SunTrust 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 SunTrust annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.SUNTRUST ANNUAL REPORT 49

management’s analysis of complex internal and external variables, and it

requires that management exercise judgment to estimate an appropriate

ALLL. As a result of the uncertainty associated with this subjectivity, the

Company cannot assure the precision of the amount reserved, should it

experience sizeable loan or lease losses in any particular period. For exam-

ple, changes in the financial condition of individual borrowers, economic

conditions, historical loss experience, or the condition of various markets

in which collateral may be sold could require the Company to significantly

decrease or increase the level of the ALLL and the associated provision for

loan losses. Such an adjustment could materially affect net income. For

additional discussion of the allowance for loan and lease losses see page

– Provision for Loan Losses and pages through – Allowance for Loan

and Lease Losses.

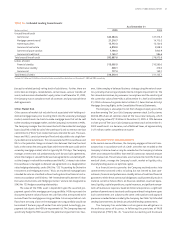

ESTIMATES OF FAIR VALUE

Fair value is defined as the amount at which a financial instrument could be

exchanged in a transaction between willing, unrelated parties in a normal

business transaction. The estimation of fair value is significant to a number

of SunTrust’s assets and liabilities, including loans held for sale, investment

securities, MSRs, OREO, other repossessed assets, goodwill, retirement and

post retirement benefit obligations, as well as assets and liabilities associ-

ated with derivative financial instruments. These are all recorded at either

fair value or at the lower of cost or fair value.

Fair value is based on quoted market prices for the same instrument

or for similar instruments adjusted for any differences in terms. If market

prices are not available, then fair value is estimated using modeling tech-

niques such as discounted cash flow analyses. In instances where required

by US GAAP, the Company uses discount rates in its determination of the fair

value of certain assets and liabilities such as retirement and post retirement

benefit obligations and MSRs. The Company provides disclosure of the key

economic assumptions used to measure MSRs and a sensitivity analysis to

adverse changes to these assumptions in Note , Securitization Activity/

Mortgage Servicing Rights, to the Consolidated Financial Statements. The

fair values of MSRs are based on discounted cash flow analyses utilizing

dealer consensus prepayment speeds and market discount rates. A detailed

discussion of key variables, including discount rate, used in the determi-

nation of retirement and post retirement obligations is in the Pension

Accounting section. Discount rates used are those considered to be com-

mensurate with the risks involved. A change in these discount rates could

increase or decrease the values of those assets and liabilities.

Fair values for investment securities and most derivative financial

instruments are based on quoted market prices. If quoted market prices are

not available, fair values are based on the quoted prices of similar instru-

ments. The fair values of loans held for sale are based on observable cur-

rent market prices. The fair values of OREO and other repossessed assets

are typically determined based on appraisals by third parties, less estimated

selling costs.

Estimates of fair value are also required in performing an impairment

analysis of goodwill. The Company reviews goodwill for impairment at the

reporting unit level on an annual basis, or more often if events or circum-

stances indicate the carrying value may not be recoverable. The goodwill

impairment test compares the fair value of the reporting unit with its car-

rying value, including goodwill. If the carrying amount of the reporting unit

exceeds its fair value an additional analysis must be performed to determine

the amount, if any, by which goodwill is impaired. In determining the fair

value of SunTrust’s reporting units, management uses discounted cash flow

models which require assumptions about the Company’s revenue growth

rate and the cost of equity.

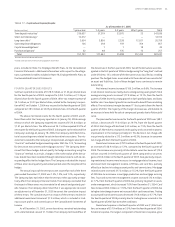

PENSION ACCOUNTING

Several variables affect the annual pension cost and the annual variability

of cost for the SunTrust retirement programs. The main variables are: ()

size and characteristics of the employee population, () discount rate, ()

expected long-term rate of return on plan assets, () recognition of actual

asset returns and () other actuarial assumptions. Below is a brief descrip-

tion of these variables and the effect they have on SunTrust’s pension costs.

Size And Characteristics Of The Employee Population

Pension cost is directly related to the number of employees covered by the

plans, and other factors including salary, age, and years of employment. The

number of employees eligible for pension benefits has increased over prior

years, especially with the addition of NCF employees at the end of .

Discount Rate

The discount rate is used to determine the present value of future benefit

obligations. The discount rate for each plan is determined by matching the

expected cash flows of each plan to a yield curve based on long term, high

quality fixed income debt instruments available as of the measurement

date, December . This assumption is updated every year for each plan.

The discount rate for each plan is reset annually on the measurement date

to reflect current market conditions for high quality bonds.

If the Company were to assume a .% increase/ decrease in the dis-

count rate for all retirement and other post retirement plans, and keep all

other assumptions constant, the benefit cost would decrease/ increase by

approximately million.

Expected Long-term Rate Of Return On Plan Assets

Based on a ten-year capital market projection of the target asset alloca-

tion set forth in the investment policy for the SunTrust and NCF Retirement

Plans, the pre-tax expected rate of return on plan assets was .% in

and . This expected rate of return is not expected to change signifi-

cantly each year.

Annual differences, if any, between expected and actual returns

are included in the unrecognized net actuarial gain or loss amount. The

Company generally amortizes any unrecognized net actuarial gain or loss in

excess of a % corridor, as defined in SFAS No. , “Employers’ Accounting

for Pensions,” (“SFAS No. ”) in net periodic pension expense over the

average future service of active employees, which is approximately eight

years. See Note , Employee Benefit Plans, to the Consolidated Financial

Statements for details on changes in the pension benefit obligation and the

fair value of plan assets.

If the Company were to assume a .% increase/decrease in the

expected long-term rate of return for the retirement and other post retire-

ment plans, holding all other actuarial assumptions constant, the benefit

cost would decrease/increase by approximately million.

Recognition Of Actual Asset Returns

SFAS No. allows for the use of an asset value that smooths investment

gains and losses over a period up to five years. However, SunTrust has

elected to use a more preferable method in determining pension expense.

This method uses the actual market value of the plan assets, and therefore,

immediately recognizes prior gains and losses. Therefore, SunTrust will