SunTrust 2005 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT94

substantially offset by higher levels of net interest income from holding first

mortgage loans.

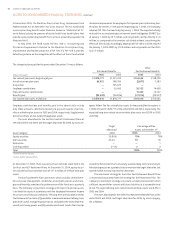

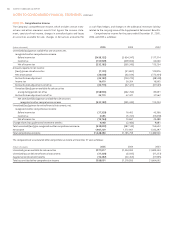

CASH FLOW HEDGES

The Company uses various interest rate swaps to convert floating rate

assets and liabilities to fixed rates. Specific types of funding and principal

amounts hedged were determined based on prevailing market conditions

and the current shape of the yield curve. The terms and notional amounts

of the swaps are determined based on management’s assessment of future

interest rates, as well as other factors.

For the years ended December , and , the Company

recognized interest income of . and interest expense of . mil-

lion, respectively, related to interest rate swaps accounted for as cash flow

hedges. This hedging strategy resulted in ineffectiveness that reduced earn-

ings by . million for the year ended December , and resulted in

zero ineffectiveness for the year ended December , .

Gains and losses on derivative contracts that are reclassified from

accumulated other comprehensive income to current period earnings are

included in net interest income. As of December , , . million,

net of taxes, of the deferred net losses on derivative instruments that are

recorded in accumulated other comprehensive income are expected to be

reclassified to interest expense in the next twelve months as derivatives

mature or as payments are made.

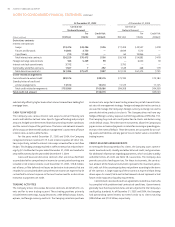

TRADING ACTIVITIES

The Company enters into various derivative contracts on behalf of its cli-

ents and for its own trading account. These trading positions primarily

include interest rate swaps, equity derivatives, credit default swaps, futures,

options, and foreign currency contracts. The Company maintains positions

in interest rate swaps for its own trading account as part of its overall inter-

est rate risk management strategy. Foreign exchange derivative contracts

are used to manage the Company’s foreign currency exchange risk and to

provide derivative products to clients. The Company does not have any

hedges of foreign currency exposure within the guidelines of SFAS No. .

The Company buys and sells credit protection to clients and dealers using

credit default swaps. These derivative instruments allow the Company to

pay or receive a stream of payments in return for receiving or providing pro-

tection in the event of default. These derivatives are accounted for as trad-

ing assets and liabilities and any gain or loss in market value is recorded in

trading income.

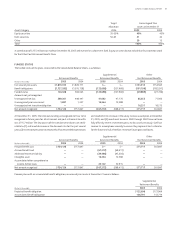

CREDITRELATED ARRANGEMENTS

In meeting the financing needs of its clients, the Company issues commit-

ments to extend credit, standby and other letters of credit, and guarantees.

For additional information regarding guarantees, which includes standby

and other letters of credit see Note , Guarantees. The Company also

provides securities lending services. For these instruments, the contrac-

tual amount of the financial instrument represents the maximum poten-

tial credit risk if the counterparty does not perform according to the terms

of the contract. A large majority of these contracts expire without being

drawn upon. As a result, total contractual amounts do not represent actual

future credit exposure or liquidity requirements.

Commitments to extend credit are agreements to lend to a client who

has complied with predetermined contractual conditions. Commitments

generally have fixed expiration dates and are subjected to the Company’s

credit policy standards. As of December , and , the Company

had outstanding commitments to extend credit to its clients totaling

. billion and . billion, respectively.

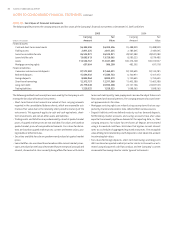

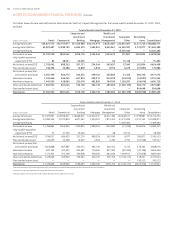

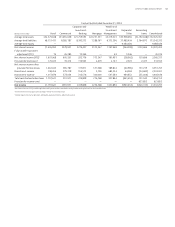

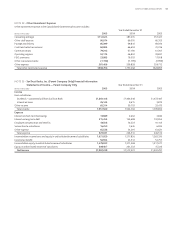

At December , At December ,

Contract or Contract or

Notional Amount Notional Amount

For Credit Risk For Credit Risk

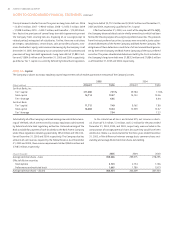

(Dollars in millions) End User Clients Amount End User Clients Amount

Derivatives contracts

Interest rate contracts

Swaps , , , ,

Futures and forwards , , — , , —

Caps/Floors , — , —

Total interest rate contracts , , , ,

Foreign exchange rate contracts , — ,

Interest rate lock commitments , — — , — —

Commodity and other contracts , ,

Total derivatives contracts , , , ,

Credit-related arrangements

Commitments to extend credit , , , ,

Standby letters of credit and

similar arrangements , , , ,

Total credit-related arrangements , , , ,

Total credit risk amount , ,

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued