SunTrust 2005 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 99

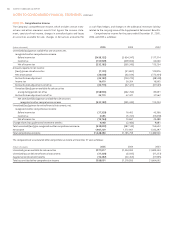

NOTE • Contingencies

On January , , the SEC issued a formal order of investigation

and the SEC Staff issued subpoenas seeking documents related to the

Company’s allowance for loan and lease losses and related matters. The

Company is cooperating, and intends to cooperate with the SEC regard-

ing this matter. In addition, the Company and its subsidiaries are parties to

numerous claims and lawsuits arising in the course of their normal busi-

ness activities, some of which involve claims for substantial amounts.

The Company’s experience has shown that the damages alleged by

plaintiffs or claimants are grossly overstated, often unsubstantiated by

legal theory, and bear no relation to the ultimate award that a court might

grant. In addition, valid legal defenses, such as statutes of limitations, fre-

quently result in judicial findings of no liability by the Company. Because

of these factors, we cannot provide a meaningful estimate of the range of

reasonably possible outcomes of claims in the aggregate or by individual

claim. However, it is the opinion of management that liabilities arising from

these claims in excess of the amounts currently accrued, if any, will not

have a material impact to the Company’s financial condition or results of

operations.

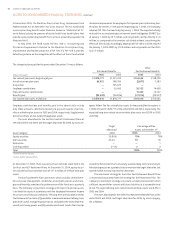

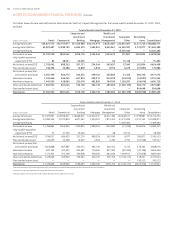

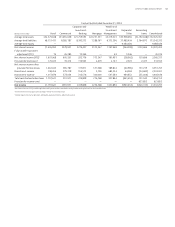

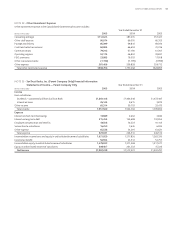

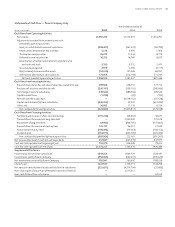

NOTE • Business Segment Reporting

The Company uses a line of business management structure to measure

business activities. The Company has five primary functional lines of busi-

ness: Retail, Commercial, Corporate and Investment Banking, Wealth and

Investment Management, and Mortgage.

The Retail line of business includes loans, deposits, and other fee-

based services for consumers and business clients with less than million

in sales (up to million in sales in larger metropolitan markets). Clients

are serviced through an extensive network of traditional and in-store

branches, ATMs, the Internet and the telephone.

The Commercial line of business provides enterprises with a full array

of financial products and services including traditional commercial lending,

treasury management, financial risk management, and corporate bankcard.

This line of business primarily serves business clients between million

and million in annual revenues and clients specializing in commercial

real estate activities.

Corporate and Investment Banking is comprised of the following busi-

nesses: corporate banking, investment banking, capital markets businesses,

commercial leasing, and merchant banking. The corporate banking strat-

egy is focused on companies with revenues in excess of million and is

organized along industry specialty and geographic lines.

Wealth and Investment Management provides a full array of wealth

management products and professional services to both individual and

institutional clients. Wealth and Investment Management’s primary seg-

ments include Private Wealth Management (brokerage and individual

wealth management) and Institutional Investment Management and

Administration.

The Mortgage line of business offers residential mortgage products

nationally through its retail, broker and correspondent channels. These

products are either sold in the secondary market primarily with servicing

rights retained or held as whole loans in the Company’s residential loan

portfolio. The line of business services loans for its own residential mortgage

portfolio as well as for others. Additionally, the line of business generates

revenue through its tax service subsidiary (ValuTree Real Estate Services,

LLC) and its captive reinsurance subsidiary (Cherokee Insurance Company).

In addition, the Company reports Corporate/Other which includes

the investment securities portfolio, long-term debt, capital, short-term

liquidity and funding activities, balance sheet risk management including

derivative hedging activities, office premises assets, provision for income

tax, and certain support activities not currently allocated to the aforemen-

tioned lines of business. Any internal management reporting transactions

not already eliminated in the results of the functional lines of business are

reflected in Reconciling Items.

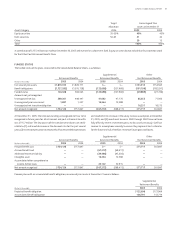

The Company continues to augment its internal management report-

ing system. Currently, the lines of business receive match maturity funds

transfer pricing to create net interest income, occupancy expense (inclusive

of the cost to carry the assets), a fully taxable-equivalent (“FTE”) gross-up

on tax exempt loans, and various support costs such as operational support

units, human resources and corporate finance.

Future enhancements to line of business segment profitability report-

ing are expected to include: the attribution of economic capital, expected

loss in lieu of net charge offs, effective tax rates, and the allocation of cer-

tain product-related expenses incurred within production support areas,

and overhead costs. The implementation of these enhancements to the

internal management reporting system is expected to materially affect

the net income disclosed for each segment with no impact on consolidated

amounts. Whenever significant changes to management reporting meth-

odologies take place, the impact of these changes is quantified and prior

period information is reclassified wherever practicable. The Company will

reflect these reclassified changes in the current period, and will provide

updated historical year-to-date, quarterly, and annual schedules.