SunTrust 2005 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUNTRUST ANNUAL REPORT90

In December , the Medicare Prescription Drug, Improvement and

Modernization Act of (the “Act”) was enacted. The Act established

a prescription drug benefit under Medicare, known as “Medicare Part D,”

and a federal subsidy to sponsors of retiree health care benefit plans that

provide a prescription drug benefit that is at least actuarially equivalent to

Medicare Part D.

In May , the FASB issued FSP No. -, “Accounting and

Disclosure Requirements Related to the Medicare Prescription Drug,

Improvement and Modernization Act (“FSP -”). FSP - provides

definitive guidance on the recognition of the effects of the Act and related

disclosure requirements for employers that sponsor prescription drug ben-

efit plans for retirees. In the quarter beginning July , , the Company

adopted FSP - retroactively to January , . The expected subsidy

reduced the accumulated post retirement benefit obligation (“APBO”) as

of January , by . million, and net periodic cost for by .

million, as compared to the amount calculated without considering the

effects of the subsidy. Accordingly, adoption of FSP - in reduced

the January , APBO by . million, and net periodic cost for

by . million.

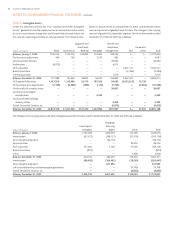

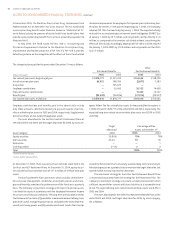

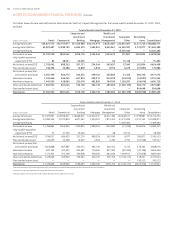

Target Percentage of Plan

Allocation Assets at December

Asset Category

Equity securities –% % %

Debt securities –

Real estate — —

Cash equivalents –%

Total % %

SunTrust Retirement Plan only.

SunTrust and NCF Retirement Plans.

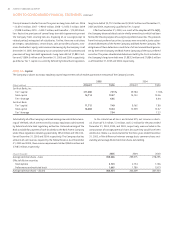

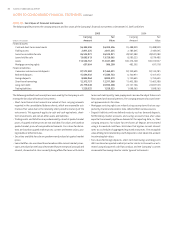

Employer contributions and benefits paid in the above table include

only those amounts contributed directly to pay participants’ plan ben-

efits or added to plan assets in and , respectively. Supplemental

Retirement Plans are not funded through plan assets.

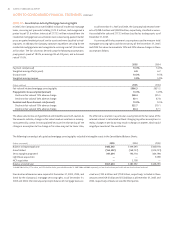

The asset allocation for the SunTrust and NCF Retirement Plans at

the end of and , and the target allocation for , by asset cat-

egory, follow. The fair value of plan assets (in thousands) for these plans is

,, and ,, at the end of and , respectively. The

expected long-term rate of return on these plan assets was .% in

and .

At December , , there was no SunTrust common stock held in the

SunTrust and NCF Retirement Plans. At December , , equity securi-

ties include SunTrust common stock of . million, or .% of total plan

assets.

The SunTrust Benefit Plan Committee, which includes several mem-

bers of senior management, establishes investment policies and strate-

gies and formally monitors the performance of the funds on a quarterly

basis. The Company’s investment strategy with respect to pension assets

is to invest the assets in accordance with the Employee Retirement Income

Security Act and fiduciary standards. The long-term primary objectives for

the Retirement Plan are to () provide for a reasonable amount of long-term

growth of capital, manage exposure to risk; and protect the assets from ero-

sion of purchasing power, and () provide investment results that meet or

exceed the Retirement Plan’s actuarially assumed long-term rate of return.

Rebalancing occurs on a periodic basis to maintain the target allocation, but

normal market activity may result in deviations.

The investment strategy for the Other Post Retirement Benefit Plans

is maintained separately from the strategy for the Retirement Plan. The

Company’s investment strategy is to create a stream of investment return

sufficient to provide for current and future liabilities at a reasonable level

of risk. The expected long-term rate of return on these assets was .% in

and .

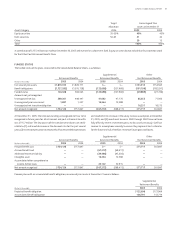

The asset allocation for the Other Post Retirement Benefit Plans at the

end of and , and target allocation for , by asset category,

are as follows:

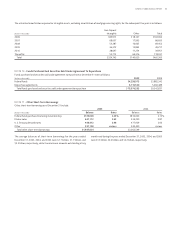

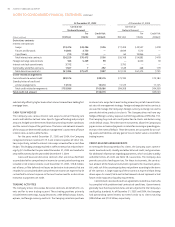

The change in plan assets for the years ended December was as follows:

Other

Retirement Benefits Post Retirement Benefits

(Dollars in thousands)

Fair value of plan assets, beginning of year ,, ,, , ,

Actual return on plan assets , , (,) ,

Acquisition — , — —

Employer contributions — , , ,

Plan participants’ contributions — — , ,

Benefits paid (,) (,) (,) (,)

Fair value of plan assets, end of year ,, ,, , ,

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS continued