SunTrust 2005 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

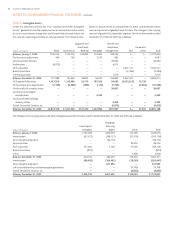

SUNTRUST ANNUAL REPORT 85

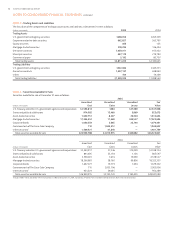

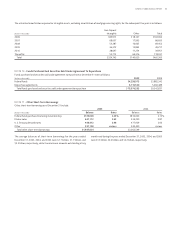

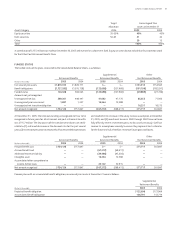

(Dollars in thousands)

Deferred tax assets

Allowance for loan and lease losses , ,

Accrued expenses , ,

Other , ,

Gross deferred tax assets , ,

Deferred tax liabilities

Net unrealized gains in accumulated other comprehensive income , ,

Leasing , ,

Employee benefits , ,

Mortgage , ,

Securities , ,

Intangible assets , ,

Fixed assets , ,

Loans , ,

Other , ,

Gross deferred tax liabilities ,, ,,

Net deferred tax liability ,, ,,

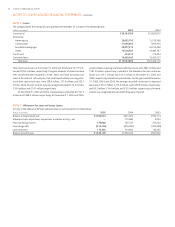

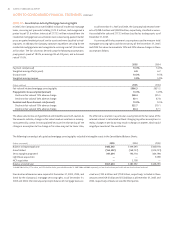

NOTE • Income Taxes

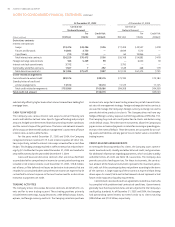

The components of income tax expense included in the Consolidated Statements of Income were as follows:

Year Ended December

(Dollars in thousands)

Current income tax expense

Federal , , ,

State , , ,

Total , , ,

Deferred income tax expense

Federal , , ,

State , , ,

Total , , ,

Total income tax expense , , ,

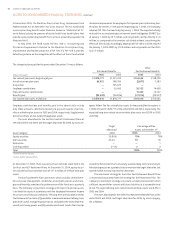

The Company’s income from international operations, before provision

for income taxes, was not significant. Additionally, the tax effect of unreal-

ized gains and losses on securities available for sale, unrealized gains and

losses on certain derivative financial instruments, and other comprehensive

income related to certain retirement plans were recorded in other com-

prehensive income and had no effect on income tax expense (see Note ,

Comprehensive Income, to the Consolidated Financial Statements).

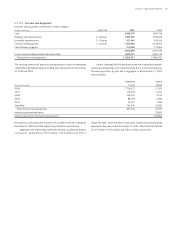

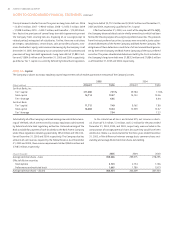

A reconciliation of the expected income tax expense at the statutory

federal income tax rate of % to the Company’s actual income tax expense

and effective tax rate for the past three years is as follows:

Deferred income tax liabilities and assets result from temporary differences

between assets and liabilities measured for financial reporting purposes and

for income tax return purposes. These assets and liabilities are measured

using the enacted tax rates and laws that are currently in effect. The signifi-

cant components of the net deferred tax liability at December were as

follows:

Percent of Percent of Percent of

Pre-Tax Pre-Tax Pre-Tax

(Dollars in thousands) Amount Income Amount Income Amount Income

Income tax expense at federal statutory rate ,, .% , .% , .%

Increase (decrease) resulting from:

Tax-exempt interest (,) (.%) (,) (.%) (,) (.%)

Income tax credits, net (,) (.%) (,) (.%) (,) (.%)

State income taxes, net of federal benefit , .% , .% , .%

Dividends on subsidiary preferred stock (,) (.%) (,) (.%) (,) (.%)

Other (,) (.%) (,) (.%) (,) (.%)

Total income tax expense and rate , .% , .% , .%