SunTrust 2005 Annual Report Download - page 39

Download and view the complete annual report

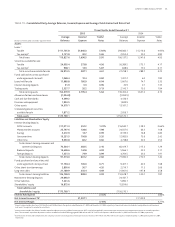

Please find page 39 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 37

dard deviations from the mean under a normal distribution. This means

that, on average, daily profits and losses are expected to exceed VaR one out

of every overnight trading days. The VaR methodology includes hold-

ing periods for each position based upon an assessment of relative trading

market liquidity. For the foreign exchange, equities, structured trades, and

derivatives desks, the Company estimates VaR by applying the Monte Carlo

simulation platform as designed by RiskMetrics™, and for the estimate of

the fixed income VaR, the Company uses Bloomberg™ analytics. For equity

derivatives, the Imagine system is used for VaR. The Company uses an inter-

nally developed methodology to estimate VaR for the collateralized debt

obligations and loan trading desks.

The estimated average combined Undiversified VaR (Undiversified

VaR represents a simple summation of the VaR calculated across each Desk)

was . million for and . million for . Trading assets net of

trading liabilities averaged . billion for and . billion for .

The estimated combined period-end Undiversified VaR was . million at

December , and . million at December , . Trading assets

net of trading liabilities were . billion at December , and .

billion at December , .

Liquidity Risk

Liquidity risk is the risk of being unable to meet obligations as they come

due at a reasonable funding cost. SunTrust manages this risk by structuring

its balance sheet prudently and by maintaining borrowing resources to fund

potential cash needs. The Company assesses liquidity needs in the form of

increases in assets, maturing obligations, or deposit withdrawals, consider-

ing both operations in the normal course of business and in times of unusual

events. In addition, the Company considers the off-balance sheet arrange-

ments and commitments it has entered into, which could also affect the

Company’s liquidity position. The ALCO of the Company measures this risk,

sets policies, and reviews adherence to those policies.

The Company’s sources of funds include a large, stable deposit base,

secured advances from the Federal Home Loan Bank (“FHLB”) and access

to the capital markets. The Company structures its balance sheet so that

illiquid assets, such as loans, are funded through client deposits, long-term

debt, other liabilities and capital. Client based core deposits, the Company’s

largest and most cost-effective source of funding, accounted for .% of

the funding base on average for compared to .% for . The

decrease in this ratio was due to a . billion increase in average loans

held for sale that was funded primarily with wholesale borrowings. Average

client based core deposits increased . billion, or .%, compared to

. Approximately two-thirds of the increase was due to the acquisition

of NCF. The remainder of the growth was the result of successful marketing

campaigns, continued growth from client activity, and the relative appeal

of alternative investments. Increases in rates, improved economic activity

and confidence in the financial markets may lead to disintermediation of

deposits, which may need to be replaced with higher cost borrowings in the

future.

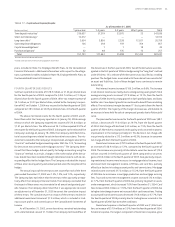

Total wholesale funding, including net short-term unsecured borrow-

ings, net secured wholesale borrowings and long-term debt, totaled .

billion at December , compared to . billion at December ,

. The increase reflects the wholesale funding required for earning asset

growth not supported by core deposit growth.

Net short-term unsecured borrowings, including wholesale domestic

and foreign deposits and fed funds, totaled . billion at December ,

compared to . billion at December , . Record mortgage

production volume increased the balance of loans held for sale, which has

been funded using short-term unsecured borrowings. Mortgage production

was . billion for compared to . billion for . The balance

of loans held for sale was . billion and . billion at December ,

and December , , respectively.

The Company maintains access to a diversified base of wholesale

funding sources. These sources include fed funds purchased, securities sold

under agreements to repurchase, negotiable certificates of deposit, off-

shore deposits, FHLB advances, Global Bank Note issuance and commercial

paper issuance. As of December , , SunTrust Bank had . bil-

lion remaining under its Global Bank Note program. This capacity reflects

a million subordinated debt issuance in the first quarter of , a

million senior debt issuance in the second quarter of and an

million subordinated debt issuance in the third quarter of . The

Global Bank Note program was established to expand funding and capital

sources to include both domestic and international investors. Liquidity is

also available through unpledged securities in the investment portfolio and

capacity to securitize loans, including single-family mortgage loans. The

Company’s credit ratings are important to its access to unsecured whole-

sale borrowings. Significant changes in these ratings could change the cost

and availability of these sources. The Company manages reliance on short

term unsecured borrowings as well as total wholesale funding through poli-

cies established and reviewed by ALCO.

The Company has a contingency funding plan that stresses the liquid-

ity needs that may arise from certain events such as agency rating down-

grades, rapid loan growth, or significant deposit runoff. The plan also

provides for continual monitoring of net borrowed funds dependence and

available sources of liquidity. Management believes the Company has the

funding capacity to meet the liquidity needs arising from potential events.

Liquidity for SunTrust Banks, Inc. – Parent Company only (“Parent

Company”) is measured comparing sources of liquidity in unpledged secu-

rities and short-term investments relative to its short-term debt. As of

December , , the Parent Company had . billion in such sources

compared to short-term debt of million. The Parent Company also

had . billion of availability remaining on its current shelf registration

statement for the issuance of debt at December , . The Georgia

Department of Banking and Finance limits dividends to % of prior year’s

net income, without its prior approval. SunTrust Bank has exceeded this lim-

itation since and has received the necessary approvals for dividends

beyond this amount. Additionally, banks are limited under Federal regula-

tions based on the prior two years’ net retained earnings plus the current

year’s net retained earnings. During , the Bank can pay . million,

plus the current year’s earnings without prior approval from the appropriate

regulatory agency.

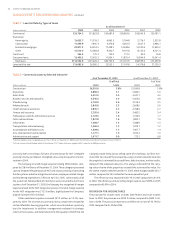

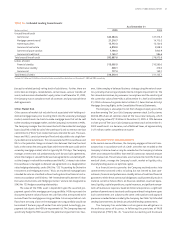

As detailed in Table , Unfunded Lending Commitments, the

Company had . billion in unused lines of credit at December ,

that were not recorded on the Company’s balance sheet. Commitments to

extend credit are arrangements to lend to a client who has complied with

predetermined contractual obligations. The Company also had . bil-

lion in letters of credit as of December , , most of which are standby

letters of credit that provide that SunTrust Bank fund if certain future events

occur. Of this, approximately . billion support variable-rate demand

obligations (“VRDOs”) remarketed by SunTrust and other agents. VRDOs

are municipal securities which are remarketed by the agent on a regu-

lar basis, usually weekly. In the event that the securities are unable to be

remarketed, SunTrust Bank would fund under the letters of credit.

Certain provisions of long-term debt agreements and the lines of

credit prevent the Company from creating liens on, disposing of, or issuing