SunTrust 2005 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 73

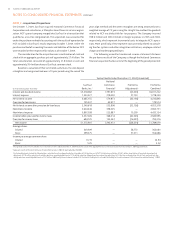

ACCOUNTING POLICIES ADOPTED

In December , the American Institute of Certified Public Accountants

(“AICPA”) issued Statement of Position (“SOP”) -, “Accounting for Loans

or Certain Debt Securities Acquired in a Transfer.” This SOP requires acquired

impaired loans for which it is probable that the investor will be unable to

collect all contractually required payments receivable to be recorded at the

present value of amounts expected to be received. The SOP also prohibits

the carrying over or creation of valuation allowances in the initial account-

ing for these loans. The SOP was effective for loans acquired in fiscal years

beginning after December , . The adoption of this SOP did not mate-

rially impact the Company’s financial position or results of operations.

In December , the FASB issued SFAS No. (Revised), “Share-

Based Payment.” This Statement replaces SFAS No. , “Accounting for

Stock-Based Compensation,” and supersedes Accounting Practice Bulletin

(“APB”) Opinion No. , “Accounting for Stock Issued to Employees”. SFAS

No. (R) clarifies and expands SFAS No. ’s guidance in several areas,

including measuring fair value, classifying an award as equity or as a liability,

accounting for non-substantive vesting provisions, and attributing compen-

sation cost to reporting periods. Under the provisions of SFAS No. (R),

the alternative to use APB Opinion No. ’s intrinsic value method of

accounting that was provided in SFAS No. , as originally issued, is elimi-

nated, and entities are required to measure liabilities incurred to employees

in share-based payment transactions at fair value. Effective January , ,

the Company adopted the fair value recognition provision of SFAS No. ,

prospectively, and began expensing the cost of stock options. The Company

has quantified the effect on net income and earnings per share if the fair

value based method had been applied on a retrospective basis in Note to

the Consolidated Financial Statements.

In March , the Securities and Exchange Commission (“SEC”)

released Staff Accounting Bulletin No. (“SAB No. ”), which

addresses the application of SFAS No. (R). The Company adopted

SFAS No. (R) effective January , using the modified prospective

application method. The adoption did not have a material impact on the

Company’s financial position or results of operations.

In May , the FASB issued SFAS No. , “Accounting Changes

and Error Corrections — a replacement of APB Opinion No. and FASB

Statement No. .” SFAS No. applies to and changes the requirements

for reporting and accounting for a change in accounting principle. This

statement requires retrospective application to prior periods’ financial

statements with changes in accounting principle, unless it is impracticable

to determine either the period-specific effects or the cumulative effect of

the change. The provisions of Opinion No. , “Accounting Changes,” that

relate to reporting the correction of an error in previously issued financial

statements and a change in accounting estimate are carried forward in

SFAS No. without change. SFAS No. also carries forward the pro-

visions of SFAS No. , “Reporting Accounting Changes in Interim Financial

Statements an amendment of APB Opinion No. ,” that govern the report-

ing of accounting changes in interim financial statements. SFAS No.

is effective for accounting changes and corrections of errors made in fiscal

years beginning after December , . The Company adopted the provi-

sions of SFAS No. on January , . The adoption of this Statement

did not impact the Company’s financial position or results of operations.

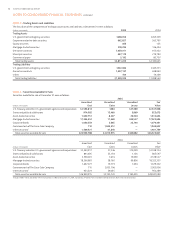

RECENTLY ISSUED AND PENDING ACCOUNTING

PRONOUNCEMENTS

In July , the FASB issued a proposed FASB Staff Position (“FSP”) No. -

a, “Accounting for a Change or Projected Change in the Timing of Cash Flows

Relating to Income Taxes Generated by a Leveraged Lease Transaction.” FSP

-a indicates that a change in the timing of the realization of tax bene-

fits on a leveraged lease will require recalculation of that lease. In January

, the FASB reached a tentative decision that an entity would not have

to reclassify a lease from leveraged lease accounting if, as a result of the

most recent recalculation, the lease no longer qualifies as a leveraged lease.

SunTrust is currently in the process of evaluating the impact that this pro-

posed guidance, if finalized, would have on the Company’s financial position

and results of operations. The FASB expects to issue the final FSP in the first

quarter of .

In July , the FASB issued an exposure draft of a Proposed

Interpretation, “Accounting for Uncertain Tax Positions.” This exposure draft

clarifies guidance on the recognition and measurement of uncertain tax

positions and, if issued, may result in companies revising their threshold for

recognizing tax benefits that have some degree of uncertainty. The expo-

sure draft also addresses the accrual of any interest and penalties related to

tax uncertainties. The FASB expects to issue the Final Interpretation, which

would include amendments to SFAS No. , “Accounting for Income

Taxes,” in the first quarter of . SunTrust is currently in the process of

evaluating the impact that this exposure draft, if finalized, would have on

the Company’s financial position or results of operations.

In December , the FASB issued FSP No. SOP --, “Terms of

Loan Products That May Give Rise to a Concentration of Credit Risk.” FSP

No. SOP -- requires additional disclosures for certain loan products

that expose entities to higher risks than traditional loan products. The FSP

requires the Company to disclose additional information such as significant

concentrations of credit risks resulting from these products, quantitative

information about the market risks of financial instruments that is consis-

tent with the way the Company manages or adjusts those risks, concen-

trations in revenue from particular products if certain conditions are met,

and the factors that influenced management’s judgment as it relates to the

accounting policy for credit losses and doubtful accounts. This FSP is effec-

tive for the reporting period ended December , . The required disclo-

sures related to the Company’s loan products that are within the scope of

this FSP are included in Note to the Consolidated Financial Statements.