do so when the impact is material.

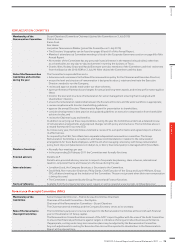

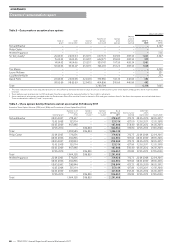

Share ownership guidelines

Shareholding guidelines

4 x base salary

for the CEO

3 x base salary for

other Executive

Directors

• The purpose is to create alignment with interests

of shareholders

• This requirement is at the upper end of typical

market practice for similar sized companies

• Increased from current guideline of 1 x base salary

to demonstrate the ongoing commitment of our

executives to acquiring and holding shares in Tesco

The Remuneration Committee believes that a significant shareholding

by Executive Directors aligns their interests with shareholders and

demonstrates their ongoing commitment to the business. Given this,

the Committee has increased the shareholding guideline from one

times base salary to four times base salary for the CEO and to three

times base salary for the other Executive Directors.

Shares held in plans which are not subject to forfeiture will be included

(on a net basis) for the purposes of calculating Executive Directors’

shareholdings, as will be shares held by an Executive’s spouse. New

appointees will typically be expected to achieve this minimum level

of shareholding within five years. Full participation in the long-term

Performance Share Plan will be conditional upon maintaining the

minimum shareholding. Most Executives already meet this enhanced

requirement but those who do not will be required to hold and not

dispose of at least 50% of the net number of shares which vest under

incentive arrangements until they meet this requirement.

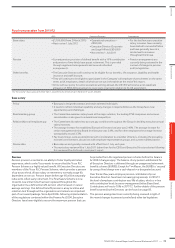

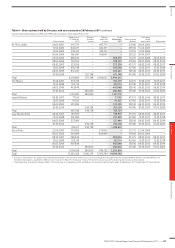

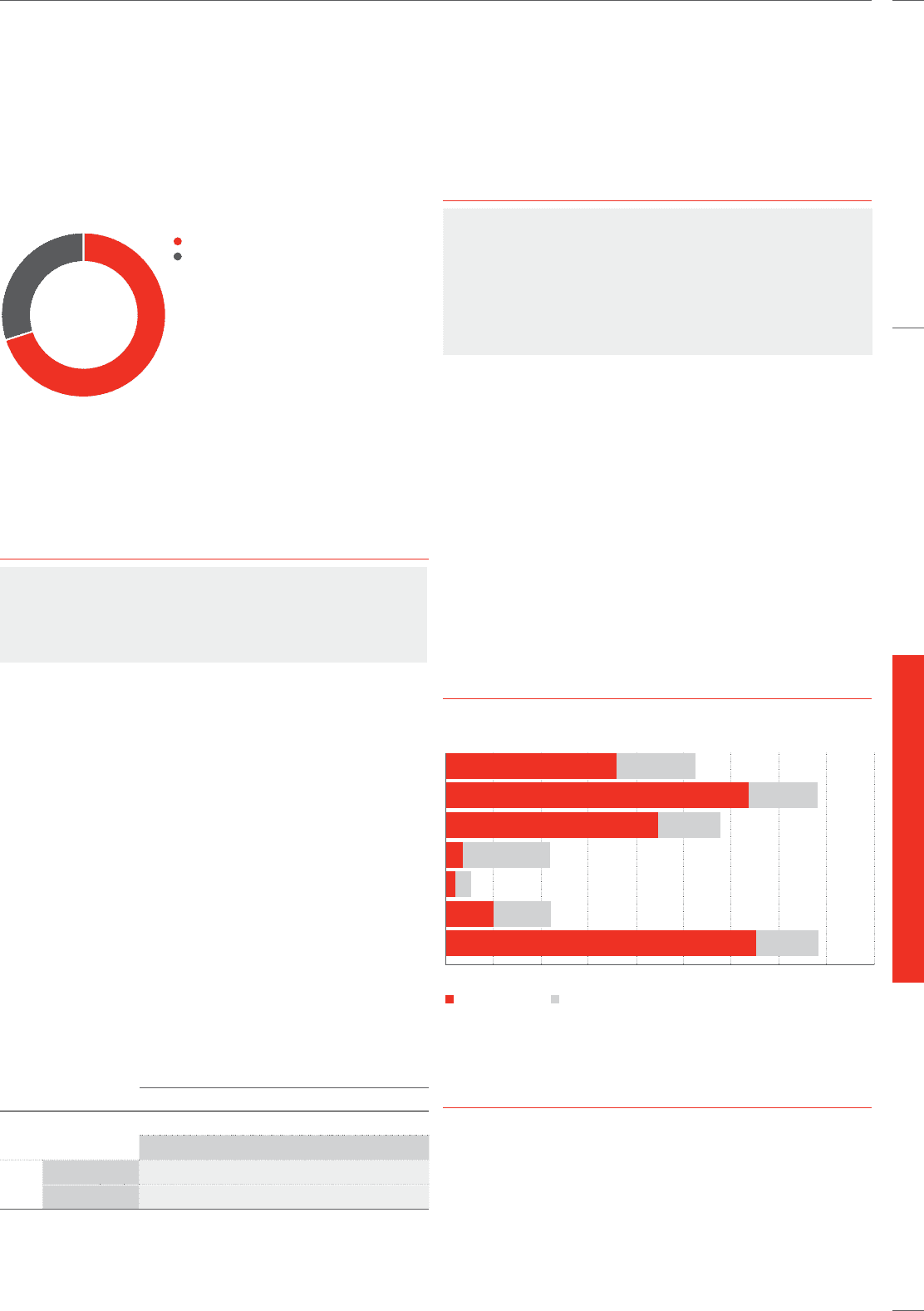

Shares held by Executive Directors as at 26 February 2011

The chart below illustrates the value of Executive Directors’

shareholdings, based on a share price at 26 February 2011 of £4.0605.

32 4

Richard Brasher

Philip Clarke

Andrew Higginson

Tim Mason

Laurie Mcllwee

£s million

Lucy Neville-Rolfe

65 7 8 910

David Potts

Ordinary shares EIP

Includes ordinary shares, and awards of shares and nil cost options made to Directors

which remain subject only to a holding period. Excludes unexercised vested executive

share options.

Service agreements

The Executive Directors all have rolling service agreements with no

fixed expiry date. These existing contracts may be terminated on

12 months’ notice by the Company and six months’ notice by the

Executive. If an Executive Director’s employment is terminated (other

than pursuant to the notice provisions in the service agreement or by

reason of resignation or unacceptable performance or conduct) the

Company will pay a sum calculated on the basis of basic salary and the

average annual bonus paid for the last two years. No account will be

taken of pension. Termination payments will be subject to mitigation

TESCO PLC Annual Report and Financial Statements 2011

—

79

Overview Business review Governance Financial statements