SunTrust 2005 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT74

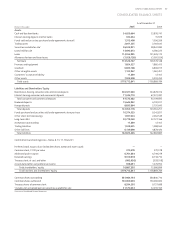

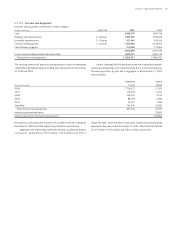

Twelve Months Ended December , (Unaudited)

National

SunTrust Commerce Pro Forma Pro Forma

(In thousands except per share data) Banks, Inc. Financial Adjustments Combined

Interest and dividend income ,, , (,) ,,

Interest expense ,, , , ,,

Net interest income ,, , (,) ,,

Provision for loan losses , , — ,

Net interest income after provision for loan losses ,, , (,) ,,

Noninterest income ,, , — ,,

Noninterest expense ,, , , ,,

Income before provision for income taxes ,, , (,) ,,

Provision for income taxes , , (,) ,

Net income ,, , (,) ,,

Average shares:

Diluted , — , ,

Basic , — , ,

Income per average common share:

Diluted . — — .

Basic . — — .

The reported results of SunTrust Banks, Inc. for the twelve months ended December , include the results of the acquired National Commerce Financial from the October , acquisition date.

Represents results of National Commerce Financial from January , through September , .

Pro forma adjustments include the following items: amortization of core deposit and other intangibles of . million, net of NCF’s historical amortization of . million, amortization of loan purchase accounting

adjustment of . million, accretion of securities purchase accounting adjustment of . million, accretion of deposit purchase accounting adjustment of . million, and acccretion of short-term and long-term bor-

rowings purchase accounting adjustments of . million. Additionally, interest expense includes . million for funding costs as though the funding for the cash component of the transaction occurred January , .

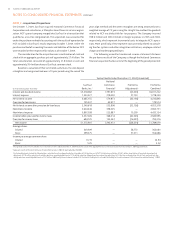

NOTE • Acquisitions/Dispositions

On October , , SunTrust acquired National Commerce Financial

Corporation and subsidiaries, a Memphis-based financial services organi-

zation. NCF’s parent company merged into SunTrust in a transaction that

qualified as a tax-free reorganization. The acquisition was accounted for

under the purchase method of accounting with the results of operations for

NCF included in SunTrust’s results beginning October , . Under the

purchase method of accounting the assets and liabilities of the former NCF

were recorded at their respective fair values as of October , .

The consideration for the acquisition was a combination of cash and

stock with an aggregate purchase price of approximately . billion. The

total consideration consisted of approximately . billion in cash and

approximately . million shares of SunTrust common stock.

Based on a valuation of their estimated useful lives, the core deposit

intangibles are being amortized over a year period using the sum of the

years digit method and the other intangibles are being amortized over a

weighted average of . years using the straight line method. No goodwill

related to NCF was deductible for tax purposes. The Company incurred

. million and . million in merger expenses in and ,

respectively, which represent incremental costs to integrate NCF’s opera-

tions. More specifically, these represent costs primarily related to consult-

ing fees for systems and other integration intitiatives, employee-related

charges and marketing expenditures.

The following unaudited condensed income statement discloses

the pro forma results of the Company as though the National Commerce

Financial acquisition had occurred at the beginning of the period presented:

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued