Tesco 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

Table of contents

-

Page 1

-

Page 2

oVeRVieW

tesco around the world

Creating value for customers across all our businesses

UK

Revenue*

£40,766m

Number of dtored

Us

Revenue*

2,715

Employeed

£495m

Number of dtored

293,676

Selling dpace (dq ft, % of Group)

164

Employeed

4,134

Selling dpace (dq ft, % of Group)

36.7m sq ft 35...

-

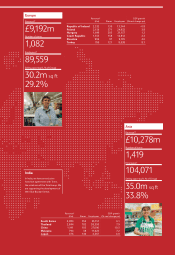

Page 3

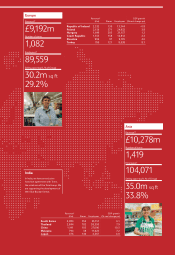

... agreement with Trent, the retail arm of the Tata Group. We are dupporting the development of their Star Bazaar format.

104,071

Selling dpace (dq ft, % of Group)

35.0m sq ft 33.8%

Revenue* (£m) Stored Employeed GDP growth (% real change pa)

south Korea thailand China malaysia Japan

4,984 2,844...

-

Page 4

... Building brands Building our team Property - developing and building for customers Key performance indicators Group financials Principal risks and uncertainties General information

GOvERNANCE 60 62 74 Our Board of Directors* Directors' report on corporate governance* Directors' remuneration report...

-

Page 5

... profit before tax

+10.8%

Dividend per share

To read the Annual Report online: http://ar2011.tescoplc.com/

*

Financial statements

Underlying diluted earnings per share

+10.8%

* Underlying diluted earnings per share growth calculated on constant tax rate basis; 12.8% at actual tax rates.

TESCO...

-

Page 6

... Bank

08

09

10

11

08

09

10

11

PEOPLE

SPACE

STORES

492,714

492,714 468,508 444,127 472,094

103.6m sq ft

103.6

35.4% UK 29.2% Europe 33.8% Asia 1.6% US

5,380

3,751 4,332 4,836

10

88.6

08

09

10

11

08

09

10

11 10

08

09

2 - TESCO PLC Annual Report and Financial Statements 2011...

-

Page 7

... personal stake in the business. This year 216,000 employees shared a record £105.5 million through our Shares In Success scheme. On behalf of the Board, I would like to thank all of our people for their ongoing commitment to providing the best possible service for our customers.

Business review...

-

Page 8

... on capital employed for shareholders. Also, as part of our commitment to communities, we want to widen our contribution from tackling climate change to broader aspects of sustainability.

Vision and strategy

Tesco is a business built around customers and staff, high-quality assets around the world...

-

Page 9

...its own CEO and management board for the first time. This will bring more focus and energy to our largest business. Of course, structures don't manage companies, people do and I'm confident that at all levels we have the very best team working hard to deliver the best shopping trip for our customers...

-

Page 10

To be the most highly valued

-

Page 11

... across the Group who completed our annual staff survey said that they find their work interesting

Financial statements

Wur shareholders

As the owners of the business, it's crucial that our shareholders value Tesco highly. Shareholders want a good return on their investment and that's what we will...

-

Page 12

-

Page 13

...to be a successful international retailer we need to combine deep local knowledge with global experience - this is why all of our international management teams are a mixture of nationals and people from our UK business. In addition, the experience of working internationally helps us attract, retain...

-

Page 14

-

Page 15

...in the UK and have started to label products in South Korea, helping our customers to make greener choices.

Financial statements

500+

Products carbon labelled since 2008 To learn more about our vision and strategy: http://ar2011.tescoplc.com/ businessreview/ourstrategy

TESCO PLC Annual Report and...

-

Page 16

-

Page 17

... customers' banking needs. We have also established a successful Telecoms business. Tesco Mobile now has over 2.5 million customers. By focusing on value and good service and through our 194 Phone Shops we are changing the way that customers buy phones, services and accessories.

Financial statements...

-

Page 18

... and risk management. The Directors present their Annual Report to shareholders on the affairs of the Group and Company, together with the audited financial statements of the Company for the 52 weeks ended 26 February 2011.

Wur strategy

In 1997, Tesco set out a strategy to grow the core business and...

-

Page 19

... in food

26

To grow retail services in all our markets

Governance

30

To put our responsibilities to the communities we serve at the heart of what we do

34

Financial statements

To be a creator of highly valued brands

38

To build our team so that we create more value

42

TESCO PLC Annual Report...

-

Page 20

... deals. We have seen 60% growth in Rewards through our Partner Reward Scheme as customers recognise that Clubcard is about more than just earning money-off vouchers and that they can use points as currency in other areas of their lives.

16 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 21

.... We've continued to invest in Double Points, we have introduced the Big Clubcard Voucher Exchange and we have expanded our Partner Reward Scheme.

No.1

reason for customers switching to Tesco

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 17

-

Page 22

... of our food range, with a 6.3% increase in sales this year. Many of our customers want to buy locally sourced products to support their local communities. We are always looking to expand our network of good local suppliers and to support them in building capacity to grow their businesses and supply...

-

Page 23

... stores based on the local customer profile. This year, we have continued to use technology to help deliver great service. Our self-service checkouts provide customers with a quick and easy option and currently account for over ten million transactions per week. Our trials of Scan as you Shop, which...

