SunTrust 2005 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT72

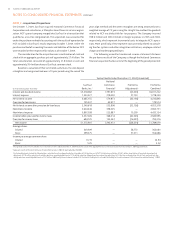

LOAN SALES AND SECURITIZATIONS

The Company sells and at times may securitize loans. When the Company

securitizes assets, it may retain a portion of the securities issued, including

senior interests and interest-only strips, all of which are considered retained

interests in the transferred assets. Retained interests in securitized assets,

including debt securities, are classified as either securities available for

sale or trading assets and are recorded at their allocated carrying amounts

based on the relative fair value of the assets sold and retained. Retained

interests are subsequently carried at fair value, which is based on quoted

market prices, quoted market prices for similar assets, or discounted cash

flow analyses. If market prices are not available, fair value is calculated

using management’s best estimates of key assumptions, including credit

losses, loan repayment speeds and discount rates commensurate with the

risks involved. Gains or losses on sales as well as future servicing fees are

recorded in noninterest income in the Consolidated Statements of Income.

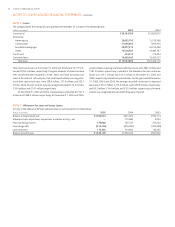

INCOME TAXES

The provision for income taxes is based on income and expense reported for

financial statement purposes after adjustment for permanent differences

such as tax-exempt income. Deferred income tax assets and liabilities result

from temporary differences between assets and liabilities measured differ-

ently for financial reporting purposes and for income tax return purposes.

These assets and liabilities are measured using the enacted tax rates and

laws that are currently in effect. A valuation allowance is recognized for a

deferred tax asset if, based on the weight of available evidence, it is more

likely than not that some portion or all of the deferred tax asset will not be

realized. Subsequent changes in the tax laws require adjustment to these

assets and liabilities with the cumulative effect included in income from

continuing operations for the period in which the change was enacted. In

computing the income tax provision, the Company evaluates the techni-

cal merits and risks of its income tax positions based on current legislative,

judicial, and regulatory guidance.

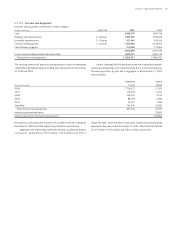

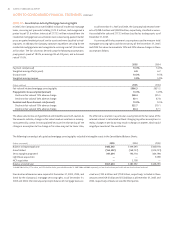

EARNINGS PER SHARE

Basic earnings per share are based on the weighted-average number of

common shares outstanding during each period. Diluted earnings per share

are based on the weighted-average number of common shares outstand-

ing during each period, plus common share equivalents calculated for stock

options and performance restricted stock outstanding using the treasury

stock method.

CASH FLOWS

For purposes of reporting cash flows, cash and cash equivalents include only

cash and due from banks, interest-bearing deposits in other banks, federal

funds sold and securities purchased under agreements to resell with an

original maturity of three months or less.

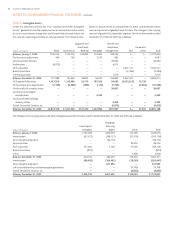

DERIVATIVE FINANCIAL INSTRUMENTS

It is the policy of the Company to record all derivative financial instruments

at fair value in the financial statements. The Company uses derivative instru-

ments to hedge interest rate exposure by modifying the characteristics of

the related balance sheet instruments. Derivatives that do not qualify as

hedges, and those transactions for which the Company has elected not to

apply hedge accounting, are carried at their current market value on the

balance sheet and changes in their fair value are recorded as trading income

in the current period.

Under the provisions of SFAS No. , “Accounting for Derivative

Instruments and Hedging Activities,” and SFAS No. , “Amendment of

Statement on Derivative Instruments and Hedging Activities,” on the

date that a derivative contract is entered into, the Company prepares writ-

ten hedge documentation, identifying the risk management objective, and

designating the derivative as () a hedge of the fair value of a recognized

asset or liability or of an unrecognized firm commitment (fair value hedge);

() a hedge of a forecasted transaction or of the variability of cash flows

to be received or paid related to a recognized asset or liability (cash flow

hedge); () a foreign currency fair value or cash flow hedge (foreign currency

hedge); or () held for trading (trading instruments). All transactions desig-

nated as accounting hedges must first be deemed effective under SFAS No.

by using the shortcut method as defined, or by performing a statisti-

cal regression analysis that indicates a high correlation between the actual

derivative and a “perfect” hypothetical derivative that has terms identical

to the critical terms of the hedged item. Additionally, transactions which do

not qualify for the shortcut method of hedge accounting are reviewed quar-

terly for ongoing effectiveness. Transactions which are not deemed effec-

tive are removed from hedge accounting classification.

Changes in the fair value of a derivative that is highly effective and

that has been designated and qualifies as a fair value hedge, along with

the loss or gain on the hedged asset or liability that is attributable to the

hedged risk (including losses or gains on firm commitments), are recorded

in current period earnings. Changes in the fair value of a derivative that is

highly effective and that is designated and qualifies as a cash flow hedge

are recorded in other comprehensive income, with any ineffective portion

recorded in current period earnings. Cash flow hedges of forecasted trans-

actions, which are no longer deemed likely to occur, are reclassified out of

other comprehensive income and into current period interest income or

expense related to the originally hedged item. Changes in the fair value of

derivative trading instruments are reported in current period earnings. For

additional information on the Company’s derivative activities, refer to Note

, Derivatives and Off-Balance Sheet Arrangements, to the Consolidated

Financial Statements.

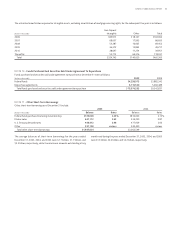

STOCKBASED COMPENSATION

The Company sponsors stock option plans under which incentive and non-

qualified stock options may be granted periodically to certain employees.

The Company’s stock options typically have an exercise price equal to the

fair value of the stock on the date of the grant and typically vest over three

years. The Company accounted for all awards granted after January ,

under the fair value recognition provisions of SFAS No. , “Accounting

for Stock-Based Compensation.” The required disclosures related to the

Company’s stock-based employee compensation plan are included in Note

, Employee Benefit Plans, to the Consolidated Financial Statements.

Effective January , , the Company adopted SFAS No. (Revised),

“Share Based Payment,” using the modified prospective application method.

The modified prospective application method applies to new awards, to any

outstanding liability awards, and to awards modified, repurchased, or can-

celled after January , . For all awards granted prior to January , ,

compensation cost has been recognized on the portion of awards for which

service has been rendered. Additionally, rather than recognizing forfeitures

as they occur, the Company will estimate the number of awards for which it

is probable that service will be rendered and will adjust compensation cost

accordingly. Estimated forfeitures will be subsequently adjusted to reflect

actual forfeitures.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued