SunTrust 2005 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

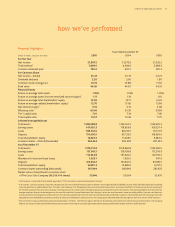

SUNTRUST ANNUAL REPORT 21

opment, procurement, and executive management. Finally, Other also

includes specialty businesses such as Transplatinum, which handles Fleet

One fuel cards and USI Alliance Corporation, which provides services for

safety, security and crime prevention to senior housing facilities.

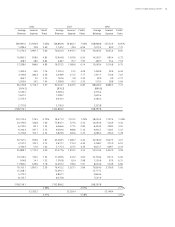

RECONCILING ITEMS

Reconciling items include adjustments necessary to reconcile manage-

ment accounting methodologies with US GAAP consolidated financial

statements. Some examples of these items are the residual offsets derived

from matched-maturity funds transfer pricing, the offset for FTE adjust-

ments, and the variance between provision for loan losses and LOBs net

charge-offs.

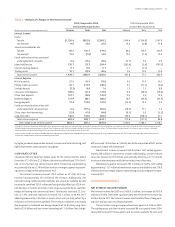

BUSINESS SEGMENT RESULTS

The following analysis details the operating results for each line of business

for the years ended December , and . Prior periods have been

restated to conform to the current period’s presentation. In the discussion

net charge-offs represent the allocated provision for loan losses for the lines

of business. Corporate/Other’s provision for loan losses represents the dif-

ference between consolidated provision for loan losses and the aforemen-

tioned allocations.

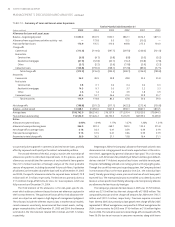

RETAIL

Retail’s total income before taxes for the twelve months ended December

, was . billion, an increase of . million, or .%, com-

pared to the same period in . This increase was attributable to the NCF

acquisition, higher net interest income and higher noninterest income par-

tially offset by higher noninterest expense.

Net interest income increased . million, or .%. The NCF

acquisition contributed approximately million of the increase. The

remainder of the increase was attributable to loan and deposit growth

and widening deposit spreads due to deposit rate increases that have been

slower relative to market rate increases. Average loans increased . bil-

lion, or .%, while average deposits increased . billion, or .%.

The NCF acquisition was the primary driver of these increases, contributing

approximately billion in loans and approximately billion in deposits.

The remaining loan growth was driven primarily by equity lines and stu-

dent lending while the remaining deposit growth was driven by demand

deposits (“DDA”), NOW accounts, and certificates of deposit. Net charge-

offs decreased . million, or .%, primarily due to a decline in consumer

indirect net charge-offs.

Noninterest income increased . million, or .%. The addi-

tion of NCF contributed approximately million of this increase. The

remaining increase was driven primarily by interchange income due to

increased debit and credit card transaction volumes.

Noninterest expense increased . million, or .%. The addi-

tion of NCF contributed approximately million of the increase. The

remaining increase was primarily driven by personnel expense due to merit

increases and headcount increases driven by branch expansion.

COMMERCIAL

Commercial’s total income before taxes for the twelve months ended

December , was . million, an increase of . million, or

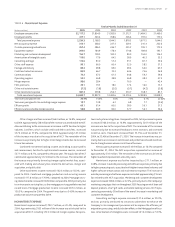

The following table for SunTrust’s reportable segments compares total income before taxes for the twelve months ended December , to the same

period last year:

TABLE • Net Income Before Taxes

Twelve Months Ended December

(Dollars in millions)

Retail ,. ,.

Commercial . .

Corporate and Investment Banking . .

Mortgage . .

Wealth and Investment Management . .

Corporate/Other (,.) (,.)

Reconciling Items . .

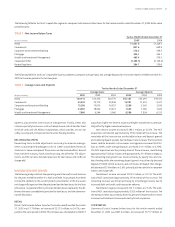

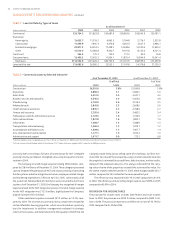

The following table for SunTrust’s reportable business segments compares average loans and average deposits for the twelve months ended December ,

to the same period in the last two years:

TABLE • Average Loans and Deposits

Twelve Months Ended December

Average loans Average deposits

(Dollars in millions)

Retail , , , , , ,

Commercial , , , , , ,

Corporate and Investment Banking , , , , , ,

Mortgage , , , , , ,

Wealth and Investment Management , , , , , ,