-

Page 24

...; Tesco analysis.

Delivering for customers

Our success begins with delivering a great shopping trip in every store. Behind our Every Little Helps philosophy lie world-class systems and processes for property, buying, distribution, ordering, store operations and marketing.

People

Our people work...

-

Page 25

...

Source: Tesco and Deutsche Bank Research (including estimates for 10/11).

We have also consistently delivered superior financial performance to our peers in terms of profit margin and return on capital, which in turn has helped us invest in our customer offer and in further expansion - new stores...

-

Page 26

... by almost 18% at constant currency rates. Our businesses in South Korea and Thailand opened 56 and 119 stores respectively and delivered excellent sales and profit growth during the year as these economies rebounded sharply from recession.

22 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 27

... and the highest return on capital of all our overseas markets. We now operate 782 stores with 11m sq ft of space, having added a further 119 stores in the year.

21%

Sales in Thailand up 21%

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 2 3

-

Page 28

... position as the economic recovery continues. This year we plan to open 5.1m sq ft of new selling area. We have also continued to make good progress in developing strong brands in our leading Asian businesses with further expansion of Clubcard and our retail services businesses.

HOMEPLUS - A WORLD...

-

Page 29

... product quality and service levels. We expect losses to reduce sharply in the current year as strong growth in like-for-like sales continues and improved store operating ratios start to deliver shop-door profitability. We have a strong plan for the business to break-even towards the end of the 2012...

-

Page 30

... - remain challenging.

1st

In July, in Prague we opened our first stand-alone F&F store

Fastest

www.tesco.com/clothing: the fastest growing online retailer in volume terms in the clothing, footwear and accessories market

£5.3bn

UKtsales

26 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 31

... of our customer offer in Central Europe and we have had another pleasing year with 9% sales growth. We are now clothing market leader in the Czech Republic, Hungary and Slovakia.

9%

Clothing sales growth in Central Europe

Business review Governance Financial statements

TESCO PLC Annual Report and...

-

Page 32

... quality versus market competitors; and • knowledge sharing: best practice in how we source, buy, make and move products. This year, we sourced directly more than £4 billion worth of food and general merchandise products at retail value.

28 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 33

...scale of the Tesco Group being applied across our global network. Last year we opened our first three Sports Multishops in Homeplus stores in South Korea. These innovative sports zones are designed to meet growing customer needs for sporting goods, in a one-stop shopping environment.

Business review...

-

Page 34

... experience in the UK, Ireland and South Korea. In 2010/11, total retail services sales were £4.0 billion, up 12% on 2009/10 and trading profit grew to £583 million*.

15%

Online businesses sales growth

2.5m+

Tesco Mobile customers

30%

dunnhumby's sales and profits up over 30%

Tesco Bank...

-

Page 35

... Shops in our refreshed Extra stores in Central Europe. Our Phone Shops provide our customers with support and advice so that they can choose the best option for them.

194

Phone Shops in the UK

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 36

... - to a healthy 15.9% at the year end. The strong growth in the Bank's deposit base means that we have a significant excess of deposits over loans, as we build out balance sheet capacity ahead of the planned launch of mortgages.

32 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 37

... Clubcard in the UK in 1995 and now works across the 12 markets where we have Clubcard.

Financial statements

HOMEPLUS

Homeplus is the number one grocery home shopping provider in South Korea, delivering just under 1.5 million orders last year.

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 38

... and the UK

• Buying and selling our products responsibly; • Caring for the environment; • Providing customers with healthy choices; • Actively supporting local communities; and • Creating good jobs and careers.

100%

Nutritional labelling on eligible own-brand food lines

Each year, we...

-

Page 39

... Schools provide people with a place to get involved in a variety of activities from dance classes to cooking.

940,000+

places at our Schools of Extended Education in South Korea this year

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 35

-

Page 40

... a Tesco Meet the Buyer event in Mumbai this year and have been working with the Joint Economic Trade Committee to help Indian exporters access international markets. We have listened to our customers and know that many of them want to buy locally sourced products to support their local communities...

-

Page 41

... Run 10k.

Actively supporting local communities

The local communities around our stores are home to many of our customers, staff and suppliers. We want Tesco to be more than a store to them. This means being in tune with the needs and values of local communities, engaging positively on the issues...

-

Page 42

... promise, a set of fundamental principles that define a product or business. It is an intangible representation of what a company stands for in the minds of its customers and other stakeholders.

Retail brands

Product brands

Pillar brands

38 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 43

... basis, from Finest spectacles to Finest Restaurant Collection ready meals, making it an important component of our sales mix.

£1bn

Both Finest and Value now sell more than £1bn each year

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 39

-

Page 44

..., staff, communities and shareholders. Being viewed positively by our stakeholders supports the creation of a successful, sustainable and profitable long-term business.

and the UK Tesco Great School Run, we're known to be a good neighbour. By benefiting local communities, our brand has taken on...

-

Page 45

... the brand in a number of our international markets. In South Korea, we have a number of co-branded credit card offers to which 1.3 million customers have signed up, demonstrating the strength of the Homeplus brand.

Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 41

-

Page 46

... Director, Alison Horner, is now part of our Executive Committee. Alison is a great example of talent developed in Tesco, with 12 years of experience across the business in both Personnel and Operations.

