SunTrust 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT 31

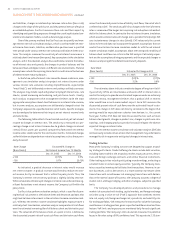

overall gross charge-offs. Recoveries and charge-offs for were favor-

ably affected primarily by improvements in the consumer segments of the

portfolio.

The ratio of the allowance to nonperforming loans increased to

.% as of December , from .% as of December , .

The improvement in this ratio was due to the decrease in nonperforming

loans.

In addition to the ALLL, the Company had . million and . mil-

lion in other liabilities as of December , and December , ,

respectively, that represents a reserve for certain unfunded commitments.

The Company’s charge-off policy meets or exceeds regulatory mini-

mums. Losses on unsecured consumer loans are recognized at days past

due compared to the regulatory loss criteria of days. Secured con-

sumer loans are typically charged-off between and days, depend-

ing on the collateral type, in compliance with Federal Financial Institutions

Examination Council’s guidelines. Commercial loans and real estate loans

are typically placed on nonaccrual when principal or interest is past due for

days or more unless the loan is both secured by collateral having realiz-

able value sufficient to discharge the debt in-full and the loan is in the legal

process of collection. Accordingly, secured loans may be charged-down to

the estimated value of the collateral with previously accrued unpaid inter-

est reversed. Subsequent charge-offs may be required as a result of changes

in the market value of collateral or other repayment prospects.

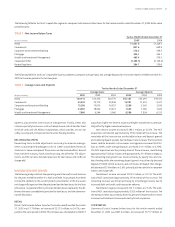

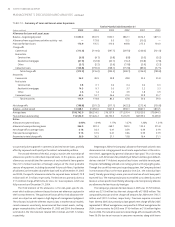

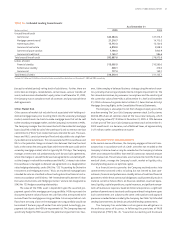

PROVISION FOR LOAN LOSSES

The provision for loan losses is the result of a detailed analysis estimating

an appropriate and adequate allowance for loan and lease losses (“ALLL”).

The analysis includes the evaluation of impaired loans as prescribed

under Statement of Financial Accounting Standards (“SFAS”) Nos.

“Accounting by Creditors for Impairment of a Loan” and “Accounting by

Creditors for Impairment of a Loan – Income Recognition and Disclosures,”

and pooled loans and leases as prescribed under SFAS No. , “Accounting

for Contingencies.” For the year ended December , , the provision

for loan losses was . million, an increase of . million, or .%,

compared to . The increase in provision expense was primarily due to

loan growth.

For the year ended December , total net charge-offs were

. million, a decrease of . million, or .%, from . For the year

ended December , , provision for loan losses was . million less

than net charge-offs. This was, in part, due to the . million charge-off

of a leverage lease for aircraft to Delta Air Lines, Inc., which had been fully

reserved in the ALLL as of December , . In addition, the Company

continued to experience improved credit quality across its loan portfolios,

sustained economic improvement within the Company’s footprint, and a

shift in the composition of the loan portfolio to include a higher percent-

age of loans secured by residential real estate, all of which had a downward

influence on the ALLL. However, significant growth in the commercial loan

portfolio in had an upward influence on the ALLL. For the year ended

December , , provision for loan losses was . million less than

net charge-offs. The net charge-offs for were primarily due to the

Company realizing losses within its commercial loan portfolio. However,

due to improved credit quality and other factors mentioned above that car-

ried into , the ALLL process did not indicate the need to maintain at the

same level or to increase the ALLL.

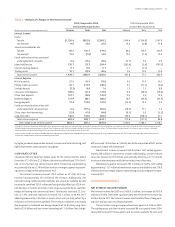

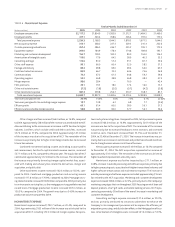

NONPERFORMING ASSETS

Nonperforming assets, which consist of nonaccrual loans, restructured

loans, other real estate owned (“OREO”) and other repossessed assets

totaled . million at December , , a decrease of . million,

or .%, from December , . The decrease was attributable to a

. million, or .%, decline in nonperforming loans and resulted in a

decline in the ratio of nonperforming assets to total loans plus OREO and

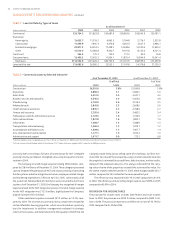

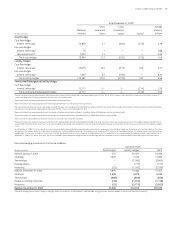

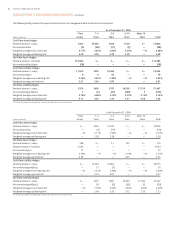

TABLE • Nonperforming Assets And Accruing Loans Past Due Days or More

As of December

(Dollars in millions)

Nonperforming Assets

Nonaccrual loans

Commercial . . . . . .

Real estate

Construction . . . . . .

Residential mortgages . . . . . .

Other . . . . . .

Consumer loans . . . . . .

Total nonaccrual loans . . . . . .

Restructured loans . . . — — —

Total nonperforming loans . . . . . .

Other real estate owned . . . . . .

Other repossessed assets . . . . . .

Total nonperforming assets . . . . . .

Ratios

Nonperforming loans to total loans .% .% .% .% .% .%

Nonperforming assets to total loans

plus OREO and other repossessed assets . . . . . .

Accruing Loans Past Due Days or More . . . . . .