SunTrust 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT50

The following table of quarterly line of business results for and was updated to reflect the management reporting methodologies in effect at

December , .

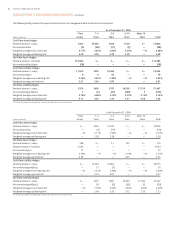

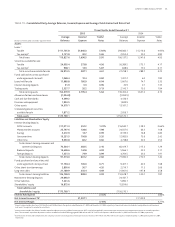

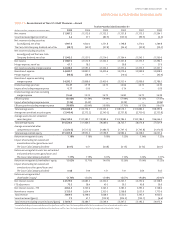

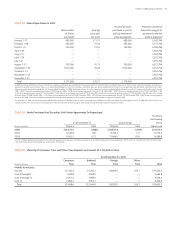

TABLE • Quarterly Line of Business Results

Retail

Three Months Ended

(Dollars in millions) Dec. Sept. June Mar. Dec. Sept. June Mar.

Average total assets ,. ,. ,. ,. ,. ,. ,. ,.

Average total liabilities ,. ,. ,. ,. ,. ,. ,. ,.

Net interest income . . . . . . . .

Fully taxable-equivalent

adjustment (FTE) — — — — — — — —

Net interest income (FTE) . . . . . . . .

Provision for loan losses . . . . . . . .

Net interest income after

provision for loan losses . . . . . . . .

Noninterest income . . . . . . . .

Noninterest expense . . . . . . . .

Total contribution before taxes . . . . . . . .

Provision for income taxes — — — — — — — —

Net income . . . . . . . .

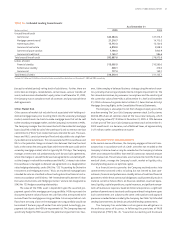

Commercial

Three Months Ended

(Dollars in millions) Dec. Sept. June Mar. Dec. Sept. June Mar.

Average total assets ,. ,. ,. ,. ,. ,. ,. ,.

Average total liabilities ,. ,. ,. ,. ,. ,. ,. ,.

Net interest income . . . . . . . .

Fully taxable-equivalent

adjustment (FTE) . . . . . . . .

Net interest income (FTE) . . . . . . . .

Provision for loan losses . . . (.) . . . .

Net interest income after

provision for loan losses . . . . . . . .

Noninterest income . . . . . . . .

Noninterest expense . . . . . . . .

Total contribution before taxes . . . . . . . .

Provision for income taxes — — — — — — — —

Net income . . . . . . . .

Net interest income is fully taxable equivalent and is presented on a matched maturity funds transfer price basis for the line of business.

Provision for loan losses represents net charge-offs for the lines of business.

MANAGEMENT’S DISCUSSION AND ANALYSIS continued

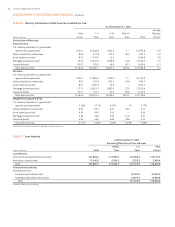

have more variability in the annual pension cost, as the asset values will be

more volatile than companies who elected to “smooth” their investment

experience.

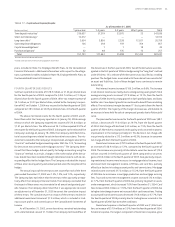

Other Actuarial Assumptions

To estimate the projected benefit obligation, actuarial assumptions are

required about factors such as mortality rate, turnover rate, retirement

rate, disability rate and the rate of compensation increases. These factors

don’t tend to change significantly over time, so the range of assumptions,

and their impact on pension cost, is generally limited. SunTrust periodi-

cally reviews the assumptions used based on historical and expected future

experience. The assumptions as of December , reflect relatively

minor changes to the turnover and retirement assumptions. The mortality

assumption was updated from Group Annuity Mortality to RP .

Additionally, the rate of compensation increase was increased from .% to

.%, based on recent experience and expectations of future inflation and

merit increases.

RECENTLY ISSUED AND PENDING ACCOUNTING

PRONOUNCEMENTS

Recently issued and pending accounting pronouncements are discussed

in Note , Accounting Policies, to the Consolidated Financial Statements

beginning on page .