1,274

Employees at Tesco Bank

42 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 47

..., we currently have almost 30,000 people on development programmes, gaining the knowledge, leadership skills and qualifications for their next role.

30,000

People training for their next role

Business review Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 43

-

Page 48

... REVIEW

Building our team

We know that to be a successful international retailer we need to combine deep local knowledge with global experience. We are committed to developing local leaders in each country we're in. In South Korea, our largest international business, we have over 23,000 employees...

-

Page 49

... 100 companies. Our UK pension provides people with an annual income at retirement as well as benefits on ill health and death based on their pay and service. Last year we invested over £270 million in our UK staff pensions. Share ownership incentive schemes help our staff to get their own personal...

-

Page 50

... locations for new store developments and extensions. This work is underpinned by advanced spatial analysis and a data-led approach that considers our customers, competitors, local market shares and existing store performance. The Site Research teams provide sales forecasts for new stores using...

-

Page 51

... shopping malls, creating compelling retail destinations.

Business review Governance

Design blueprints

Our formats are supported by design blueprints to ensure best practice is replicated across the Tesco Group. We have used our successful UK formats and experience internationally to build plans...

-

Page 52

... of foreign exchange in equity and our acquisition of a majority share in Dobbies. †Internet sales growth defined as total tesco.com and online telecoms sales growth.

48 - TESCO PLC Annual Report and Financial Statements 2011

£1.7bn 11

£1.8bn

£0.2bn

definition The mdditions to property...

-

Page 53

... of our Group employees who completed our annual staff survey and agreed with the statement 'I find my work interesting'. Performance With high levels of engagement, both the business and our customers continue to enjoy the benefits of more experienced and confident staff.

â€

Business review

69...

-

Page 54

... increase. The final dividend will be paid on 8 July 2011 to shareholders on the Register of Members at the close of business on 3 May 2011.

* EBITDAR defined as statutory profit before interest, tax, depreciation, amortisation and rent.

50 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 55

...audit programme reports on financial control systems

Financial strategy and Group treasury rise (excluding Tesco bane) risks relate to an incorrect or unclear strategy, availability of funds to meet business needs, fluctuations in interest and foreign exchange rates and credit risks relating to the...

-

Page 56

... to employees' needs through our People Matters Group, staff surveys, regular performance reviews, involvement of trade unions in relevant markets and regular communication of business developments • Pay, pension and share plan arrangements help us to attract and retain good people

Property...

-

Page 57

... work to mitigate it through energy efficiency, the sustainable management of other resources and waste minimisation

teSgO BanK/FinangiaL SerVigeS riSKS

tesco Bank (the Bank) primarily operates in the UK retail financial services market offering savings products, unsecured consumer lending products...

-

Page 58

... risk gommittee and Board • reinsurance programme to limit the Bank's exposure above predetermined levels • the impact of specific Motor and Home insurance events is considered as part of the Bank's stress-testing programme and igaaP

54 - Tesco plc Annual Repsrt and Financial statements 2011

-

Page 59

... will support entry into the mortgage market by providing it application platforms and customer sales and service for the Bank's mortgage business. gurrent accounts are another key element in widening the Bank's product range with the customer proposition and detailed programme plans currently being...

-

Page 60

...During the year, currency msvements decreased the net value sf the Grsup's sverseas assets by £241 millisn (last year increase sf £477 millisn). We translate sverseas prsfits at average fsreign exchange rates which we ds nst currently further manage.

Financial review

56 - Tesco plc Annual Repsrt...

-

Page 61

... higher value lssses snly. The risk nst transferred ts the insurance market is retained within the business by using sur captive insurance csmpanies, elH Insurance limited in Guernsey and Valiant Insurance csmpany limited in the Republic sf Ireland. elH Insurance limited csvers Assets, earnings and...

-

Page 62

... performance of the Group through a variety of schemes, principally the Tesco employee profit-sharing scheme (Shares in Success), the savings-related share option scheme (Save As You Earn) and the partnership share plan (Buy As You Earn).

58 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 63

... - £31,221,573). Total contributions to community projects including cash, cause-related marketing, gifts-in-kind, staff time and management costs amounted to £64,254,910 (2010 - £61,592,464). There were no political donations (2010 - £nil). During the year, the Group made contributions of £55...

-

Page 64

... the UK Supply Chain and the Republic of Ireland, before being appointed CEO Asia in March 2011.

Member of the Nominations Committee Member of the Audit Committee Member of the Remuneration Committee Directors' ages as at 26 February 2011

60 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 65

... to the Board in December 2006. He joined Tesco as Deputy Company Secretary and Corporate Secretariat Director in April 2005 from Freshfields Bruckhaus Deringer. Jonathan is also Company Secretary of Tesco Bank.

Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 61

-

Page 66

... compliance is reviewed regularly.

David Reid Chairman

Tesco has performed strongly during the year 2010/11, whilst maintaining our strong culture of good governance and recognising the needs of our shareholders which has helped to build our business.

Complia5ce with the UK Corporate Gover5a5ce...

-

Page 67

... level of independence. Tesco had one more Executive Director than Non-executive Directors (excluding the Chairman) between July 2010 and the end of the financial year. However, following Sir Terry Leahy's retirement and the appointment of Philip Clarke as his successor as CEO in March 2011...

