SunTrust 2005 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT82

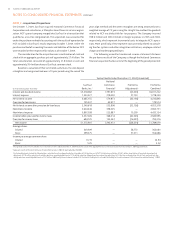

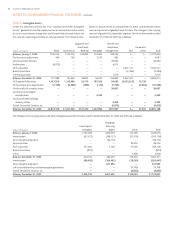

The following is an analysis of capitalized mortgage servicing rights included in intangible assets in the Consolidated Balance Sheets:

(Dollars in thousands)

Balance at beginning of year , , ,

Amortization (,) (,) (,)

Servicing rights originated , , ,

Lighthouse acquisition — — ,

NCF acquisition — , —

Balance at end of year , , ,

Included . million, . million, and . million for the years ended December , , , and , respectively, on loans that have been paid-in-full and loans that have been foreclosed.

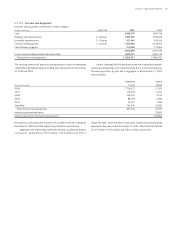

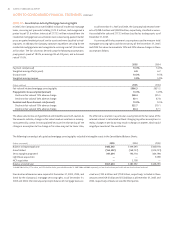

The above sensitivities are hypothetical and should be used with caution. As

the amounts indicate, changes in fair value based on variations in assump-

tions generally cannot be extrapolated because the relationship of the

change in assumption to the change in fair value may not be linear. Also,

the effect of a variation in a particular assumption on the fair value of the

retained interest is calculated without changing any other assumption. In

reality, changes in one factor may result in changes in another, which could

magnify or counteract the sensitivities.

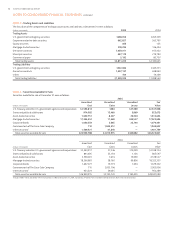

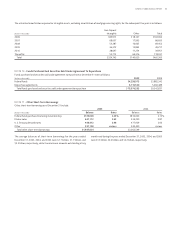

Payment rate (annual) .% .%

Weighted-average life (in years) . .

Discount rate .% .%

Weighted-average coupon .% .%

(Dollars in millions)

Fair value of retained mortgage servicing rights . .

Prepayment rate assumption (annual) .% .%

Decline in fair value of % adverse change . .

Decline in fair value of % adverse change . .

Residual cash flows discount rate (annual) .% .%

Decline in fair value of % adverse change . .

Decline in fair value of % adverse change . .

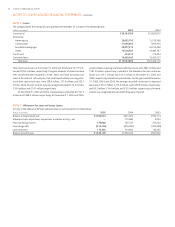

NOTE • Securitization Activity/Mortgage Servicing Rights

In , the Company securitized . million of residential mortgage

loans, receiving net proceeds totaling . million, and recognized a

pretax loss of . million. Interests of . million retained from the

residential mortgage loan securitization were valued using quoted market

prices or quoted market prices of similar assets and were classified as trad-

ing assets. In addition, the Company continues to perform servicing for the

residential mortgage loans and recognized a servicing asset of . million

at fair value. The fair value was derived using the following assumptions:

prepayment speed of .%, an average life of . years, and a discount

rate of .%.

As of December , and , the Company had retained inter-

ests of . million and . million, respectively, classified as securi-

ties available for sale and . million classified as trading assets as of

December , .

A summary of the key economic assumptions used to measure total

mortgage servicing rights and the sensitivity of the December ,

and fair values to immediate % and % adverse changes in those

assumptions follows.

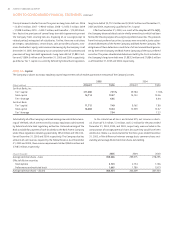

No valuation allowances were required at December , , , and

for the Company’s mortgage servicing rights. As of December ,

and , the total unpaid principle balance of mortgage loans ser-

viced was . billion and . billion, respectively. Included in these

amounts were . billion and . billion as of December , and

, respectively, of loans serviced for third parties.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued