SunTrust 2005 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

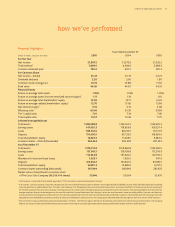

In 2005 our hard work paid off. Net income was $2.0 billion, or

$5.47 per share, up from $1.6 billion, or $5.19 per share, in 2004.

Once again, the men and women of SunTrust did a great job of serv-

ing the needs of our clients while running our business efficiently.

Once again, they translated the earnings potential of our Company

into strong year-over-year performance.

During 2005, we also built our underlying capacity to continue to

deliver strong results in a highly competitive industry. We did this by

“Seeing beyond money,” in a manner of speaking. We invested in our

franchise. We enhanced our product line. We developed our talent.

We sharpened our focus on expense control. And we placed additional

emphasis on identifying — and managing — the risks inherent in our

business. This is a priority for all financial services providers as we operate

in an uncertain economy and a demanding regulatory environment.

2005 was a year generally characterized by the continuation of

positive performance trends despite some challenging market conditions.

We saw steady growth in our biggest earnings component, net

interest income, which was driven almost entirely by solid loan and

deposit growth. At the same time, we generated strong fee-based

income that in turn contributed to a handsome gain in total revenues.

With revenues growing at a faster rate than expenses, we achieved

“positive operating leverage” for the year, a good indication of our

ability to keep expenses in line. Finally, credit trends were positive in

2005; indeed, they were among the strongest we’ve seen in some

time and set a positive tone in this critical area as 2006 began.

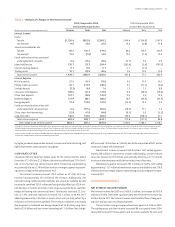

To place 2005 progress in context, shareholders may recall that

we engineered a significant and multi-dimensional transformation

at SunTrust in recent years. As we navigated through a succession of

industry challenges and market crosscurrents, we built our businesses,

expanded our franchise, refined our operating model, modernized

our infrastructure, and placed an increased emphasis on efficiency.

Most recently, and very visibly, we developed a world-class sales

and service organization committed to retaining clients and building

long-term relationships.

What it all adds up to is that we have established a solid foundation

for SunTrust’s future success. Of course our performance to some

degree will always reflect industry trends, national and regional

economic conditions, the ups and downs of the business cycle and

various market dynamics. That being said, we believe we are as well

positioned as ever to leverage the growth opportunities offered by

our demographically attractive geographic footprint —perhaps

the best footprint in U.S. banking —and demonstrated capabilities

in our key lines of business: Retail Banking, Commercial Banking,

Corporate and Investment Banking, Mortgage Banking, and Wealth

and Investment Management.

Looking ahead, our goal is to continue to deliver business-driven

earnings growth that compares favorably with that of our peers

over a multi-year timeframe. As we see it, this longer-term financial

orientation, balanced with our focus on near-term earnings progress,

positively differentiates SunTrust as an investment opportunity.

We are pleased to report that in February 2006 the Board of

Directors approved an increase of 11 percent in the annual dividend

on SunTrust common stock, another indication of how strong, steady

performance pays off.

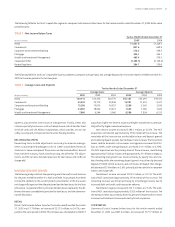

The Management’s Discussion and Analysis section of this report

provides a comprehensive review of our 2005 results. For purposes

of this letter, we invite your attention to some highlights of the

year—financial and non-financial—that not only illustrate SunTrust’s

current performance focus, but also help explain why we are opti-

mistic about our prospects as we look to 2006 and beyond.

SUNTRUST 2005 ANNUAL REPORT 13

to our shareholders

In the preceding pages of this annual report we have sought to convey how we’re bringing

to life SunTrust’s distinctive client promise —“Seeing beyond money.” From a shareholder

perspective, the idea of “Seeing beyond money” might at first blush seem incongruous.

After all, the point of investing in SunTrust is very much about money: at the end of the

day, shareholders are looking to us to deliver steady, sustainable earnings growth. All of

us at SunTrust are very conscious of that expectation. And we work hard to meet it.