SunTrust 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 SUNTRUST 2005 ANNUAL REPORT

Business Highlights

We further institutionalized our Company-wide sales culture.

Today, the key components of a world-class sales organization are

very much in place at SunTrust. This includes frequent sales meet-

ings in all geographic banking regions and all business lines with spe-

cific sales and referral goals, tracking and measurement mecha-

nisms, and most importantly, incentives that align employee, client,

and shareholder interests. Our sales people increasingly take a “360

degree view” of each client’s needs and look across business lines to

deliver the full range of SunTrust products and services. A visible

result of this focus is significantly higher levels of referrals and cross-

sales. One example of this: an emphasis on cross-selling home equity,

deposit and other consumer products to mortgage clients resulted in

over 100,000 of these products being sold to those clients, a

substantial increase over 2004.

We are seeing the benefits of our merger with the former

National Commerce Financial Corporation (“NCF”) in significant

new business opportunities as well as operating efficiencies that

exceeded our initial projections by almost a third. The merger was

legally completed in late 2004 with the highly visible conversion

of customer accounts and launch of the SunTrust brand into former

NCF markets taking place in April 2005. By any standard, the con-

version was smooth and successful, providing the latest example of

SunTrust’s skill at merger integration.

To increase our market reach, we announced plans to expand

into the demographically attractive Charleston, South Carolina area,

where over the next three years we’ll open 16 traditional and in-

store branches to complement our presence in other parts of the

state.

In early 2006, we signed a new strategic banking agreement with

Wal-Mart that provides for enhancement of our partnership over the

next three years. We also announced plans to acquire 11 in-store

branches in Florida Wal-Mart Supercenter stores in a move that

bolsters the highly successful partnership we have with Wal-Mart

throughout our footprint.

We accelerated implementation of performance initiatives

within our five key lines of business. Some examples include:

•In Retail Banking, in addition to enhancing our branch presence,

we upgraded our online banking capabilities for small business

clients, streamlined our deposit products, and improved turn-

around times for home equity loans through a combination of

technology and process improvements while lowering the cost

per closed loan.

•In Commercial Banking, expanded use of sales management

technology plus an increased emphasis on cross-sales resulted in

solid growth in the Commercial and Industrial, and Real Estate

loan portfolios and points to the success of our relationship

management approach. Targeted investments in Treasury

Management technology and commercial card products, coupled

with a sales strategy focused on a wider range of payment solu-

tions, resulted in increased sales volumes while also enhancing our

competitive position in this high-potential core business segment.

•In Corporate and Investment Banking, we stepped-up cross-sell-

ing of capital markets products to the Corporate, Commercial,

and Wealth and Investment Management client bases and

enhanced our capital markets capabilities by investing in both

new and existing products.

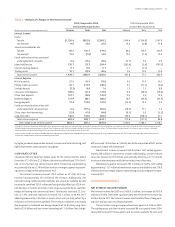

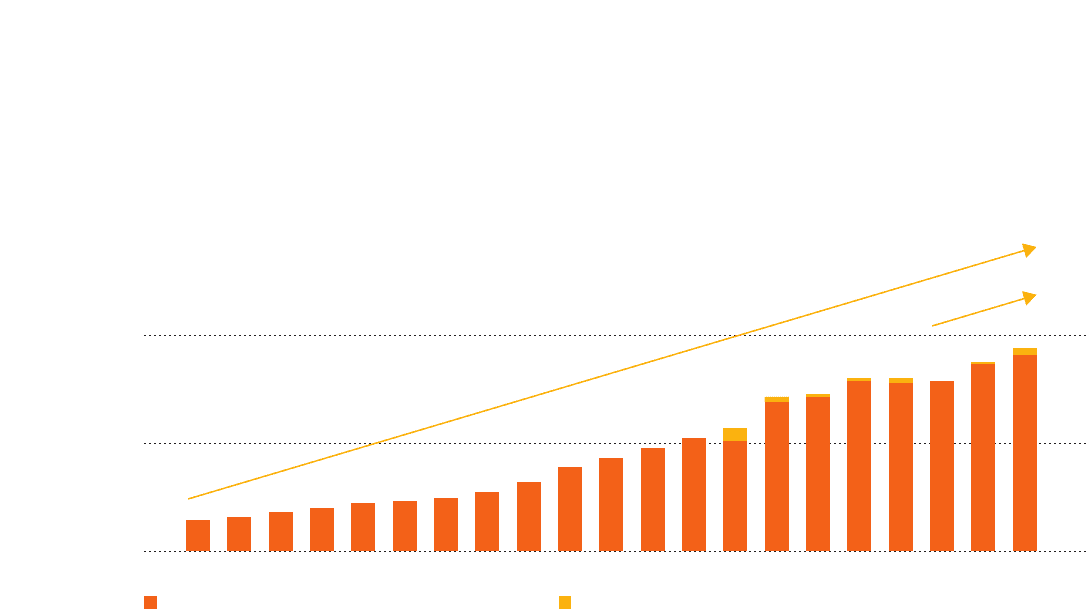

85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05

$0.00

$3.00

$6.00

10.0% CAGR

9.2% CAGR

0.84

0.93

1.09

1.19

1.31

1.38

1.45

1.64

1.89

2.32

2.56

2.87

3.13

3.04 0.37

4.30

4.72 0.07

4.66 0.14

4.73

5.19 0.06

5.47 0.17

0.09

4.13 0.10

EPS per Generally Accepted Accounting Principles (GAAP) Reduction in EPS due to merger expense

BOTTOM LINE MOMENTUM

The rate of growth in SunTrust’s earnings per share (“EPS”)1in recent years compares favorably with the long-term historical trend in the EPS

compound annual growth rate (“CAGR”)2. This is a good indication of solid momentum in bottom line earnings over time.

1EPS as originally reported and adjusted for stock splits.

2CAGR based on GAAP EPS excluding merger expense.