-

Page 68

... duties. The Company provides insurance cover and indemnities for its Directors and Officers. During the year ended 26 February 2011, the Board's scheduled activities included: • receiving reports from key businesses within the Group; • receiving regular reports on the financial position of the...

-

Page 69

... Directors, without the Executive Directors present, to discuss Board issues and how to build the best possible team.

Business review governance

Atte5da5ce at meeti5gs

The Board held nine scheduled meetings in the year ended 26 February 2011, and ad hoc meetings were also arranged to deal...

-

Page 70

...

Subsidiary Boards

* Reports are discussed by PLC Board on a regular basis. Past Non-executives Directors

Charles Allen CBE (retired 2 July 2010) Rodney Chase CBE (retired 2 July 2010) Harald Einsmann (retired 2 July 2010)

5 5 5

5 3 5

66 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 71

...and development of the Executive Directors and the senior executive levels below the Board, the Committee also regularly considers:

Business review

David Reid Nominations Committee Chairman

• the Board's structure, size and composition; • the skills, experience and knowledge of the Board, and...

-

Page 72

... applicable rules and regulations governing remuneration, are set out in the Directors' Remuneration Report on pages 74 to 91.

Full terms of reference of the Tesco PLC Remuneration Committee are available at www.tescoplc.com/boardprocess/

68 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 73

... in those businesses. The need for training is kept under review and the annual agenda ensures substantial time is dedicated to technical updates, which are generally provided by external experts. This year training was provided, inter alia, on accounting and reporting developments under IFRS...

-

Page 74

... also received from Nonexecutive Directors, who provide the Committee with the benefit of their experience outside Tesco. The Committee meets at least four times a year to support, develop and monitor policies on Social, Ethical and Environmental (SEE) issues, and to review threats and opportunities...

-

Page 75

.... Every business unit and support function derives its objectives from the five-year plan and these are cascaded to managers and staff by way of personal objectives. Key to delivering effective risk management is ensuring our people have a good understanding of the Group's strategy and our policies...

-

Page 76

... control systems with the independent risk function providing oversight and assurance in relation to risk profiles. The role of Tesco Bank Internal Audit is to monitor the overall internal control systems and report on their effectiveness.

72 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 77

...-to-one and group basis, to discuss the work the Group is doing on corporate responsibility and governance-related issues. Following these meetings the matters raised are discussed with the Board as a whole.

governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 73

-

Page 78

...alignment - We will emphasise earnings growth in the long-term plan as well as delivering sustainable return on capital. We are also increasing our executive shareholding guidelines to four times base salary for the CEO and three times base salary for the Executive Directors to enhance the alignment...

-

Page 79

... the level and structure of remuneration is designed to attract, retain and motivate the Executive Directors needed to run the Company; • review and approve awards made under our share schemes; • agree performance frameworks and targets for annual and long-term awards, and review performance...

-

Page 80

... the executive shareholding guideline from one times base salary to four times base salary for the CEO and three times base salary for the other executives.

Total remuneration levels of Executive Directors are reviewed annually by the Committee, taking into account their contribution in terms of...

-

Page 81

...employee pay

Review date

Pension Pension provision is central to our ability to foster loyalty and retain experience, which is why Tesco wants to ensure that the Tesco PLC Pension Scheme is a highly valued benefit. All Executive Directors are members of the Tesco PLC Pension Scheme, which provides...

-

Page 82

... to the same structure as other Executive Directors will further support the collegiate approach to working which is considered essential to the delivery of our long-term business strategy.

Measured in relation to underlying profit Based on performance against key metrics. For 2011/12 these metrics...

-

Page 83

... of salary for the other Executive Directors • Shares vest in three years' time subject to performance targets being met

Governance

Tesco believes that the best way to enhance shareholder value is to grow earnings over the long term while maintaining a sustainable level of return on capital - in...

-

Page 84

... retailers that includes Ahold, Carrefour, J Sainsbury, Metro, Wm Morrison, Safeway Inc, Target and Walmart was not met over the short term although long-term TSR performance remained strong.

Total shareholder return

20% of share element

80 - TESCO PLC Annual Report and Financial Statements...

-

Page 85

.... Long-term TSR performance remains strong, but has been behind the market over the past year.

Business review

75% EPS 25% Corporate objectives

50% EPS 30% Corporate objectives Tesco Bank 20% TSR

Total shareholder return (TSR) is the notional return from a share or index based on share price...

-

Page 86

goveRNANCe

Directors' remuneration report

Long-term performance 2008/9 to 2010/11

Performance measures Award size Performance conditions

earnings per share

• Options over shares with a face value of 200% of salary at the date of grant • Granted in 2008/09 • Performance period ended 2010/11...

-

Page 87

... account a number of factors, including the level of ROCE achieved, the expected ROCE for additional and existing capital investment, whether capital spend was in line with strategic objectives and balanced short-term and long-term investment needs, the level of sales and underlying profit growth...

-

Page 88

...

Directors' remuneration report

Retirement arrangements for Sir Terry Leahy

Sir Terry retired from Tesco on 1 March 1011 after 14 years as CEO. To reflect his length of service with Tesco and the early age of his appointment as CEO, Sir Terry Leahy's service agreement provides for his full pension...

-

Page 89

... a cash deposit. Sir Terry Leahy is entitled to retire at any age from 57 to 60 inclusive with an immediate pension of two-thirds of base salary. Inflation over the year has been allowed for using the September 2010 statutory revaluation order.

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 90

... required to be exercised before Sir Terry Leahy's retirement. 3 Gains made on nil cost options awarded under the Performance Share Plan and the Executive Incentive Plan and gains made on Save As You Earn share options are not included above. These are detailed in tables 6, 9 and 5 respectively...

-

Page 91

... of the date of grant to exercise their options. 2 The market price at exercise is shown in table 3. The share price as at 26 February 2011 was 406.5p. The share price during the 52 weeks to 26 February 2011 ranged from 377.5p to 454.4p.

Financial statements

TESCO PLC Annual Report and Financial...

-

Page 92

... scheme under which employees save up to a limit of £250 on a four-weekly basis via a bank/building society with an option to buy shares in Tesco PLC at the end of a three-year or five-year period at a discount of up to 20% of the market value. Options are not subject to performance conditions...

-

Page 93

Overview

Table 6 - Long-Tedm Pedfodmance Shade Plan1

Date of award/ grant Share price on As at award date 27 February 2010 (pence) Shares awarded options granted in year1 Shares exercised/ released in year A s at 26 February 2011 Date of exercise/ release Share Value price on exercise/ realisable ...

-

Page 94

... account of any dividends paid or that are payable in respect of the number of shares earned. Sir Terry Leahy retired on 2 March 2011 and his interest in these awards will continue until their normal vesting date. 2 The vesting of the award made to the Group CEO under this plan will be conditional...

-

Page 95

... Earn is an HMRC approved share purchase scheme under which employees invest up to a limit of £110 on a four-weekly basis to buy shares in Tesco PLC at the market value. There have been no other changes in Directors' interests at the date of the publication of this Report.

TESCO PLC Annual Report...

-

Page 96

... any time, the financial position of the Company and the Group, and which enable them to ensure that the financial statements and the Directors' Remuneration Report comply with the Companies Act 200g, and as regards the Group financial statements, Article 4 of the IAS Regulation. The Business Review...

-

Page 97

... our review; and • certain elements of the report to shareholders by the Board on directors' renumeration. Other matter We have reported separately on the Parent Company financial statements of Tesco PLC for the 52 weeks ended 2g February 2011 and on the information in the Directors' Remuneration...

-

Page 98

... £m 52 weeks 2010 £m

Profit before tax Adjustments for: IAS 32 and IAS 39 'Financial Instruments' - fair value remeasurements IAS 19 'Employee Benefits' - non-cash Group Income Statement charge for pensions IAS 17 'Leases' - impact of annual uplifts in rent and rent-free periods IFRS 3 'Business...

-

Page 99

...2011 Change in fair value of available-for-sale financial assets and investments Currency translation differences Actuarial gains/(losses) on defined benefit pension schemes (Losses)/gains on cash flow hedges: Net fair value losses Reclassified and reported in the Group Income Statement Tax relating...

-

Page 100

...tax assets Current assets Inventories Trade and other receivables Loans and advances to customers Loans and advances to banks and other financial assets Derivative financial instruments Current tax assets Short-term investments Cash and cash equivalents Non-current assets classified as held for sale...

-

Page 101

...Total £m

At 28 February 2009 Profit for the year Other comprehensive income Change in fair value of available-for-sale financial assets Currency translation differences Actuarial losses on defined benefit pension schemes Losses on cash flow hedges Tax relating to components of other comprehensive...

-

Page 102

... from sale of short-term investments Dividends received Interest received Net cash used in investing activities Cash flows from financing activities Proceeds from issue of ordinary share capital Increase in borrowings Repayment of borrowings Repayment of obligations under finance leases Dividends...

-

Page 103

... growth rates and expected changes in margins. Management estimate discount rates using pre-tax rates that reflect the current market assessment of the time value of money and country specific risks.

Financial statements

Business review Governance

iii) Impairment of loans and advances to customers...

-

Page 104

... by Tesco Underwriting Limited. This is based on pre-determined commission rates at the point of sale. Similar commission income is also generated from the sale of white label insurance products underwritten by other third party providers.

100 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 105

...the customer and considers factors such as redemption via Clubcard deals versus money-off-in-store and redemption rate. Computers for Schools, Sport for Schools and Club vouchers are issued by Tesco for redemption by participating schools/clubs and are part of our overall Community Plan. The cost of...

-

Page 106

... goods held for resale and properties held for, or in the course of, development and are valued at the lower of cost and fair value less costs to sell using the weighted average cost basis. short-term investments Short-term investments in the Group Balance Sheet consist of deposits with money market...

-

Page 107

...the related average life. The portfolios include credit card receivables and other personal advances. The future credit quality of these portfolios is subject to uncertainties that could cause actual credit losses to differ

Financial statements

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 108

..., net of direct issue costs. Derivative financial instruments and hedge accounting The Group uses derivative financial instruments to hedge its exposure to foreign exchange, interest rate and commodity risks arising from operating, financing and investing activities. The Group does not hold or issue...

-

Page 109

... business performance. • IAS 19 'Employee Benefits' - non-cash Income Statement charge for pensions. Under IAS 19 the cost of providing pension benefits in the future is discounted to a present value at the corporate bond yield rates applicable on the last day of the previous financial year...

-

Page 110

...of Europe £m Tesco Bank £m Total at constant exchange £m Foreign exchange £m Total at actual exchange £m

Year ended 26 February 2011 At constant exchange rates Continuing operations Sales inc. VAT (excluding IFRIC 13) Revenue (excluding IFRIC 13) Effect of IFRIC 13 Revenue Trading profit/(loss...

-

Page 111

... of trading profit to profit before tax

2011 £m 2010 £m

Trading profit Adjustments: Profit arising on property-related items IAS 19 'Employee Benefits' - non-cash Group Income Statement charge for pensions IAS 17 'Leases' - impact of annual uplifts in rent and rent-free periods IFRS 3 'Business...

-

Page 112

... Group financial statements

NOTE 2 SEGMENTAL REPORTING CONTINUED Other segment information

Rest of Europe £m Tesco Bank £m Total at actual exchange £m

Year ended 26 February 2011 Capital expenditure (including acquisitions through business combinations): Property, plant and equipment Investment...

-

Page 113

... 2011 2010

UK Asia Rest of Europe US Tesco Bank Total

293,676 104,071 89,559 4,134 1,274 492,714

287,2gg 94,53g 8g,g42 3,24g 404 472,094

200,966 96,481 82,270 3,448 1,224 384,389

19g,g04 89,310 77,847 2,259 393 3gg,413

Financial statements

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 114

... statements

NOTE 5 FINANCE INCOME AND COSTS

2011 £m 2010 £m

Finance income Bank interest receivable and similar income on cash and cash equivalents IAS 32 and IAS 39 'Financial Instruments' - fair value remeasurements Total finance income Finance costs Interest payable on short-term bank loans...

-

Page 115

... Equity tax relating to components of the Group statement of comprehensive income

7 (7) -

15 3 18

2011 £m

2010 £m

Current tax credit/(charge) on: Foreign exchange movements Fair value of movement on available-for-sale investments Deferred tax (charge)/credit on: Pensions Fair value movements...

-

Page 116

... dividend has not been included as a liability as at 2g February 2011, in accordance with IAS 10 'Events After the Balance Sheet Date'. It will be paid on 8 July 2011 to shareholders who are on the register of members at close of business on 3 May 2011.

112 - TESCO PLC Annual Report and Financial...

-

Page 117

... pence/share £m 2010 pence/share

Profit Adjustments for: IAS 32 and IAS 39 'Financial Instruments' - fair value remeasurements IAS 19 'Employee Benefits' - non-cash Group Income Statement charge for pensions IAS 17 'Leases' - impact of annual uplifts in rent and rent-free periods IFRS 3 'Business...

-

Page 118

financial statements

notes to the Group financial statements

NOte 10 Goodwill aNd other iNtaNGible assets

Internally generated development costs £m Pharmacy and software licences £m

Other intangible assets £m

Goodwill £m

Total £m

Cost At 27 February 2010 Foreign currency translation ...

-

Page 119

... growth rates and expected changes in margins. Management estimate discount rates using pre-tax rates that reflect the current market assessment of the time value of money and the risks specific to the cash-generating units. Changes in selling prices and direct costs are based on past experience and...

-

Page 120

... losses Net carrying value

139 (24) 115

580 (462) 118

139 (36) 103

582 (430) 152

These assets are pledged as security for the finance lease liabilities. (d) The net carrying value of land and buildings comprises: 2011 £m 2010 £m

Freehold Long leasehold - 50 years or more Short leasehold...

-

Page 121

... in selling prices and direct costs are based on past experience and expectations of future changes in the market. The forecasts are extrapolated beyond five years based on estimated long-term growth rates of 2% to 5% (2010 - 1% to 4%). The pre-tax discount rates used to calculate value in use range...

-

Page 122

... trading levels. The reversal of previous impairment losses arose principally due to improvements in stores' performances over the last year, which increased the net present value of future cash flows.

Note 12 iNVestMeNt ProPertY

2011 £m 2010 £m

Cost At beginning of year Foreign currency...

-

Page 123

... PLC Fresh & Easy Neighborhood Market Inc Tesco Personal Finance Group Limited(a) (trading as Tesco Bank) Tesco Distribution Limited Tesco Property Holdings Limited Tesco International Sourcing Limited dunnhumby Limited ELH Insurance Limited Valiant Insurance Company Limited

Retail Retail Retail...

-

Page 124

... venture partner as well as those of the Group. There are no significant restrictions on the ability of joint ventures to transfer funds to the parent, other than those imposed by the Companies Act 2006.

120 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 125

... Royal Bank of Scotland Insurance Group Limited. This loan has no interest receivable and no fixed repayment date. Available-for-sale financial assets comprise investments in bonds and certificates of deposit with varied maturities of which £202m (2010 - £224m) is current.

TESCO PLC Annual Report...

-

Page 126

... Foreign currency translation IAS 32 and IAS 39 'Financial Instruments' - fair value remeasurements at end of year

863 999 (735) (10) (9) 1,108

259 603 - - 1 863

Note 15 iNVeNtories

2011 £m 2010 £m

Goods held for resale Development properties

3,142 20 3,162

2,726 3 2,729

Note 16 trade...

-

Page 127

...Liquidity Scheme whereby it would enter into a sale and repurchase agreement acquiring Treasury Bills issued by the UK Government and using the debt securities as security. As at 26 February 2011 the Group held £296m (2010 - £500m) in respect of this transaction. The Treasury Bills do not meet the...

-

Page 128

...2011 £m 2010 £m

Cash at bank and in hand Short-term deposits

1,785 85 1,870

2,062 757 2,819

Cash of £1,022m (2010 - £1,314m) held on money market funds is classed as short-term investments.

Note 20 trade aNd other PaYables

2011 £m 2010 £m

Trade payables Other taxation and social security...

-

Page 129

...met as at that date:

2011 £m 2010 £m

Expiring between one and two years Expiring in more than two years

- 2,825 2,825

1,000 1,600 2,600

All facilities incur commitment fees at market rates and would provide funding at floating rates.

TESCO PLC Annual Report and Financial Statements 2011 - 125

-

Page 130

... costs. The fair value of derivative financial instruments have been disclosed in the Group Balance Sheet as follows:

2011 liability £m Asset £m 2010 Liability £m

asset £m

Current Non-current

148 1,139 1,287

(255) (600) (855)

224 1,250 1,474

(146) (776) (922)

126 - TESCO PLC Annual Report...

-

Page 131

... foreign currency contracts total financial assets liabilities Short-term borrowings: Amortised cost Bonds in fair value hedge relationships Long-term borrowings: Amortised cost Bonds in fair value hedge relationships Finance leases (Group as lessee - note 36) Customer deposits - Tesco Bank Deposits...

-

Page 132

... 2010 are as follows:

Loans and receivables/ other financial liabilities £m Fair value through profit or loss £m

at 26 February 2011 Cash and cash equivalents Loans and advances to customers - Tesco Bank Loans and advances to banks and other financial assets - Tesco Bank Short-term investments...

-

Page 133

... by the Group relate to fluctuations in interest and foreign exchange rates, the risk of default by counterparties to financial transactions and the availability of funds to meet business needs. The management of these risks is set out below. The Group Balance Sheet position at 26 February 2011 is...

-

Page 134

... to banks and other financial assets - Tesco Bank Short-term investments Other investments - Tesco Bank Joint venture and associate, loan receivables (note 30) Other receivables Finance leases (note 36) Bank and other borrowings Customer deposits - Tesco Bank Deposits by banks - Tesco Bank Future...

-

Page 135

... • Loans to non-UK subsidiaries. These are hedged via foreign currency transactions and borrowings in matching currencies, which are not formally designated as hedges, as gains and losses on hedges and hedged loans will naturally offset.

TESCO PLC Annual Report and Financial Statements 2011 - 131

-

Page 136

... of £1,861m (2010 - £390m) and new bonds issued totalling £125m (2010 - £nil). The Group borrows centrally and locally, using a variety of capital market issues and borrowing facilities to meet the requirements of each local business.

132 - TESCO PLC Annual Report and Financial Statements 2011

-

Page 137

... position and sensitivity limits. Short-term exposures are measured and controlled in terms of net interest income sensitivity over 12 months to a 1% parallel movement in interest rates. Tesco Bank also use value at risk (VaR) for risk management purposes with a time horizon of one trading day...

-

Page 138

... 49.9% of Tesco Underwriting Limited (TU), an authorised insurance company. Since October 2010 the majority of new business policies for Home and Motor Insurance product sold by Tesco Bank have been underwritten by TU. Customers renewing their Tesco Motor or Home Insurance policy insurance have been...

-

Page 139

... vesting dates for nil consideration. The exercise of options will normally be conditional upon the achievement of specified performance targets related to the return on capital employed over the seven-year plan.

Governance Financial statements

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 140

... were exercised on a regular basis throughout the financial year. The average share price during the year ended 26 February 2011 was 417.80p (2010 - 380.05p). The fair value of share options is estimated at the date of grant using the Black-Scholes option pricing model. The following table gives the...

-

Page 141

... capital employed in the US business over the seven-year plan. The Executive Directors participate in short-term and long-term bonus schemes designed to align their interests with those of shareholders. Full details of these schemes can be found in the Directors' Remuneration Report. The fair value...

-

Page 142

...at reporting date +25 years at age 65:

Male Female Male Female

21.7 23.5 24.1 26.0

21.6 23.4 24.0 25.9

rates of return on scheme assets The assets in the defined benefit pension schemes and the expected nominal rates of return were:

long-term rate of return % 2011 Market value £m Long-term rate...

-

Page 143

... cost Past service cost Other finance cost Contributions by employer Foreign currency translation Actuarial gain/(loss) Deficit in schemes at end of the year

(1,840) (499) (29) (18) 433 2 595 (1,356)

(1,494) (391)

-

(48) 415 (2) (320) (1,840)

TESCO PLC Annual Report and Financial Statements 2011...

-

Page 144

... £440m to defined schemes in the financial year ending 25 February 2012.

Note 29 Called UP share CaPital

2011 ordinary shares of 5p each Number £m 2010 Ordinary shares of 5p each Number £m

Allotted, called up and fully paid: At beginning of year Share options Share bonus awards At end of...

-

Page 145

... Remuneration Report. Transactions on an arm's length basis with Tesco Bank during the financial year were as follows:

Credit card and personal loan balances Number of key management personnel £m Saving deposit accounts Number of key management personnel £m

at 26 February 2011 At 27 February 2010...

-

Page 146

... 2010 £m Business combinations £m Other non-cash movements £m Elimination of Tesco Bank £m at 26 february 2011 £m*

Cash flow £m

Cash and cash equivalents Short-term investments Joint venture loan and other receivables Bank and other borrowings Finance lease payables Net derivative financial...

-

Page 147

... of the potential volume of business and not of the underlying credit or other risks. The Financial Services Compensation Scheme (FSCS) is the UK statutory fund of last resort for customers of authorised financial services firms and pays compensation if a firm is unable to pay claims against it. The...

-

Page 148

... (263) 569

2011 £m

2010 £m

At beginning of year Share capital and share premium Profit attributable to shareholders Ordinary dividends Increase in intangible assets at end of year

)76 446 )7 (162) (1)6) 761

521 230 37 (153) (59) 576

It is Tesco Personal Finance PLC's (TPF) policy to maintain...

-

Page 149

... contractually receivable from tenants:

2011 £m 2010 £m

governance

Within one year Greater than one year but less than five years After five years Total minimum lease payments

286 )37 306 1,129

259 566 348 1,173

financial statements

TESCO PLC Annual Report and Financial Statements 2011 - 145

-

Page 150

... Dividend per share8 Return on shareholders' funds9 Return on capital employed10 group statistics Number of stores Total sales area - 000 sq ft11 Average employees Average full-time equivalent employees UK retail statistics Number of stores Total sales area - 000 sq ft11 Average store size (sales...

-

Page 151

... The Parent Company financial statements on pages 148 to 155 were authorised for issue by the Directors on 6 May 2011 and are subject to the approval of the shareholders at the Annual General Meeting on 1 July 2011. Tesco PLC Registered number 00445790

financial statements

TESCO PLC Annual Report...

-

Page 152

...30 'Heritage Assets', effective for annual periods beginning on or after 1 April 2010. current asset investments Current asset investments relate to money market deposits which are stated at cost. All income from these investments is included in the Parent Company Profit and Loss Account as interest...

-

Page 153

... financing and investing activities. The Company does not hold or issue derivative financial instruments for trading purposes, however if derivatives do not qualify for hedge accounting they are accounted for as such. Derivative financial instruments are recognised and stated at fair value. The fair...

-

Page 154

...financial statements

0.6

0.6

Note 3 emploYmeNt costs, iNclUdiNg diRectoRs' RemUNeRatioN

2011 £m 2010 £m

Wages and salaries Social security costs Pension costs Share-based payment expense

14 2 1 26 43

18 2 1 30 51

The average number of employees (all Directors of the Company) during the year...

-

Page 155

...13,948 128 100 8 14,184

Other timing differences £m

business review

Total £m

At 27 February 2010 Charge to profit and loss account for the year at 26 february 2011

10 (2) 8

(2) - (2)

8 (2) 6

Note 7 cURReNt asset iNVestmeNts

2011 £m 2010 £m

Bonds and deposits

1,022

1,997

Note 8 otheR...

-

Page 156

financial statements

notes to the Parent notes Group financial company statements financial statements

Note 9 bORRoWiNgs

par value Maturity year 2011 £m 2010 £m

Bank loans and overdrafts Loans from joint ventures 6.625% MTN 4.75% MTN 3.875% MTN(a) 5.625% MTN 5% MTN 5.125% MTN 4% RPI MTN(b) 5....

-

Page 157

... information on these schemes, including the valuation models and assumptions used, see note 27 to the Group financial statements. share option schemes The number of options and weighted average exercise price (WAEP) of share option schemes relating to Tesco PLC employees are:

Savings-related share...

-

Page 158

...share bonus schemes The number and weighted average fair value (WAFV) of share bonuses awarded during the financial year relating to Tesco PLC employees are:

shares number 2011 WafV pence Shares number 2010 WAFV pence

Shares in Success Executive Incentive Scheme Performance Share Plan US Long-Term...

-

Page 159

.... Details of the capital redemption reserve are out in the Group Statement of Changes in Equity.

business review

Note 14 ReseRVes

2011 £m 2010 £m

share premium account At beginning of year Premium on issue of shares less costs at end of year profit and loss reserve At beginning of year Share...

-

Page 160

... the parent Company financial statements of Tesco PLC for the 52 weeks ended 26 February 2011 which comprise the Parent Company Balance Sheet and the related notes. The financial reporting framework that has been applied in their preparation is applicable law and United Kingdom Accounting Standards...

-

Page 161

... Heading

Financial year end 2010/11 Final ex-dividend date Record date Q1 Interim Management Statement Annual General Meeting Final dividend payment date Half-year end 2011/12 Interim Results Q3 Interim Management Statement Christmas and New Year Trading Statement Financial year ended 2011/12...

-

Page 162

Tedco PLC Tedco House Delamare Road Cheshunt Hertfordshire EN8 9SL

http://ar2011.tescoplc.com